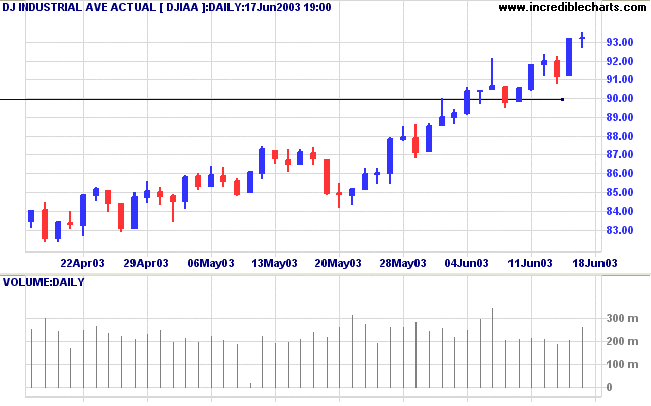

Volume shown is the entire volume traded on the NYSE.

Trading Diary

June 17, 2003

The Dow closed almost unchanged at 9323 on higher volume, signaling selling pressure.

The intermediate trend is up.

The primary up-trend is up.

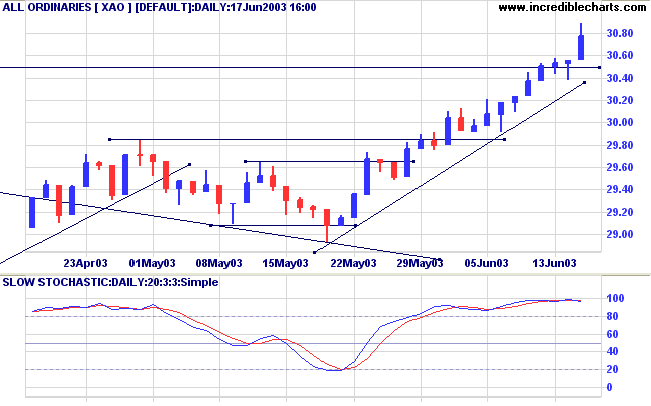

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

Positive economic data supported the market in a day when profit-taking was evident. (more)

New York (17.49): Spot gold climbed to $US 362.90.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

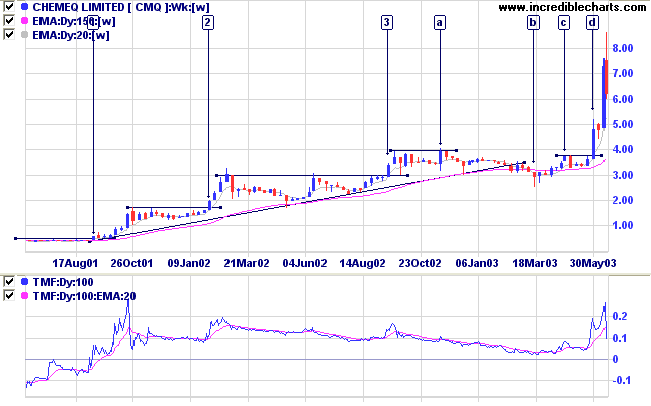

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; and Twiggs Money Flow (21) signals accumulation, having completed two bullish troughs above zero.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3050.

Long-term: The primary trend reversal has confirmed the March 18 follow through signal. Long if the All Ords is above 3050.

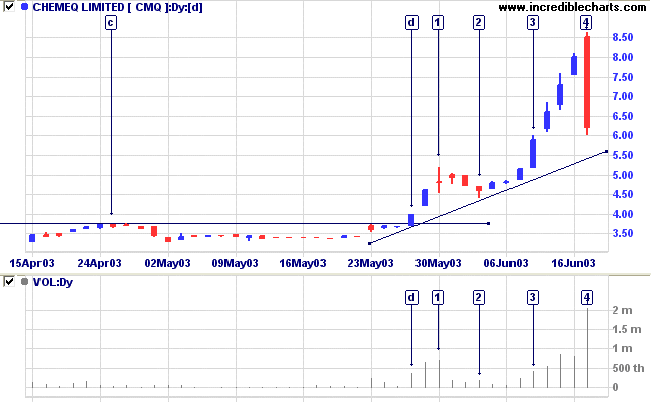

CMQ has corrected sharply, after a fast up-trend developed into an unsustainable spike.

A trailing percentage stop (6%), calculated on the intra-day High of 8.64, would have triggered at 8.12.

A 6% trailing stop, as calculated by most brokers, based on the previous day's close, would only trigger at 7.52.

Methinks they should revise their formula.

Twiggs Money Flow (100) still signals accumulation; and MACD (26,12,9) is still positive.

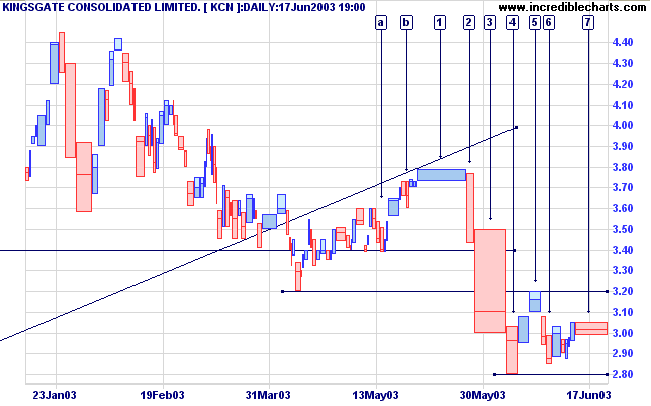

Kingsgate has broken below the long-term trendline in early April.

Equivolume highlights heavy selling into the subsequent rally at [1] and in the down-trend at [3].

The weak close and light volume at [4] signaled that the large drop had exhausted momentum.

The subsequent pull-back failed to break above resistance at 3.20.

This was followed by a period of consolidation on light volume before heavy selling resumed at the over-square bar at [7].

A fall below 2.80 will be a strong bear signal.

but by reflection, force of character, and judgment;

in these qualities old age is usually not poorer, but is even richer.

~ Marcus Tullius Cicero (c. 106-43 BC).

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.