Bugbear virus warning

Be very suspicious of emails with file attachments,

It is easy to impersonate a sender.

Check that your virus software has the latest updates

and scan all incoming mail. Bugbear files often have a .scr extension.

Trading Diary

June 10, 2003

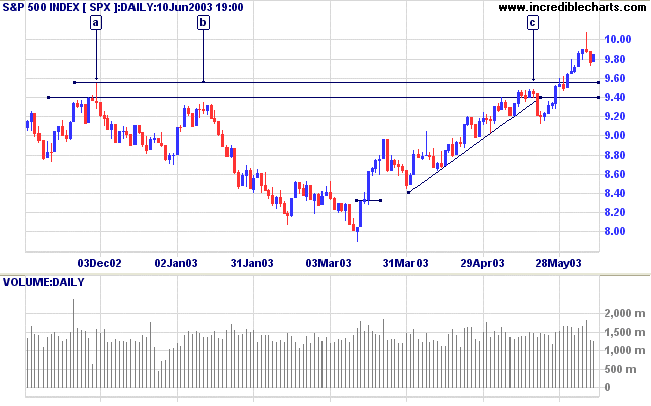

The Dow formed an inside day on low volume. The pattern signals uncertainty, but the close back above the 9000 support level (up 0.8% at 9054) reduces the likelihood of a false (marginal) break.

The intermediate trend is up.

The primary up-trend is up.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The world's largest cell phone maker warns that earnings will be at the low end of previous forecasts, due to weak economic conditions in the US and Europe, and the impact of SARS in China. (more)

New York (16.48): Spot gold dropped to $US 352.20.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

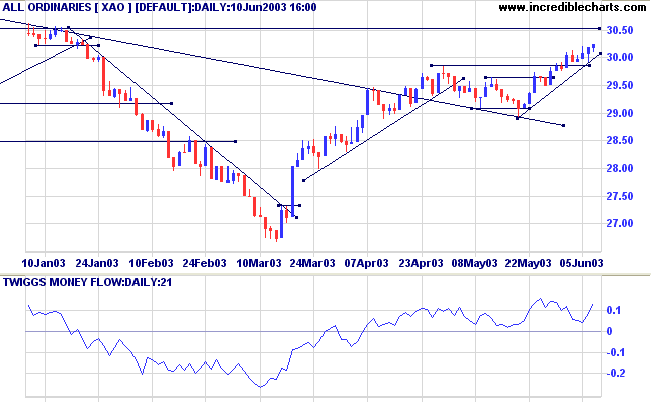

The primary trend is down. A close above 3050 will signal an up-trend.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) has crossed to above zero, signaling accumulation.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; and Twiggs Money Flow (21) signals accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

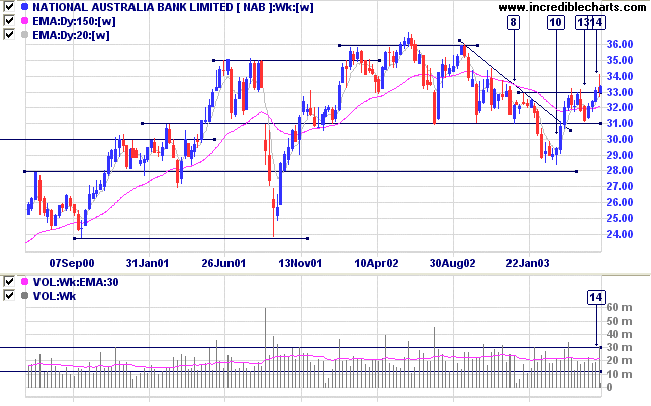

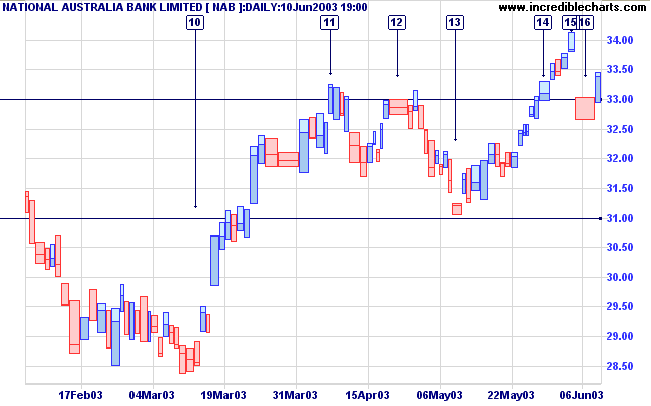

NAB recently completed an inverted head and shoulders, at [8], [10] and [13].

Weekly volume on the breakout [14] was average, but surged in the following week on the pull-back to the 33.00 support line.

Twiggs Money Flow (100) has crossed to above zero, signaling accumulation.

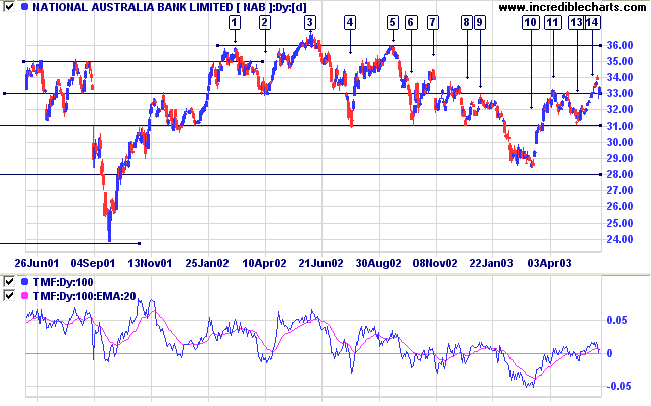

Relative Strength (price ratio: xao) and Twiggs Money Flow (21) have held above zero; MACD is bullish.

Price then retreated back to support at 31.00, exhausting momentum with a downward gap on fair volume at [13], the weak close hinting at a reversal. The following day gapped up, completing an island reversal.

NAB then broke above the 33.00 resistance level at [14] on strong volume but the weak close indicated selling pressure.

The rally continued on thin volume, before the peak at [15] formed another island reversal following a weak close.

The gap down to [16] was on strong volume; the close above the support line signaling strong buying support at 33.00.

A break above the high of [15] would be bullish.

Failure to break above [15] may result in consolidation above the support level, a bullish sign in the longer term.

A close below 33.00 would be bearish.

The fearful are caught as often as the bold.

- Helen Keller.

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.