The server is back up and running.

There was no diary for Wednesday as we were unable to deliver chart images from the server.

We plan to introduce a second server to run in tandem with the first,

to minimize future down-time.

Trading Diary

June 25, 2003

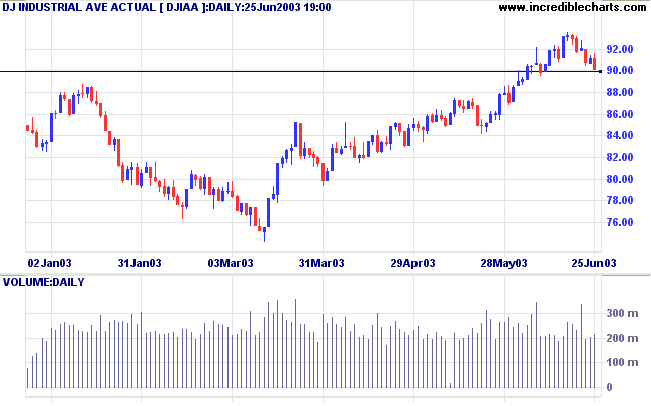

The Dow closed 1.1% down at 9011 on slightly higher volume; testing the 9000 support level.

The intermediate trend is up.

The primary up-trend is up.

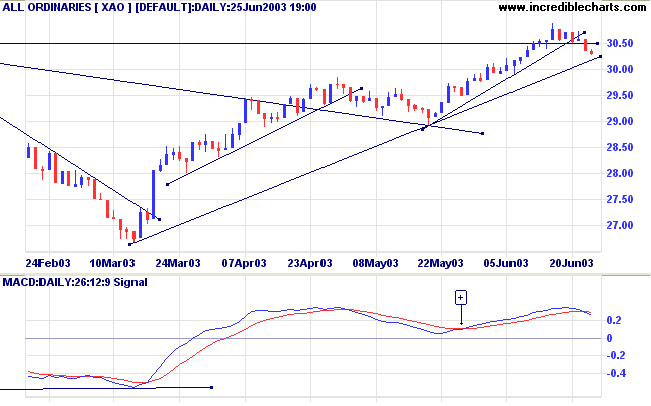

The intermediate trend is up. The break of the trendline and 1000 support level signals weakness.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long.

The Federal Reserve Board cut the overnight lending rate to one per cent, the lowest level in 45 years. (more)

New York (18.14): Spot gold is down at $US 347.40.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) has crossed to below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals accumulation.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3050.

Long-term: The primary trend reversal has confirmed the March 18 follow through signal. Long.

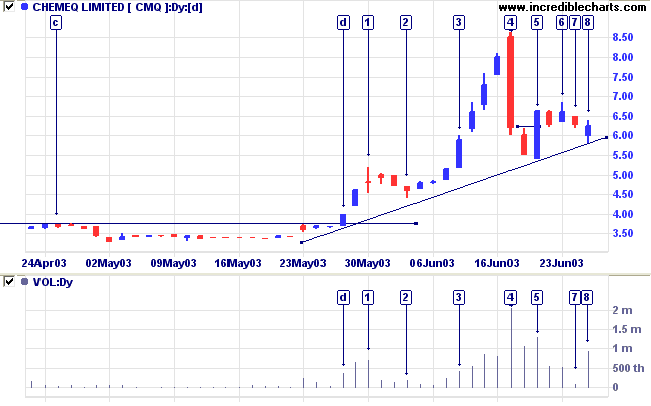

After completing a spike at [4] Chemeq corrected sharply to a low at [5].

There is some resistance to higher prices with [6] failing to close above the high of [5].

The subsequent correction started on thin volume at [7] before encountering buying support at [8].

Strong volume and a high close signal the likelihood of another rally.

Twiggs Money Flow (100-day) still signals accumulation

Relative Strength (price ratio: xao) is neutral.

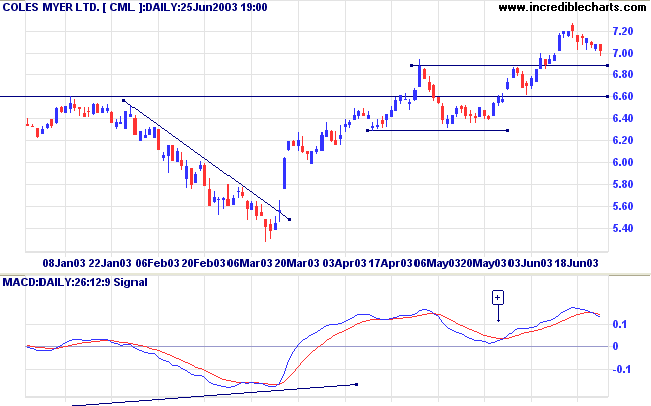

MACD (26,12,9) has crossed below its signal line, after completing a bullish trough above zero [+].

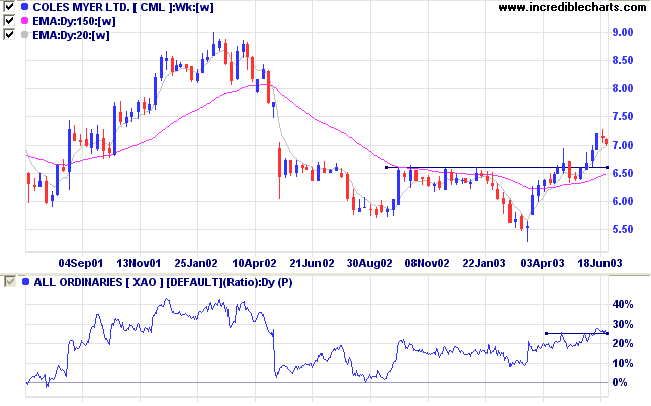

Coles continues to impress after having broken above resistance at 6.60.

Relative Strength (price ratio: xao) recently made a new 3-month high; and

Twiggs Money Flow (100-day) signals accumulation.

A pull-back to support at 6.60 will indicate a slower, more sedate trend.

MACD (26,12,9) has crossed below its signal line, after completing a bullish trough above zero [+].

An up-turn above the zero line will be a bull signal.

A break below 6.60 would be bearish.

Erect new stocks to trade beyond the line;

With air and empty names beguile the town,

And raise new credits first, then cry 'em down;

Divide the empty nothing into shares,

And set the crowd together by the ears.

~ Daniel Defoe (1660 - 1731).

Use the legend to change indicator colors.

Click the color button next to an indicator and select a new color from the palette.

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.