Trading Diary Archives

We are busy transferring the archives to a new area on the website

that is accessible only to Premium members.

We will notify you when the archives are available.

Trading Diary

June 12, 2003

After a strong rally Wednesday, the Dow failed to make further gains; closing slightly higher at 9196 on low volume.

The intermediate trend is up.

The primary up-trend is up.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

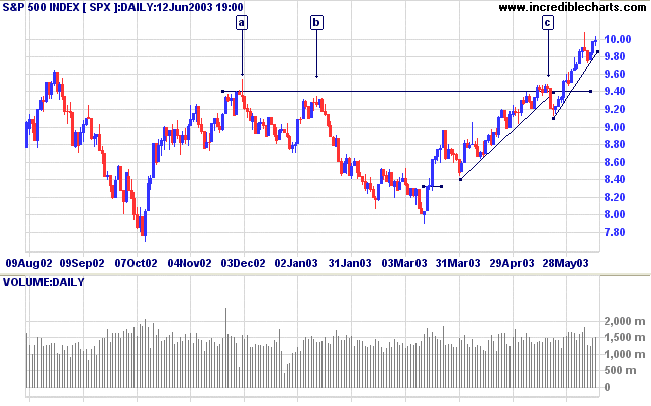

Intermediate: Long if the S&P closes above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The database software developer reported a 31% increase in fourth quarter earnings. (more)

New York (17.27): Spot gold eased to $US 353.00.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

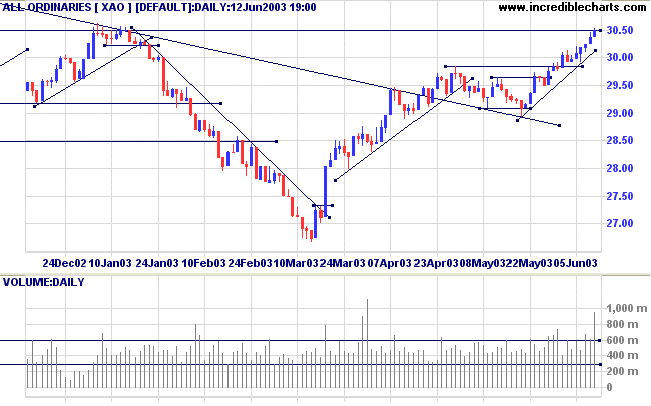

A close above 3050 will signal the start of a primary up-trend.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; and Twiggs Money Flow (21) has completed a second bullish trough above zero.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

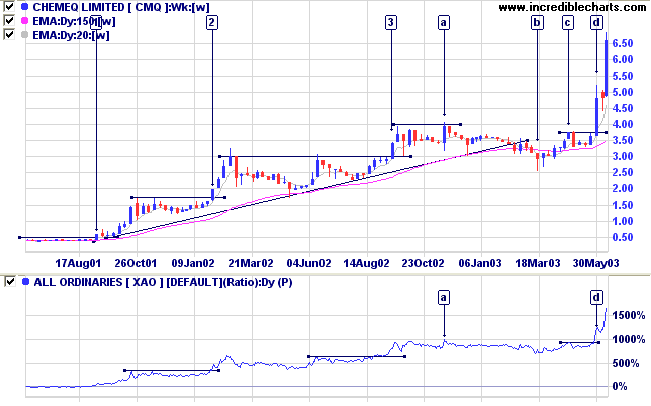

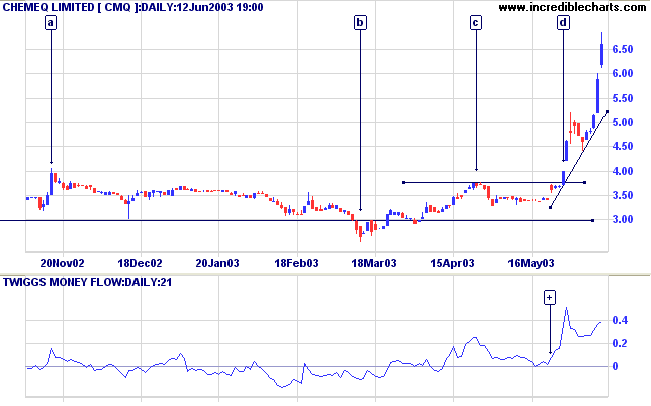

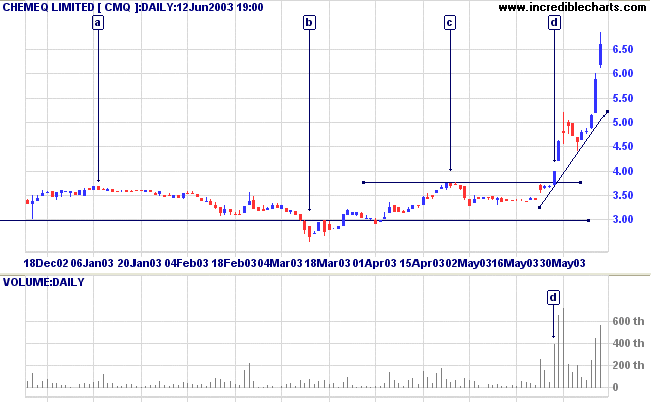

Chemeq has broken out of a broad consolidation pattern on exceptional volume.

The pattern resembles a cup and handle: the cup from [a] to [c], and the handle from [c] to [d].

I find the % Of 3-Month High stock screen (set at 98%) very useful for identifying potential breakouts.

In the weekly chart below, these can be identified as [1], [2], [3], [c] and [d].

When confirmed by a 3-month high on the Relative Strength indicator (price ratio: xao), and a spike in volume, they are exceptionally powerful.

Twiggs Money Flow (100) can provide further confirmation. In the case of CMQ, the indicator has signaled accumulation ever since [1].

Twiggs Money Flow (21) and MACD (26,12,9) have both completed bullish troughs above zero [+].

There is a strong possibility of the trend turning into a spike. Because of the high volatility, corrections can be as much as 30% of the current price.

Beware: some brokers calculate % trailing stops based on closing price only and do not take the day's high and low into account. In volatile markets this can lead to significant losses and you may have to calculate your stops manually.

Re-enter if volume and range dry-up on the correction; using a buy-stop above the day's high.

~ Buddha, 568-488 B.C.

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.