This issue of the daily Trading Diary

is exclusive to Premium members.

Free Trials entered in April 2003 have expired but the discount price is extended for 10 days

to accommodate members waiting for ETOs and warrants.

Trading Diary

June 2, 2003

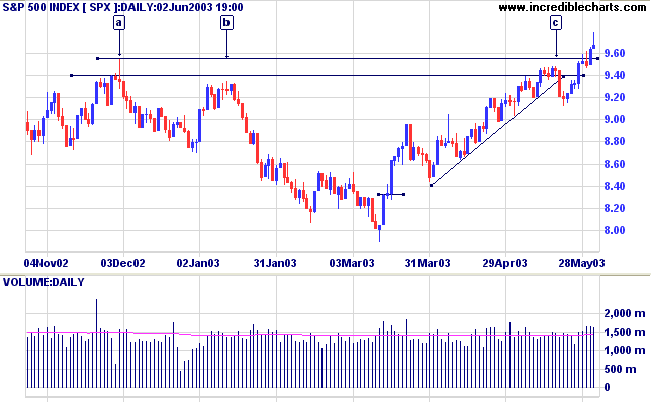

The Dow tested resistance at 9000 before retreating back to close at 8897 on higher volume.

The intermediate trend is up.

A close above 9000 will signal the start of a primary up-trend.

The intermediate trend is up.

The primary trend is above 954 [a], signaling an up-trend.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long - the primary trend has turned upwards (S&P above 954).

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Go long - the S&P 500 primary trend has turned upwards.

The Institute for Supply Management's index of manufacturing activity rose to 49.4, from 45.4 in April. The figure is above expectations but still below 50, indicating contraction. (more)

New York (17.45): Spot gold improved to $US 365.50.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

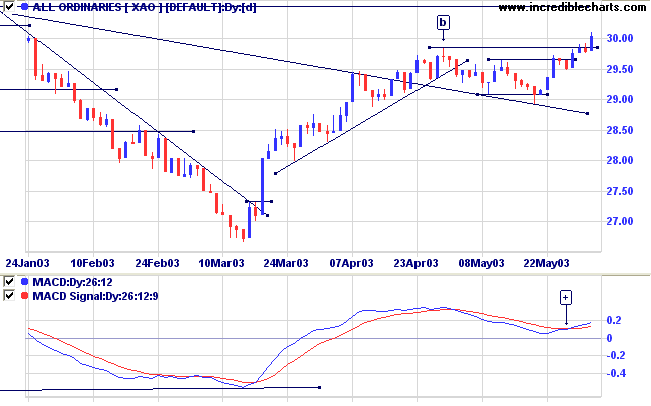

The primary trend is down. A close above 3050 will signal an up-trend.

MACD (26,12,9) is above its signal line, completing a bullish trough above zero at [+]; Slow Stochastic (20,3,3) is above its signal line; and Twiggs Money Flow (21) shows accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

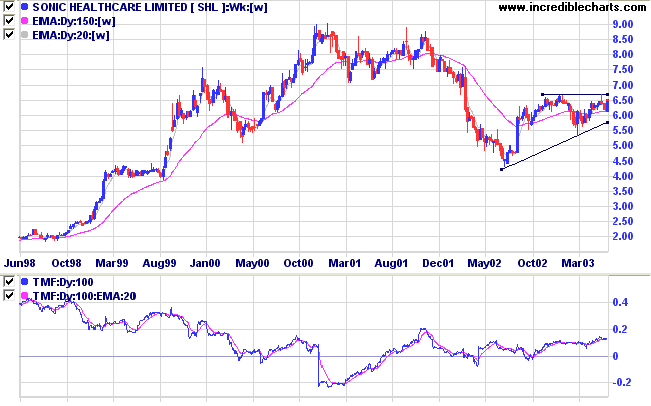

A reader mentioned Sonic Health Care [SHL] last week.

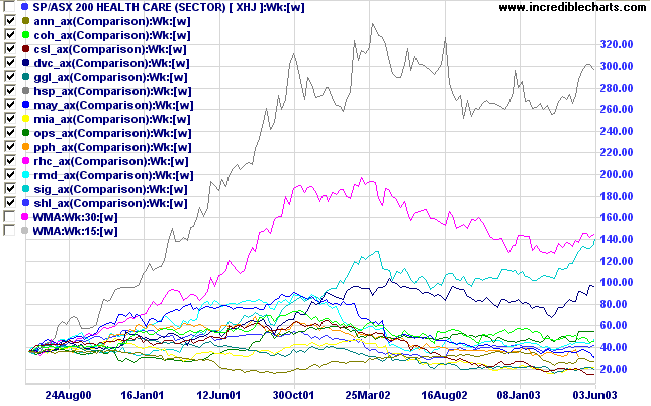

If we look at the Health Care sector, Sigma is the only stock that has reached new highs on the 3-year sector comparison chart. The rest of the sector is stuck in the doldrums.

Twiggs Money Flow (100) signals accumulation and a close above 6.63 will be bullish; but this may take a while.

A fall below 5.35 would be bearish.

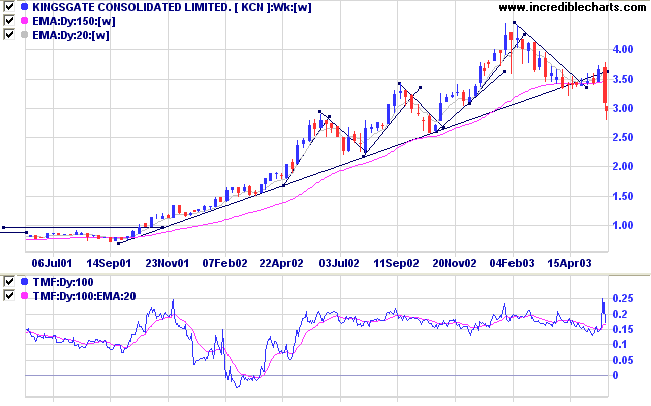

Last covered on March 26, 2003.

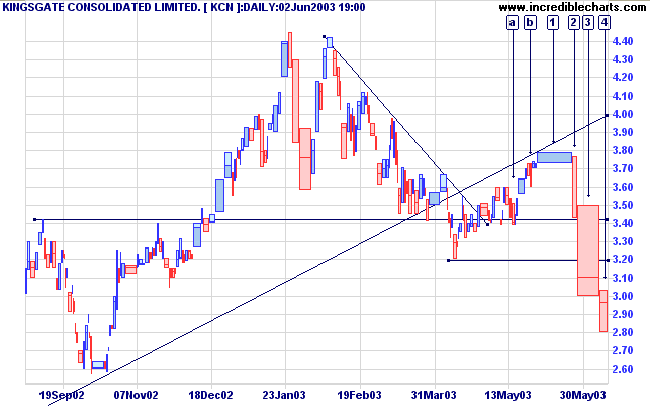

The close below the April low signals a change in the primary trend.

Every indicator highlights certain patterns but omits others. There is no indicator that embodies all the behavior visible on the price and volume chart.

On the equivolume chart the over-square bar at [1] is a clear indication of heavy resistance. The break below the low of [1], on day [2], is a strong reversal signal.

The power bar down at [3] broke below support at 3.42 and again at 3.20.

The latest bar at [4] shows lighter volume and a long shadow; the market is catching its breath before deciding what further direction to take.

After a day like [1] short-term traders should have their stop below the low of [1], or [b] at the lowest.

Anyone other than a short-term trader should not be taking long entries in a stock below its primary upward trendline.

Anyone who does not have a stop loss in place should not be trading - it's like tightrope walking without a safety net.

which, taken at the flood,

leads on to fortune.

- William Shakespeare: Julius Caesar

Click here to access the Trading Diary Archives.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.