Apologies for the delays.

Our technical team is working on the problem.

Trading Diary

June 18, 2003

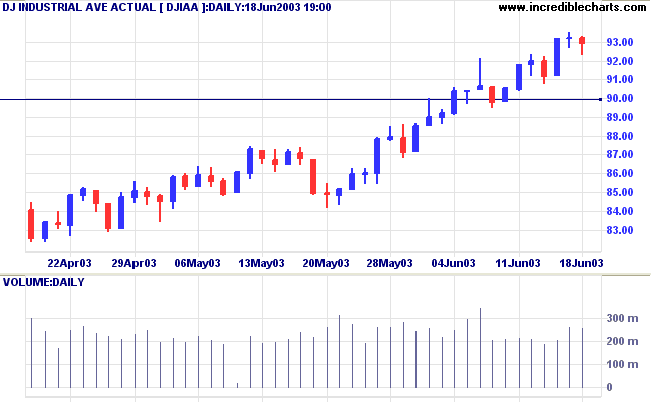

The Dow retreated 0.3% to 9293 on average volume, signaling continued uncertainty.

The intermediate trend is up.

The primary up-trend is up.

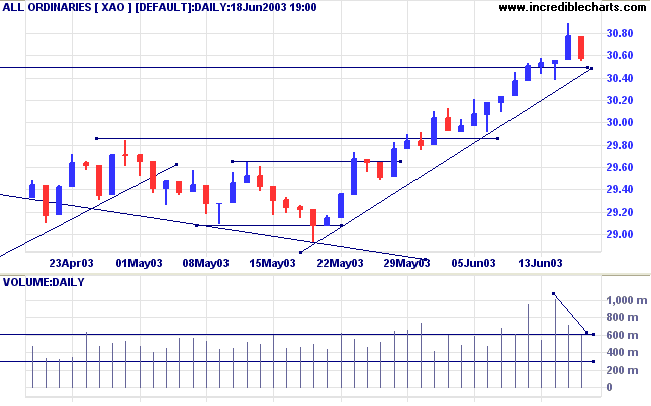

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The photographic film-maker halved its' second-quarter earnings forecasts, blaming SARS for slow sales in Asia. (more)

New York (17.46): Spot gold eased to $US 357.20.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; and Twiggs Money Flow (21) signals accumulation, having completed two bullish troughs above zero.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3050.

Long-term: The primary trend reversal has confirmed the March 18 follow through signal. Long if the All Ords is above 3050.

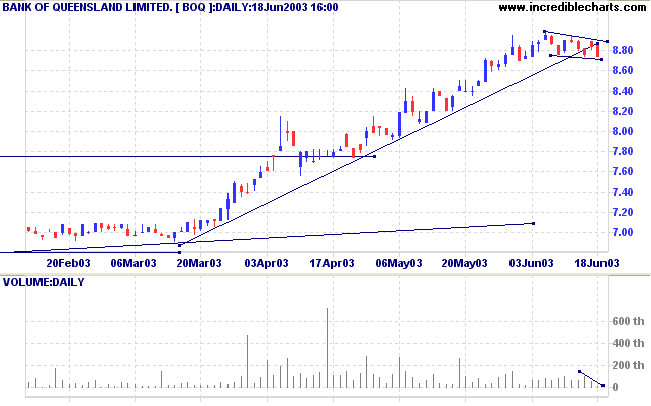

BOQ is in a fast upward trend but has broken the intermediate trendline - twice in the past few days.

Twiggs Money Flow (100-day and 21-day) is neutral; MACD (26,12,9) has crossed below its signal line.

Relative Strength (price ratio: xao) has declined from its peak at the start of June.

Volume has dried up on the latest down-swing, signaling the likelihood of an upward breakout.

A break above the upper border of the flag will be a bullish signal; and may present short-term traders an opportunity to increase their long position.

A break below the lower border of the flag will be bearish and may signal a return to the primary trendline.

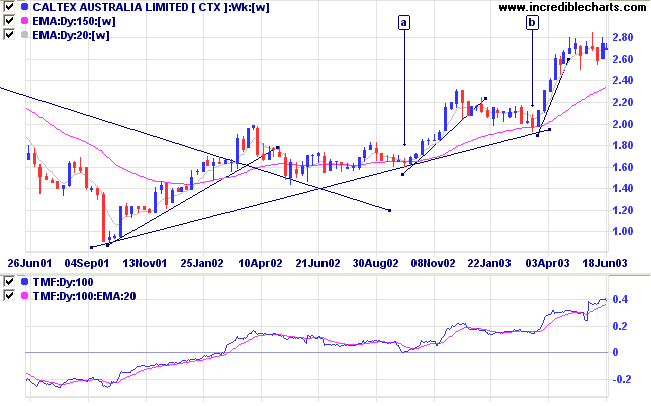

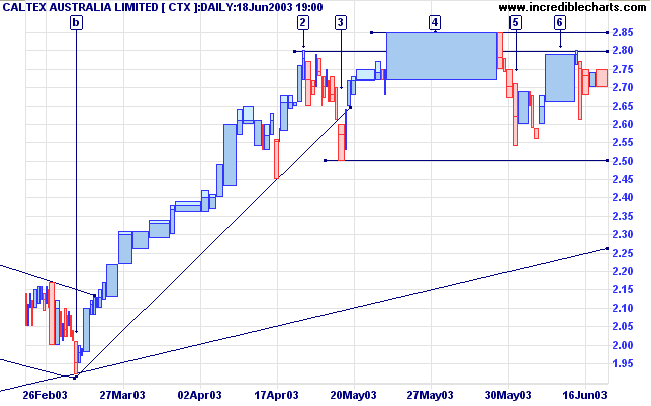

Caltex is consolidating after a fast rally, from [b].

The previous two rallies were both followed by periods of sideways consolidation, rather than a sharp correction back to the primary trendline.

Twiggs Money Flow (100-day and 21-day) signal strong accumulation; MACD (26,12,9) has declined but is still above zero.

Relative Strength (price ratio: xao) has declined from its May peak.

Resistance continues with the broad bar at [6].

A rise above 2.85 will be a strong bull signal.

A fall below 2.50 will be bearish, signaling a re-test of support at the primary trendline.

~ General George S. Patton.

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.