Use the up/down arrows on the toolbar

to scroll through the charts on your watchlist.

Trading Diary

June 19, 2003

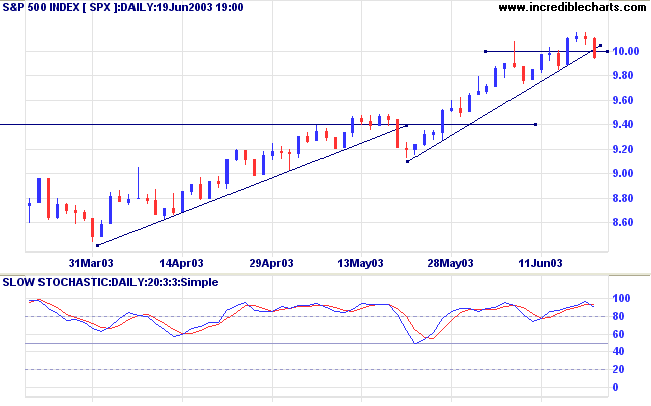

The Dow fell 1.2% to 9179, on encouragingly lower volume. The index appears to be headed for a re-test of the 9000 support level.

The intermediate trend is up.

The primary up-trend is up.

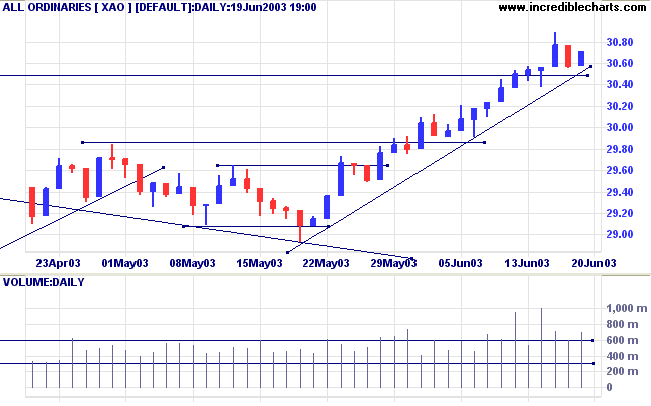

The intermediate trend is up. The break of the trendline and support level signals weakness.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1011.

Long-term: Long.

There was more profit-taking ahead of Friday's triple-witching hour.

New jobless claims fell to 421,000 for the week ended June 14th, but are still well above the key 400,000 level, which indicates rising unemployment. (more)

New York (17.27): Spot gold recovered to $US 361.80.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; and Twiggs Money Flow (21) signals accumulation, having completed two bullish troughs above zero.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3071.

Long-term: The primary trend reversal has confirmed the March 18 follow through signal. Long.

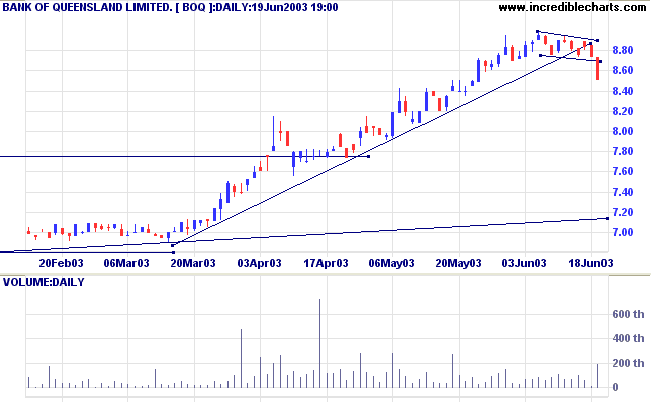

BOQ has broken out below the flag pattern on higher volume.

Twiggs Money Flow (21-day) signals distribution; MACD (26,12,9) is below its signal line.

Relative Strength (price ratio: xao) continues to fall, from its peak at the start of June.

With an overall bullish market this position is fairly risky and they will need to protect against a bear trap - where price reverses back above the flag and resumes the up-trend.

A fall below 8.50 (the latest low) will be bearish

A rise above 8.73 (the high of latest bar) would signal uncertainty.

A rise above the upper border of the flag will be a bull signal.

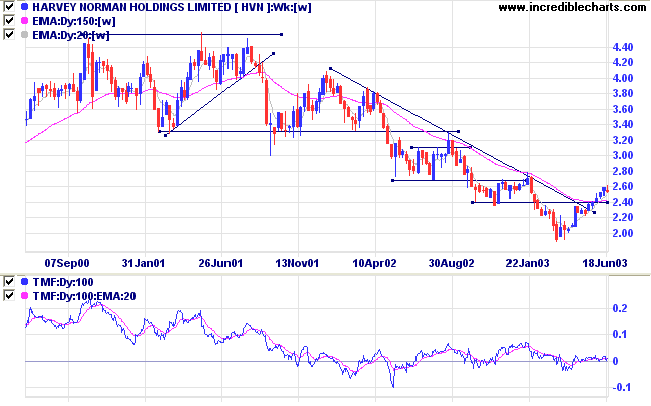

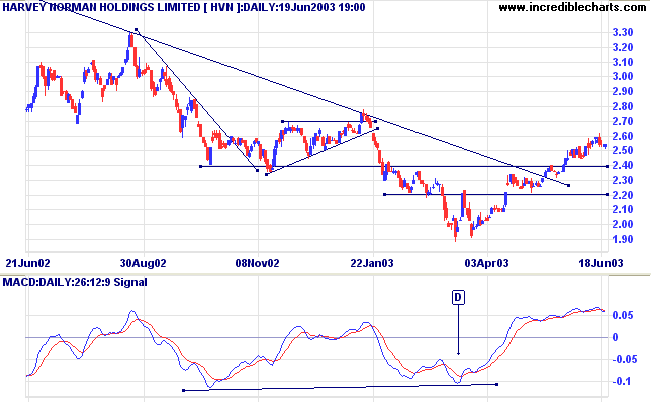

HVN has rallied above the long-term downward trendline and formed a V-bottom.

Twiggs Money Flow (100-day) has edged back above zero, to signal accumulation.

Relative Strength (price ratio: xao) is rising.

MACD (26,12,9) shows a bullish divergence at [D].

Volume has been lower in recent weeks, reinforcing the likelihood of a pull-back.

Opportunities to go long may present themselves if volume and volatility dry up at the support levels, during a pull-back.

A fall below 2.20 would be bearish.

The line between failure and success is so fine

that we scarcely know when we pass it;

so fine that we are often on the line and do not know it.

~ Elbert Hubbard (1856 - 1915).

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.