Introduction of ASX ETOs and warrants is taking longer than anticipated

but we expect to have them ready shortly.

Trading Diary

July 2, 2003

The Dow rallied strongly, closing up 1.1% at 9142 on higher volume.

The intermediate trend is still down. Tuesday's false break, below support at 8900, is a bullish sign.

The primary trend is up.

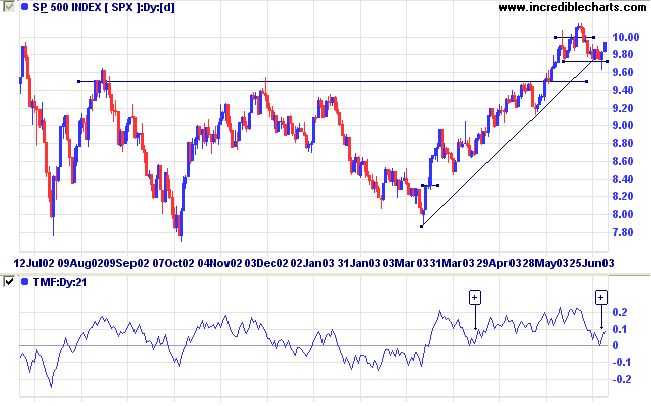

The intermediate trend has turned up. Tuesday's false break below 972 is a bullish sign.

The primary trend is up.

The intermediate trend is up. A rise above 1686 will complete a bullish double bottom pattern.

The primary trend is up.

Intermediate: Long if the S&P is above 989.

Long-term: Long.

US markets will close 1.00 p.m. Thursday ahead of Friday, Fourth of July holiday.

New York (17.57): Spot gold rose to $US 351.20.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is still down.

The primary trend is up.

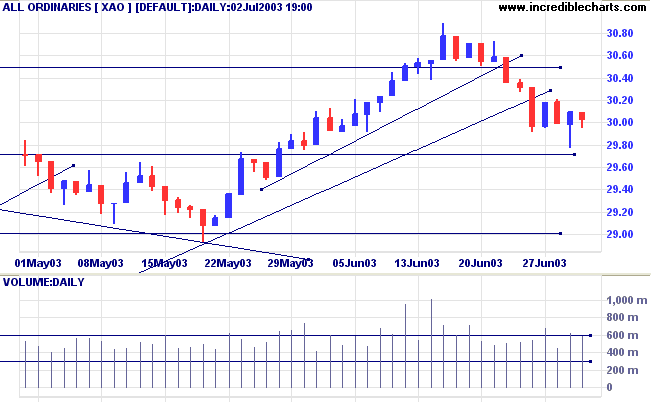

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3021.

Long-term: Long.

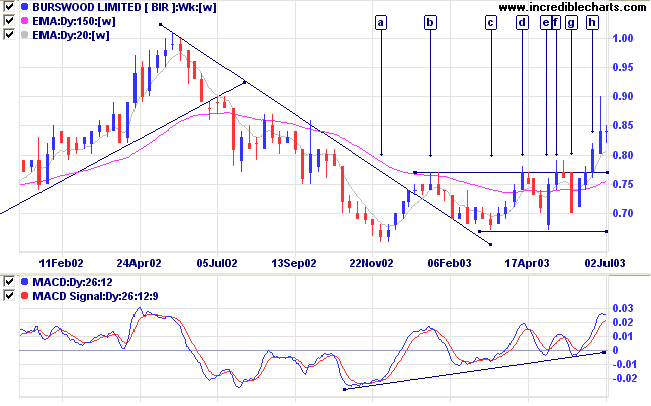

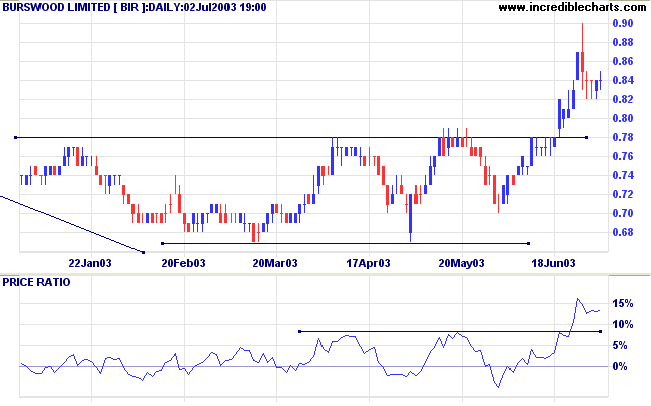

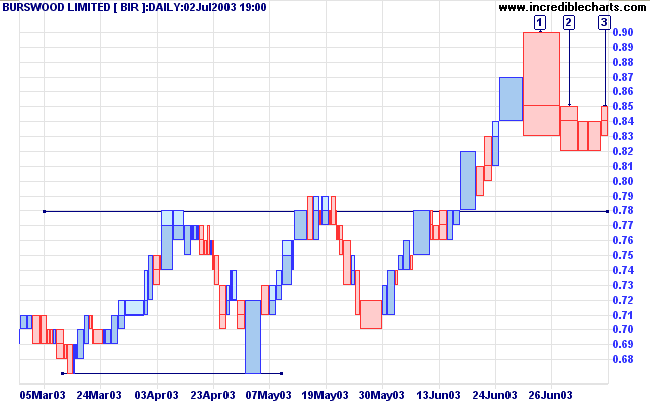

BIR broke out of a stage 1 base at [h] after failed attempts at [d] and [f].

The V-bottom at [a] re-tested support at [c], becoming a double bottom, and again at [e] to form a triple bottom,

before a higher trough at [g] signaled the likelihood of a breakout.

MACD is trending upwards, a bullish sign.

Failure of the 0.78 support level would be bearish.

A straight rally above 0.85 may be prone to failure unless accompanied by heavy volume.

the ground upon which one treads seems not to move, and one can live undisturbed.

So it is with Time in one's life.

~ Marcel Proust, The Past Recaptured (1927).

When conducting a stock screen

you can select all equities, sector indexes only,

or all equities in a specific sector or industry group.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.