Please do not enter your activation key on more than one computer.

The authentication software, when activated, will prevent Incredible Charts from running.

This cannot be reversed (other than by formatting your hard disk).

If you have already entered your activation key on a second computer,

please contact Support before 31 May 2003.

This only applies to Premium members activation keys.

Trading Diary

May 26, 2003

The market is closed Monday for Memorial Day.

The Chartcraft NYSE Bullish % Indicator climbed to 62.56% on May 23; following a Bull Correction buy signal (April 3).

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

New York (12.00): Spot gold closed early at $US 370.80.

On the five-year chart gold has respected the long-term upward trendline.

The intermediate trend is down but on a weak signal. A rise above 2984 will signal reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

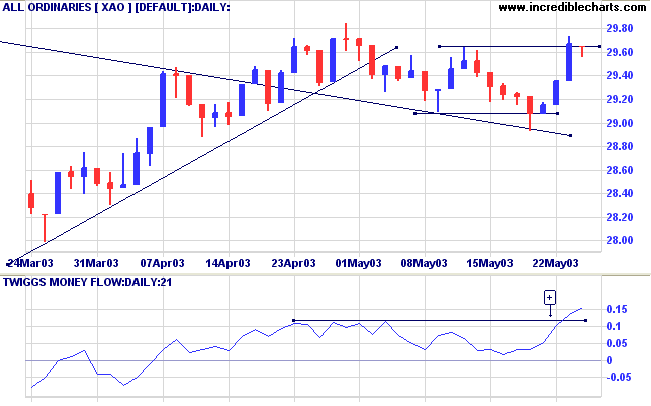

Slow Stochastic (20,3,3) has crossed to above its signal line; Twiggs Money Flow (21) shows a bullish signal, respecting the zero line at [+]; MACD (26,12,9) is below its signal line but threatens to complete a similar signal to TMF.

Intermediate: Long if the primary trend reverses up ( crosses above 3062 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

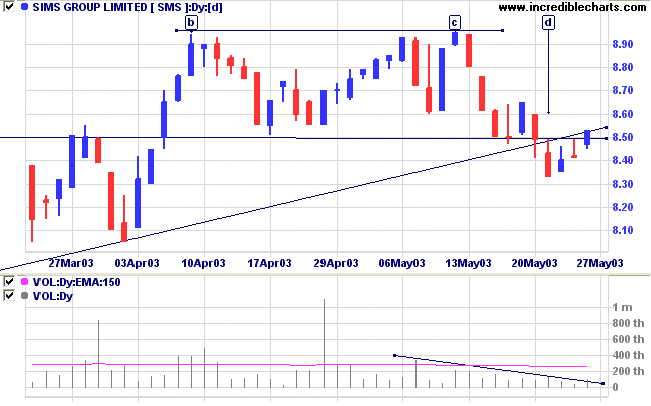

Last covered on May 21, 2003.

SMS broke below support at [d], completing an intermediate double top reversal, from [b] and [c]. The stock has since pulled back to test resistance at 8.50. The first 2 days were on lower volume but the third day closed above 8.50 on slightly higher volume.

The close above resistance signals that the pattern is weak and a further higher close will indicate failure.

The world is full of magical things

patiently waiting for our wits to grow sharper.

- Bertrand Russell

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.