Trading Diary

June 6, 2003

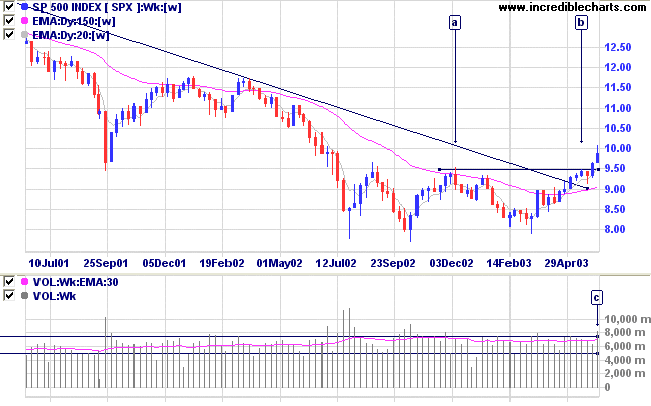

The Dow formed a gravestone candle, closing 0.2% higher at 9062 on higher volume. The pattern signals short-term weakness and we are likely to see a re-test of the new 9000 support level.

The intermediate trend is up.

The primary up-trend is up.

The intermediate trend is up.

The primary trend is up, with the index having broken above the high of [a] on strong volume [c].

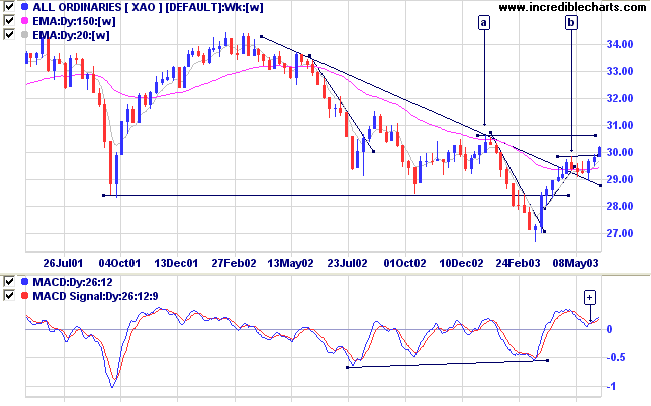

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

Unemployment levels increased to 6.1% in May, but job cuts are below forecasts. (more)

New York (15.30): Spot gold closed the week down at $US 363.60.

On the five-year chart gold is above the long-term upward trendline.

MACD has completed a bullish trough above zero.

Twiggs Money Flow (100) has crossed to above zero after a lengthy period of distribution.

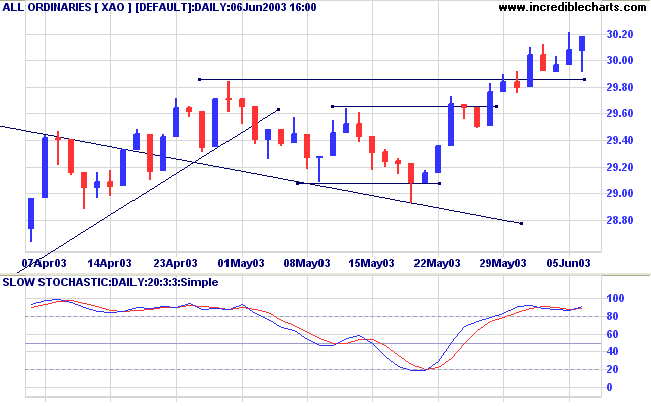

After falling through the morning the All Ordinaries rallied to close up 10 points at 3018, but on disappointing volume.

The intermediate trend is up.

The primary trend is down. A close above 3050 will signal an up-trend.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) crossed to above its signal line; and Twiggs Money Flow (21) signals accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is level)

- Materials [XMJ] - stage 3 (RS is falling)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is level)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 1 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is level)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) is up slightly to 61 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Banks (6)

- Broadcasting & Cable TV (5)

- Diversified Financial (4)

Stocks analyzed during the week were:

- Kingsgate Consolidated - KCN

- Sonic Health Care - SHL

- Bank of Queensland - BOQ

- Commonwealth Bank - CBA

- Telecom New Zealand - TEL

but I think I have a capacity for action.

- Theodore Roosevelt, one of the most popular US Presidents.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.