To find out more about US indexes

Trading Diary

June 3, 2003

The Dow formed an inside day, closing up 0.3% at 8922 on lower volume. We may see a short correction before another attempt at the 9000 resistance level.

The intermediate trend is up.

A close above 9000 will signal the start of a primary up-trend.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

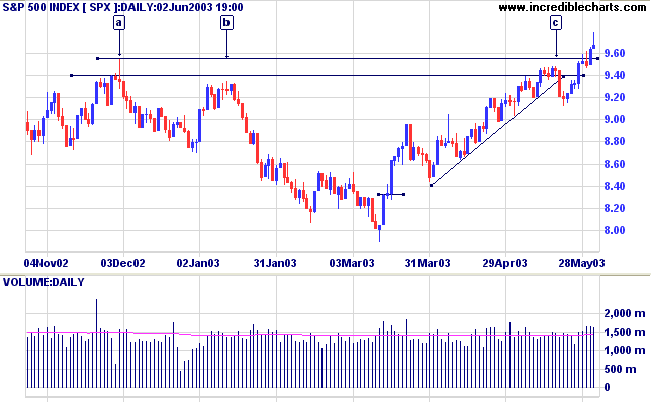

Intermediate: Long if the S&P rises above 979 - the primary trend has turned upwards (S&P above 954).

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The SEC investigation of accounting practices in a minor retail stores unit of IBM should have no material impact on earnings but may unsettle investors. (more)

New York (17.57): Spot gold is almost unchanged at $US 365.00.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

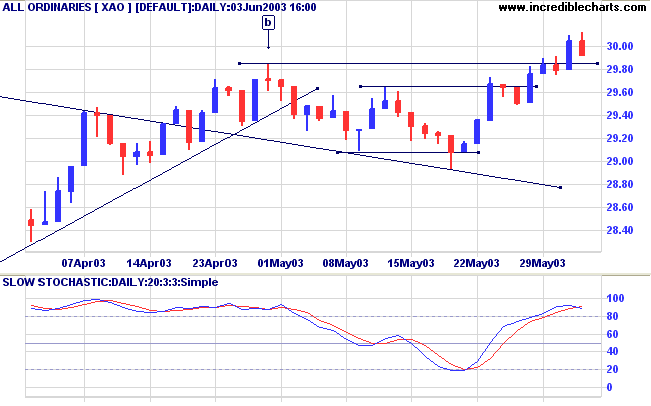

The primary trend is down. A close above 3050 will signal an up-trend.

MACD (26,12,9) is above its signal line, having completed a bullish trough above zero at [+]; Slow Stochastic (20,3,3) has crossed below its signal line; and Twiggs Money Flow (21) is falling.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

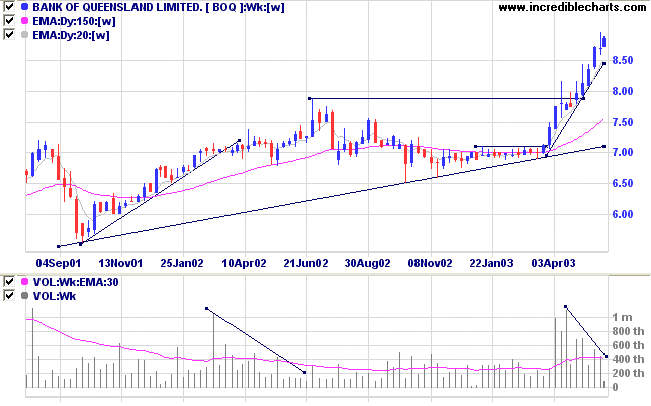

Last covered on April 21, 2003.

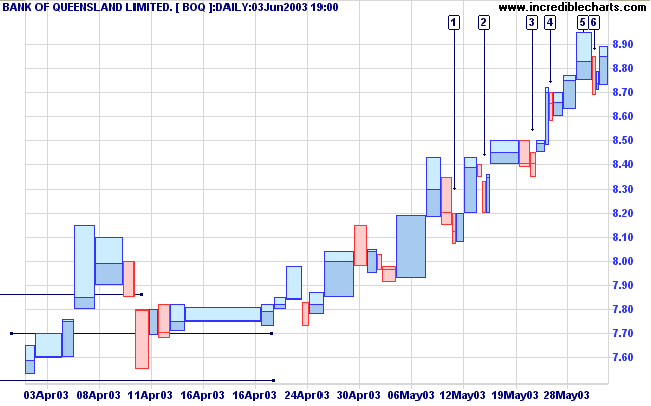

After a period of consolidation BOQ has trended strongly upwards over the last 2 months

Volume has declined in recent weeks and Twiggs Money Flow (100) has not yet managed to break above zero.

Relative Strength (price ratio: xao) and MACD (26,12,9) are rising fast.

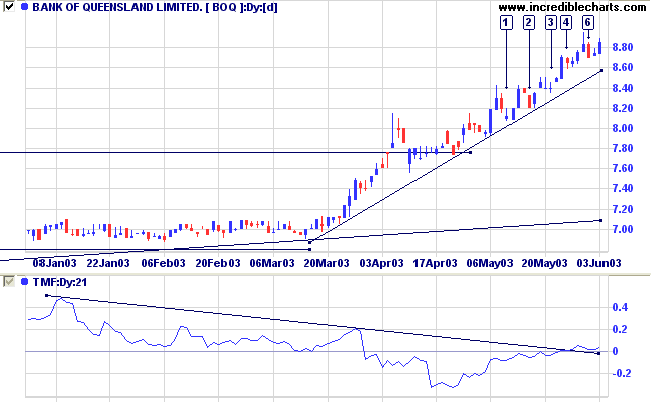

The trend is still fast, with short pull-backs, most of which hold above the preceding peak.

But the long shadow at [5], on reasonable volume, shows some profit-taking as the trend progresses.

Traders who are already long should consider locking in profits with tighter stops. It may not be time to sell yet but at some point the stock is likely to lose momentum, followed by a correction back to the long-term trendline.

never, never, never,

in nothing great or small,

large or petty, never give in

except to convictions

of honor and good sense.

Never yield to force;

never yield to the apparently

overwhelming might of the enemy.

- Winston Churchill: speech made October 1941

to the boys at Churchill's old public school, Harrow.

Click here to access the Trading Diary Archives.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.