US indexes and ASX hourly updates are now available

to Premium members. See What's New for details.

Check Help >> About to ensure that your software has been updated to Incredible Charts version 4.0.2.200.

Earlier versions will no longer work with the new data.

Trading Diary

May 29, 2003

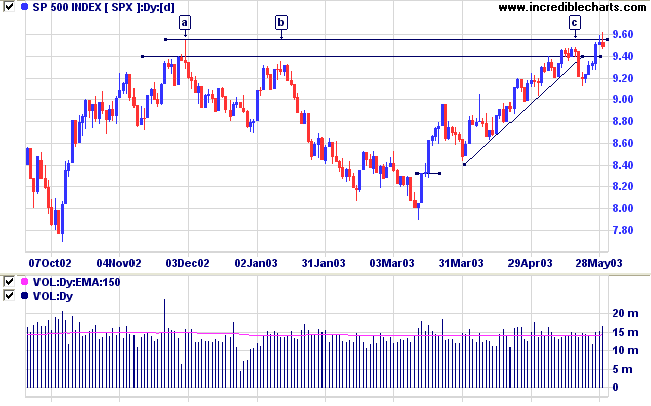

The Dow retreated 0.9% to close at 8711 on higher volume.

The intermediate trend is up.

The primary trend is down; a close above 9076 will signal a reversal.

The intermediate trend is up.

The primary trend is down; a close above 954 [a] will signal an up-trend.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the primary trend reverses up (S&P closes above 954).

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Go long if the S&P 500 primary trend turns upwards.

GDP growth for the first quarter was revised upwards to 1.9%, from an initially reported 1.6%. (more)

New York (16.45): Spot gold has rallied to $US 369.30.

On the five-year chart gold has respected the long-term upward trendline.

The intermediate trend is up.

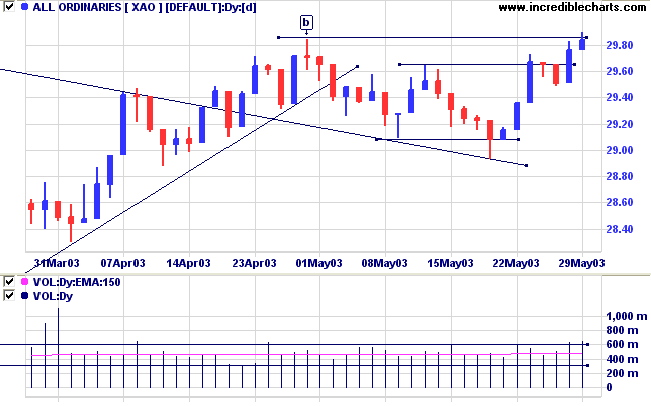

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) has crossed to above its signal line; Slow Stochastic (20,3,3) is above; and Twiggs Money Flow (21) shows accumulation.

Intermediate: Long if the primary trend reverses up ( crosses above 3062 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

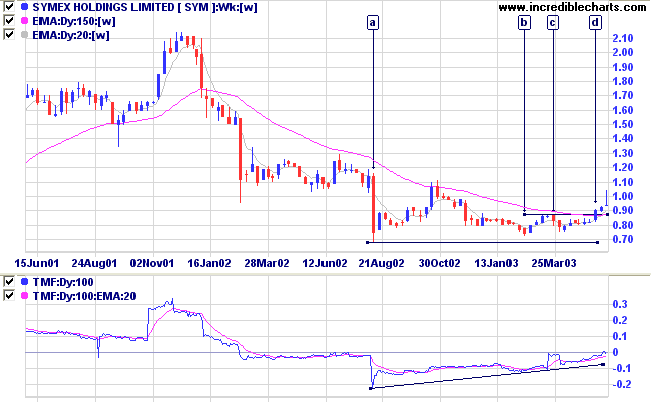

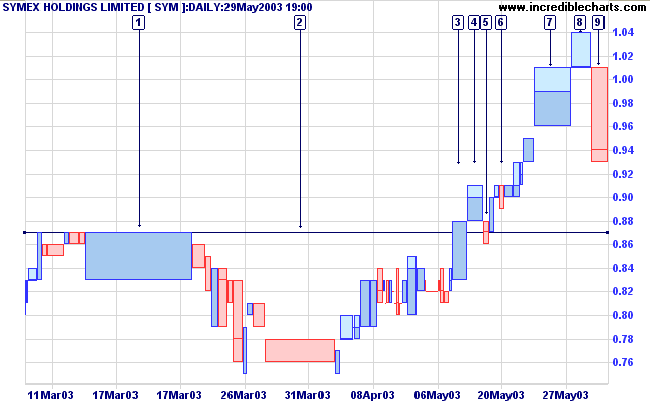

Last covered on May 19, 2003.

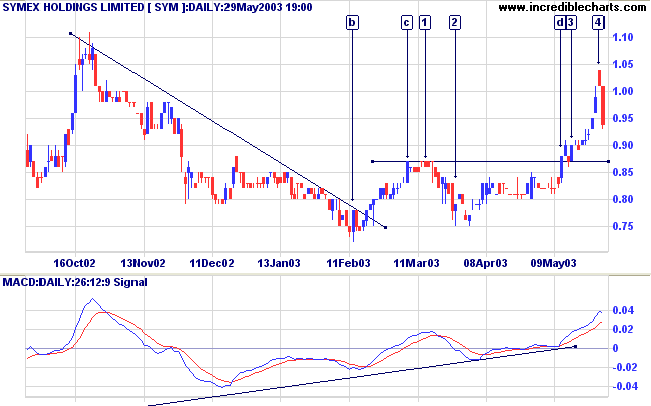

SYM broke above resistance at [c] and proceeded to rally strongly. Price has now corrected sharply.

Twiggs Money Flow (100) is rising.

Price starts gapping up, culminating in a strong closing price reversal at [4]: price gapped up strongly at the opening but then retreated to close near the previous high.

Relative Strength (price ratio: xao) is rising; MACD (26,12,9) and Twiggs Money Flow (21) are bullish.

Short-term traders may have moved their stop-loss below the low of [8] after the reversal signal.

Those with a longer-term view may still have their stops below the low of [5] or [6].

If volume dries up in the next few days, the pull-back is likely to respect support at 0.87; and consolidate before another rally.

"You see", he

explained, "I consider that a man's brain originally is like a

little empty attic,

and you have to stock it with such furniture as you

choose.

A fool takes in all the lumber of every sort that he comes

across,

so that the knowledge which might be useful to him gets crowded

out,

or at best is jumbled up with a lot of other things

so that he has a difficulty in laying his hands upon it.

Now the skilful workman is very careful indeed as to what he

takes into his brain-attic.

He will have nothing but the tools which may help him in doing

his work,

but of these he has a large assortment, and all in the most

perfect order.

It is a mistake to think that that little room has elastic

walls and can distend to any extent.

Depend upon it there comes a time when for every addition of

knowledge

you forget something that you knew before.

It is of the highest importance, therefore,

not to have useless facts elbowing out the useful ones."

- Sir Arthur Conan Doyle: Sherlock Holmes, in A Study in

Scarlet

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.