and the Daily Trading Diary.

Free members may have noticed that the stock screens are now performed on adjusted data.

Trading Diary

June 27, 2003

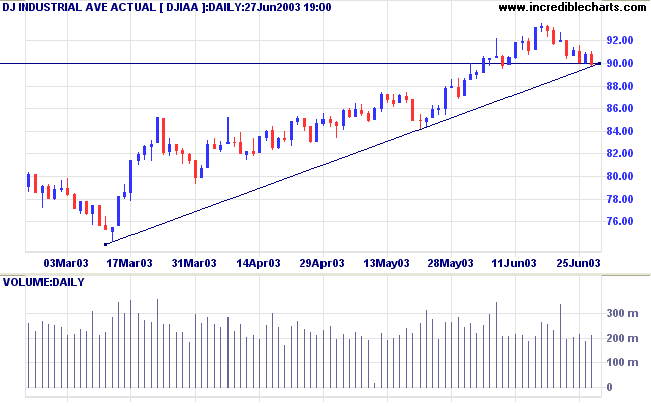

The intermediate trend has turned down.

The primary trend is up.

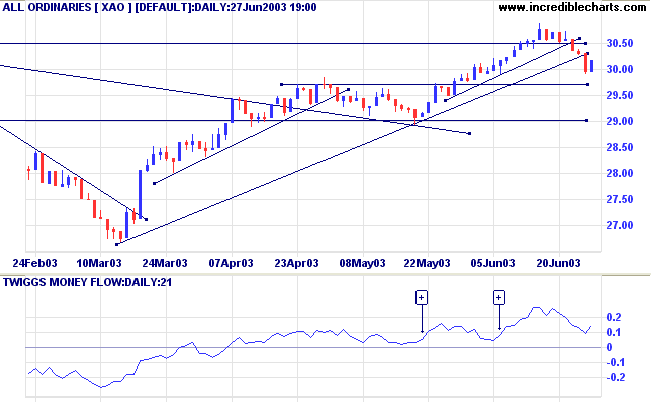

The intermediate trend has turned down.

The primary trend is up.

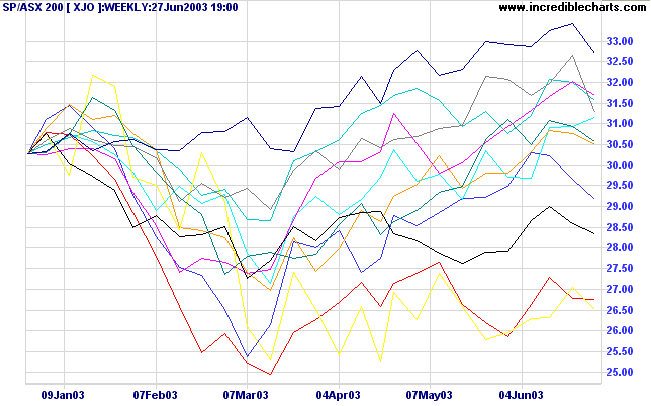

The intermediate trend is still up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator is at 74.41% (June 26).

Short-term: Short if the S&P 500 is below 974; Long if above 992.

Intermediate: Long if S&P 500 is above 1000.

Long-term: Long if S&P 500 is above 1000.

Are the Fed rate cuts enough to turn the US economy around? (more)

New York (13.30): Spot gold closed the week at $US 344.90.

The intermediate trend is down.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals accumulation.

Changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is level)

- Materials [XMJ] - stage 3 (RS is falling)

- Industrials [XNJ] - stage 1 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 2 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is level)

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is level)

- Utilities [XUJ] - stage 2 (RS is rising)

Utilities;

Financials;

Consumer Staples;

Property Trusts;

Energy; and

Telecommunications.

is rising but shows recent weakness;

Materials,

Health Care and

IT are still struggling.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) is down at 47 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Oil & Gas Exploration & Production (4)

- Diversified Financial (3)

- Diversified Metals & Mining (3)

- Steel (3)

Stocks analyzed during the week were:

- Foodland - FOA

- Chemeq - CMQ

- Coles Myer - CML

- Westpac - WBC

- St George - SGB

Time is the coin of your life.

It is the only coin you have,

and only you can determine how it will be spent.

Be careful lest you let other people spend it for you.

- Carl Sandburg.

To delete a large number of trendlines or captions,

and select Delete All Trendlines or Delete All Captions.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.