To find out more about US indexes

Trading Diary

June 4, 2003

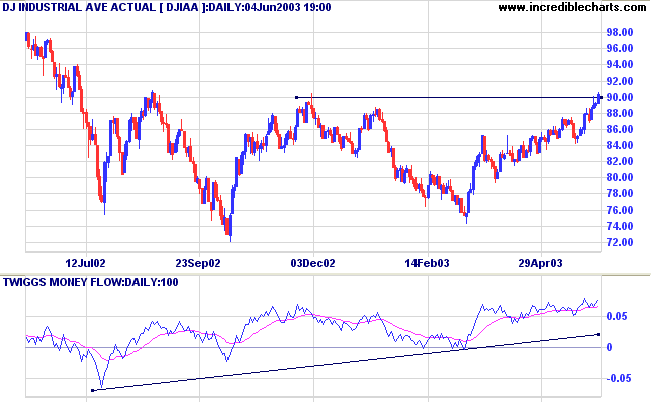

The Dow broke through the 9000 resistance level, rallying 1.3% to close at 9038 on higher volume.

The intermediate trend is up.

The close above 9000 signals the start of a primary up-trend.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 979.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The Institute for Supply Management's index of non-manufacturing activity jumped to 54.7 in May, compared to 50.2 in April and well above expectations. (more)

New York (17.54): Spot gold has fallen to $US 361.50.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

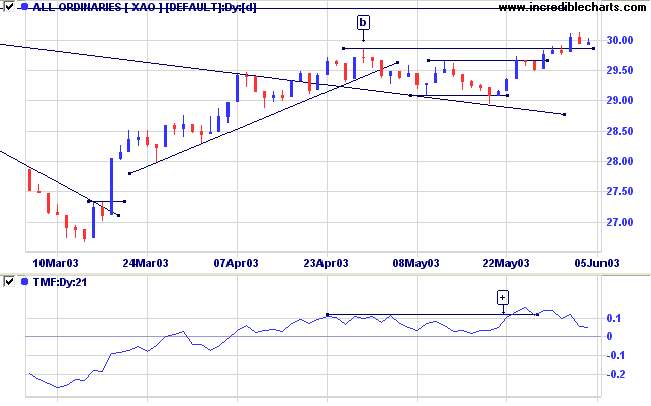

The primary trend is down. A close above 3050 will signal an up-trend.

MACD (26,12,9) is above its signal line, having completed a bullish trough above zero at [+]; Slow Stochastic (20,3,3) is below its signal line; and Twiggs Money Flow (21) continues to hold above zero, signaling accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Last covered on December 18, 2002.

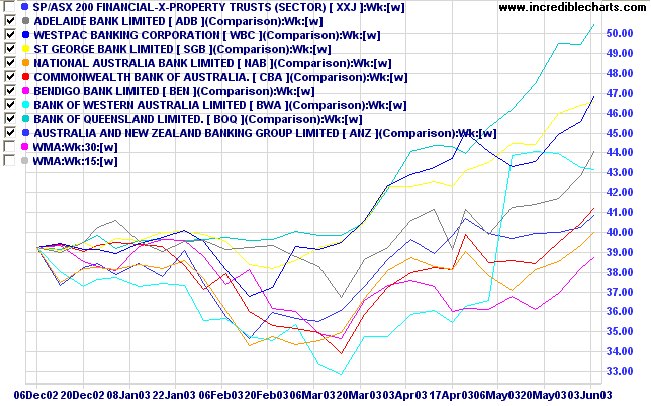

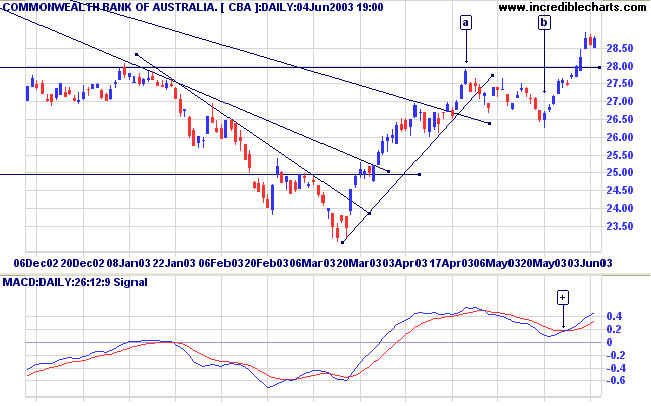

The banking sector shows a number of stocks moving into up-trends.

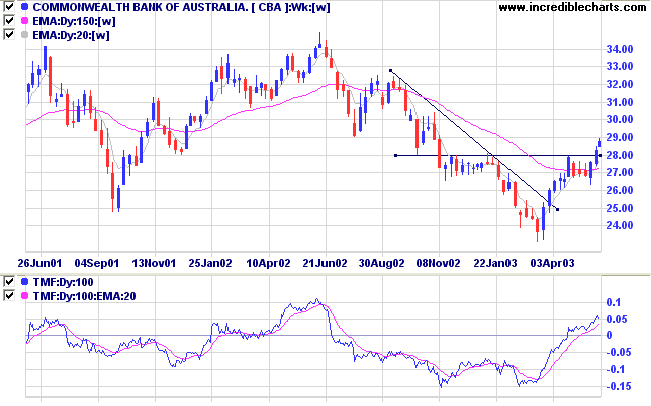

CBA has just exceeded its April high.

Twiggs Money Flow (100) has crossed to above zero, signaling accumulation.

Relative Strength (price ratio: xao) is rising.

Twiggs Money Flow (21) signals accumulation.

Price tested the resistance level at [a], but then consolidated below 28.00 at [b] instead of swinging back down to test support levels (below 24.00) - a strong bullish sign.

Volume to [b] is lighter, supporting the bullish signal.

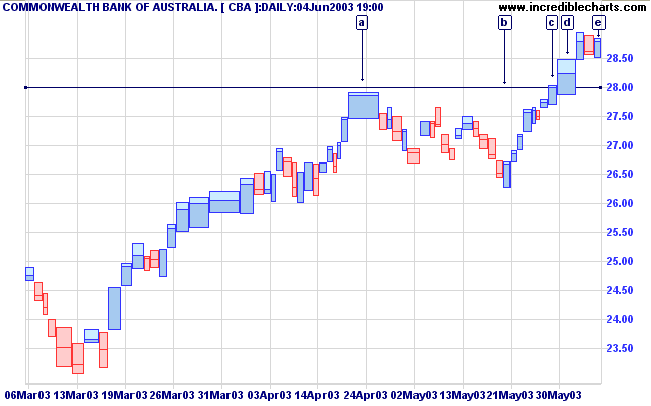

On the next rally, price hesitates at [c] before breaking above resistance on strong volume at [d].

What we now see is a pull-back to test support at 28.00.

There may still be a later pull-back to re-test the support level:

- short-term traders may move their stops up below each subsequent trough, to lock in profits;

- longer-term traders may hold their stop below 28.00 for quite some time, to avoid being shaken out of the up-trend.

Failure is a teacher

- a harsh one, perhaps, but the best.

So go ahead and make mistakes.

Make all you can.

Because that is where you will find success.

On the far side of failure.

- Thomas J Watson.

[CT: obviously not with all your capital at risk]

Click here to access the Trading Diary Archives.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.