Please do not enter your activation key on more than one computer.

The authentication software, when activated, will prevent Incredible Charts from running.

This cannot be reversed (other than by formatting your hard disk).

If you have already entered your activation key on a second computer,

please contact Support before 31 May 2003.

Trading Diary

May 23, 2003

The market will be closed Monday for Memorial Day.

The intermediate upward trendline has been broken. A rise above 8766 will signal continuation; a fall below 8394 will signal a reversal.

The primary trend is down; a rise above 9076 will signal a reversal.

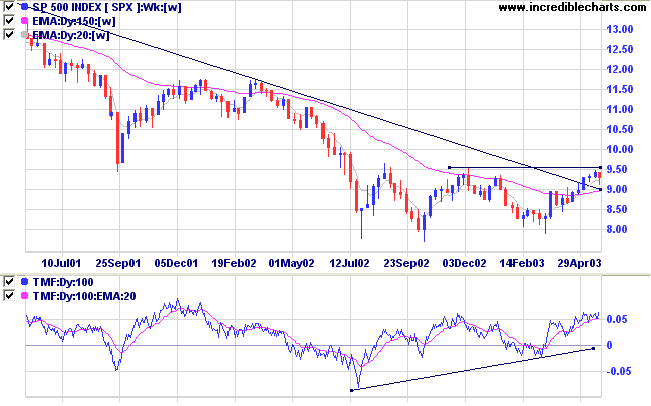

The intermediate upward trend is weak. A fall below 912 will signal reversal; a rise above 948[b], continuation.

The primary trend is down; a rise above 954[a] will signal an up-trend.

The intermediate trend is weak. A fall below 1478 will signal a down-trend; a rise above 1552 will signal continuation.

The index is in a primary up-trend.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

The Senate passed the $US 350 billion tax cut by a slender 51-50. The bill will now be signed into law by President Bush. (more)

New York (15.30): Spot gold closed the week at $US 368.30.

On the five-year chart gold has respected the long-term upward trendline.

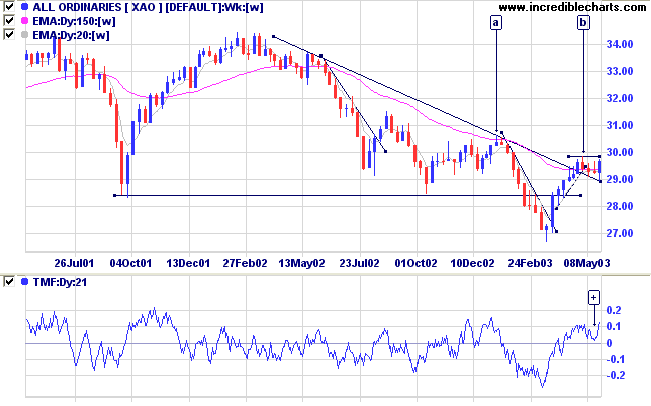

The intermediate trend is down but on a weak signal. A rise above 2984[b] will signal reversal.

The primary trend is down. A rise above 3062[a] will signal an up-trend.

Slow Stochastic (20,3,3) has crossed to above its signal line; Twiggs Money Flow (21) shows a bullish signal, respecting the zero line at [+]; MACD (26,12,9) is below its signal line but threatens to complete a similar signal to TMF.

Intermediate: Long if the primary trend reverses up ( crosses above 3062[a] ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is level)

- Materials [XMJ] - stage 3 (RS is falling)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

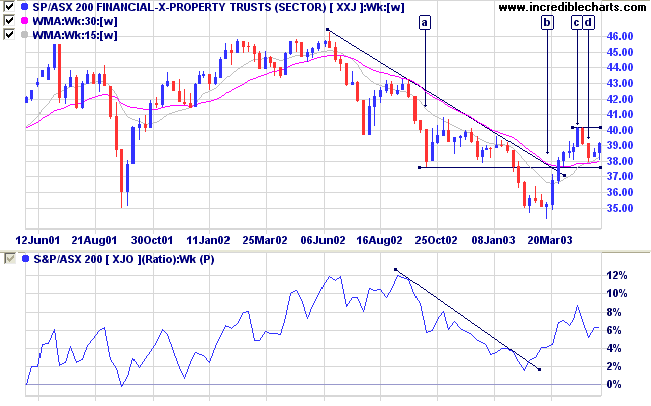

- Financial excl. Property Trusts [XXJ] - stage 1 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) rose to 79 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- REITs (14)

- Gold (5)

When the only tool you own is a hammer,

every problem begins to resemble a nail.

- Abraham Maslow

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.