High and low values for the theoretical index assume that all stocks hit their highs at the same time (high value)

and their lows at the same time (low value). Volume shown is the entire volume traded on the NYSE.

The high/low/close is calculated each hour and takes into account each stock's different price movements, up or down.

Volume shown is the NYSE volume for the thirty selected stocks.

See the Index Menu for details of other indexes.

Trading Diary

June 16, 2003

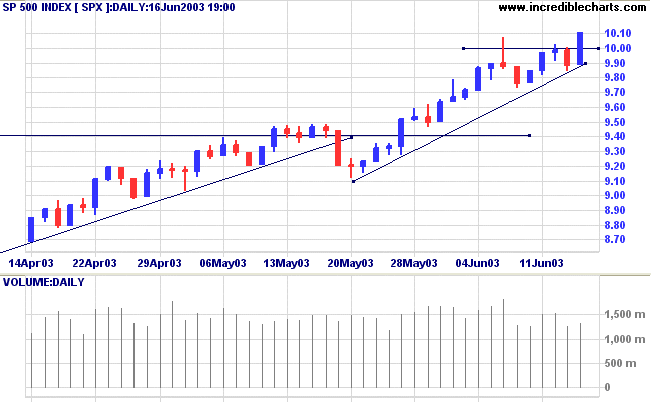

The Dow rallied 2.2% to close at 9318 on average volume. The one-day correction on low volume, Friday, signals a strong up-trend.

The intermediate trend is up.

The primary up-trend is up.

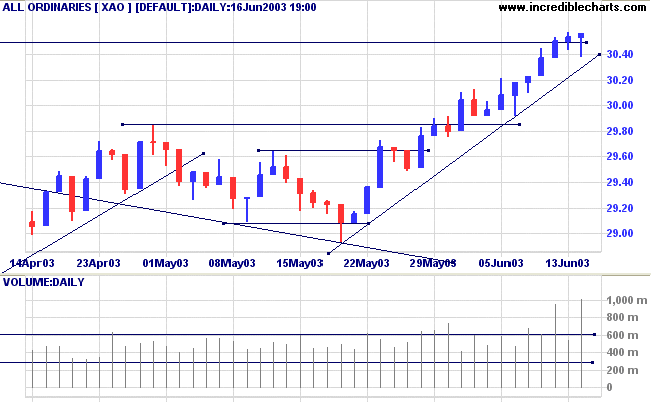

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P closes above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The Federal Reserve of New York cheered the market when its' manufacturing index more than doubled, rising to 26.8 from 10.6 in May. (more)

New York (20.25): Spot gold climbed to $US 359.10.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; and Twiggs Money Flow (21) is rising strongly after completing a second bullish trough above zero.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3050.

Long-term: The primary trend reversal has confirmed the March 18 follow through signal. Long if the All Ords is above 3050.

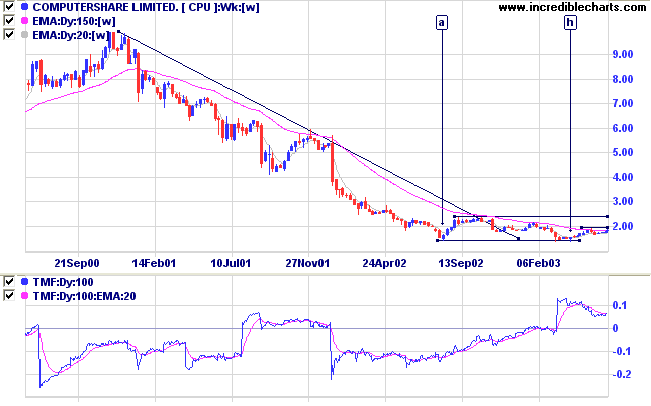

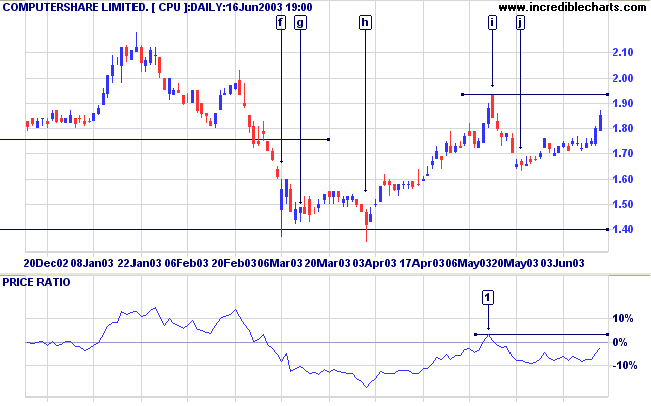

CPU has formed a broad stage 1 base after a lengthy decline.

Twiggs Money Flow (100) has risen strongly over the last 12 months to signal accumulation.

The pattern failed, as most V-bottoms do, after a sharp rally to [b].

CPU then drifted lower to re-test support at [f], forming a broad base in the process.

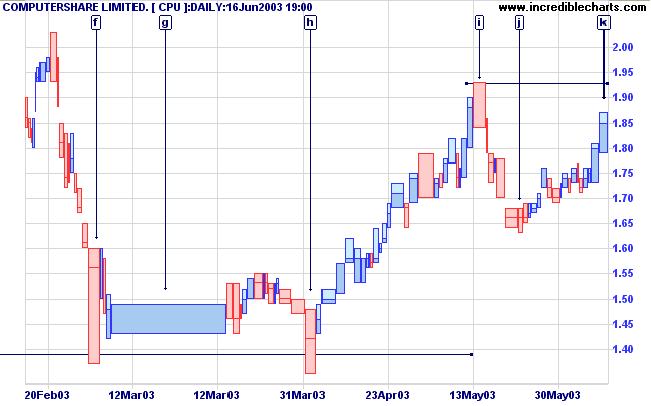

False (or marginal) breaks below the support level at [f] and [h] are a bullish sign.

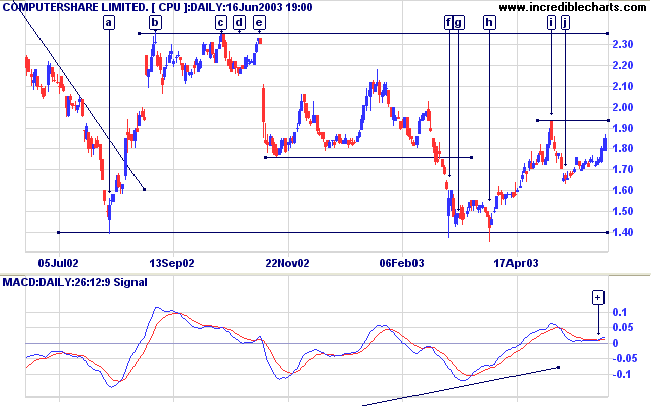

Twiggs Money Flow (21) signals accumulation; and MACD (26,12,9) has completed a bullish trough above zero [+].

You can also see the false breaks at [f] and [h], with closes back above the support level.

The subsequent rally ran out of momentum at [i] but regrouped at [j], after weak closes on fair volume.

The last two bars at [k] show strong gains on increased volume.

Bear in mind that there is resistance overhead between 2.00 and 2.36.

A break above 2.36 will be a strong bull signal.

A fall below the low of [j] would be bearish.

Nothing should be able to harm a man but himself.

Nothing should be able to rob a man at all.

What a man really has is what is in him.

What is outside of him should be a matter of no importance.

~ Oscar Wilde (1854-1900)

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.