Some of the hourly updates are arriving late.

We have asked our data supplier to resolve this.

Use Securities>>Refresh Current Security From Server

if you want to update a chart that is already open.

Trading Diary

July 1, 2003

After falling in early trading the Dow later rallied to close up 0.62% at 9040 on higher volume.

The intermediate trend is down. The false break below support at 8900 is a bullish sign.

The primary up-trend is up.

The intermediate trend is down. The false break below 972 is a bullish sign.

The primary trend is up.

The intermediate trend is up. Equal lows on the 9th, 24th and today are a bullish sign.

The primary trend is up.

Intermediate: Long if the S&P is above 989.

Long-term: Long.

US markets will close 1.00 p.m. Thursday ahead of Friday, Fourth of July holiday.

New York (17.29): Spot gold rose again to $US 350.40.

On the five-year chart gold is above the long-term upward trendline.

Twiggs Money Flow (100) signals accumulation.

Recent months display a distinct V-bottom and we may see a re-test of support levels before a real bull market develops.

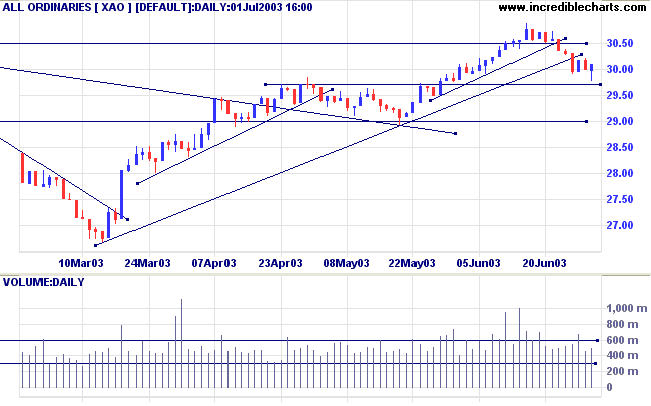

The All Ordinaries fell in early trading but later rallied to form a hammer reversal signal. The index closed 10 points up at 3009 on higher volume.

The intermediate trend is down.

The primary trend is up. If price holds above support at 2970 this will indicate that the up-trend is still strong. A fall to 2900 will signal weakness.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3021.

Long-term: Long.

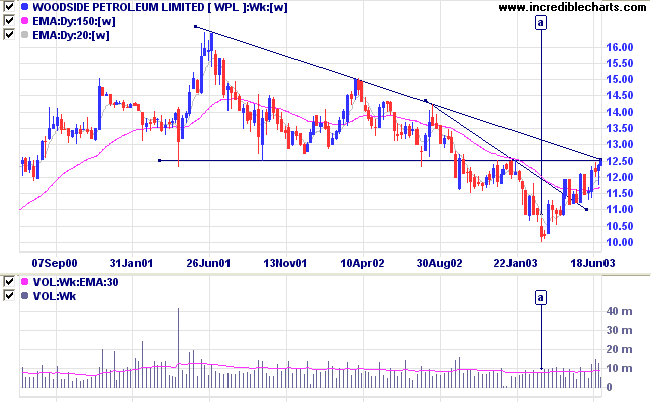

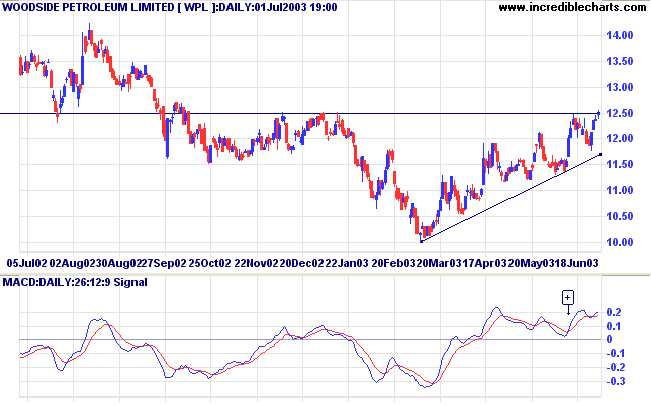

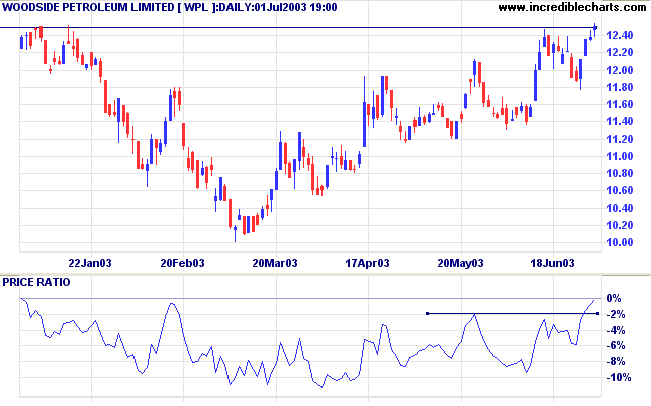

Energy stocks are improving, with the sector index [XEJ] forming a 6-month high.

Woodside has formed a V-bottom in recent months and now approaches a critical point: the conjunction of the 12.50 resistance level and the primary (downward) trendline. There was no cathartic volume spike at [a] so resistance can be expected to be fairly heavy.

Conservative traders will wait for a pull-back to the new support level before entering long positions.

V-bottoms are always fragile and a fall below the recent trough at 11.76 would be bearish, signaling a possible re-test of support at 10.00.

Through the continuous input of small drops of oil.

If the drops of oil run out, the light of the lamp cease.

What are these drops of oil in our lamps?

They are the small things of daily life;

faithfulness, punctuality, small words of kindness,

a thought for others, our way of being silent,

of looking, of speaking, and of acting.

These are the true drops of love...

Be faithful in small things because it is in them that your strength lies.

~ Mother Theresa.

To filter out illiquid stocks you can either:

Limit your screen to the ASX 200 or ASX 100 (select under Indexes and Watchlists),

Example: A volume filter of 200,000 returned 480 ASX stocks (including 173 of the ASX 200).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.