Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 19, 2003

The intermediate upward trendline has been broken, signaling weakness.

The primary trend is down; a rise above 9076 will signal a reversal.

The intermediate upward trendline is broken, signaling weakness.

The primary trend is down; a rise above 954 will signal an up-trend.

The intermediate trend is up, but weakening.

The index is in a primary up-trend.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Treasury Secretary John Snow's comments imply that the US government is comfortable with a weaker dollar. (more)

New York (18.35): Spot gold has surged to $US 365.80.

On the five-year chart gold has respected the long-term upward trendline.

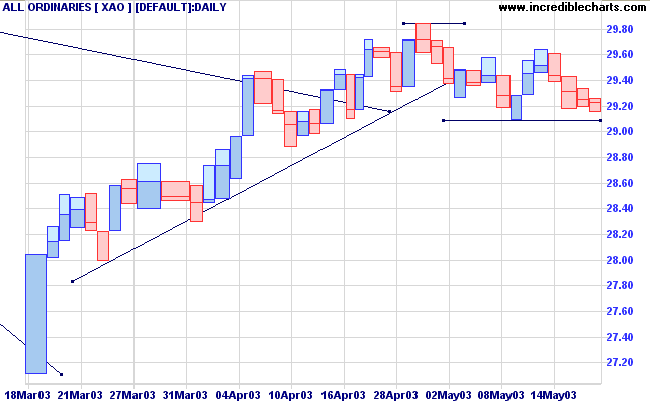

The intermediate up-trend is weak and a close below 2909 will signal a reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) is weakening.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the intermediate trend reverses down (falls below 2909).

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

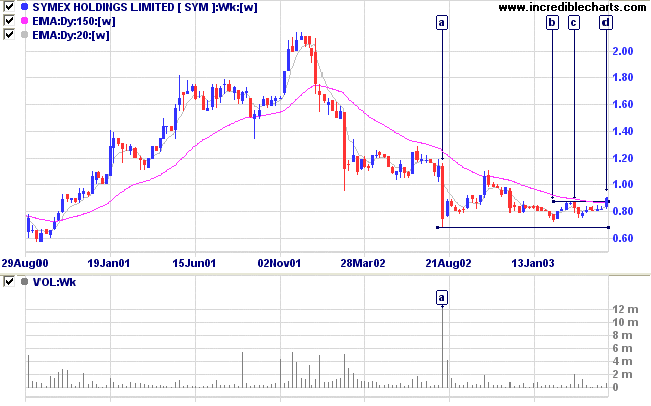

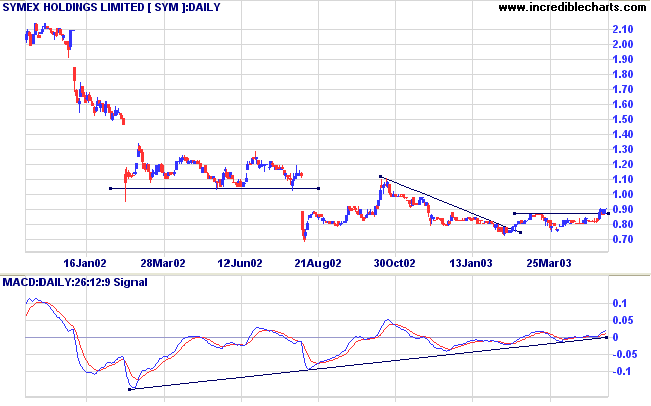

SYM has formed a new 3-month high [d] after a broad base, following a steep stage 4 down-trend.

Note the sharp downward spike at [a] accompanied by huge volume - commonly referred to as a shakeout. This normally establishes a strong support level for the stock, evident on the chart below. SYM re-tested support at [b] after an initial rally had formed a vulnerable V-bottom. And we now have a break above the high of [c], signaling an up-turn.

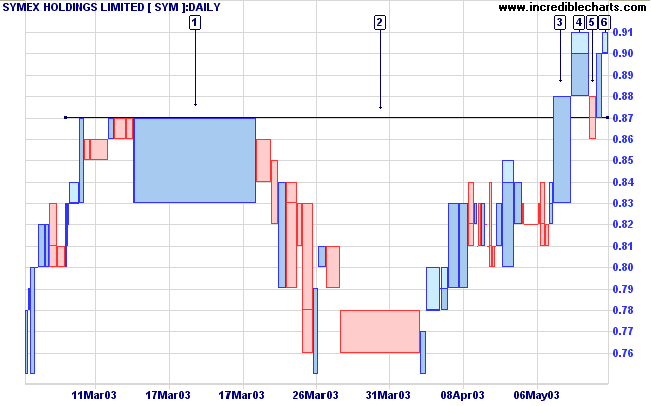

The power bar at [3] shows a healthy breakout and the pull-back at [5] only lasted one day.

The subsequent rally at [6] is on thin volume and closed back at 0.90; we may encounter further consolidation before the rally continues.

A close below the support level would be bearish.

In times of change, learners inherit the

earth,

while the learned find themselves beautifully equipped

to deal with a world that no longer exists.

- Eric Hoffer.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.