Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 15, 2003

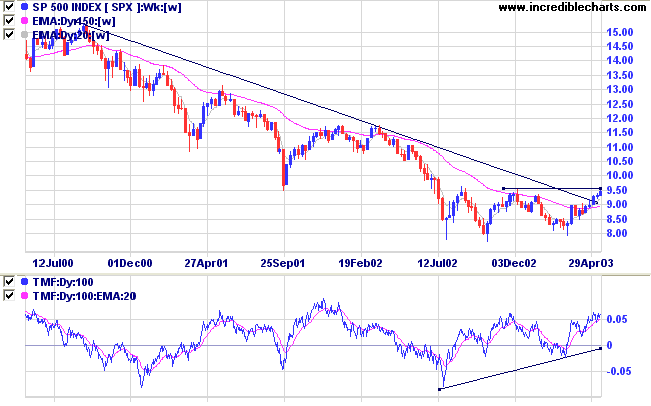

The intermediate trend is up.

The primary trend is down; a rise above 9076 will signal a reversal.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal an up-trend.

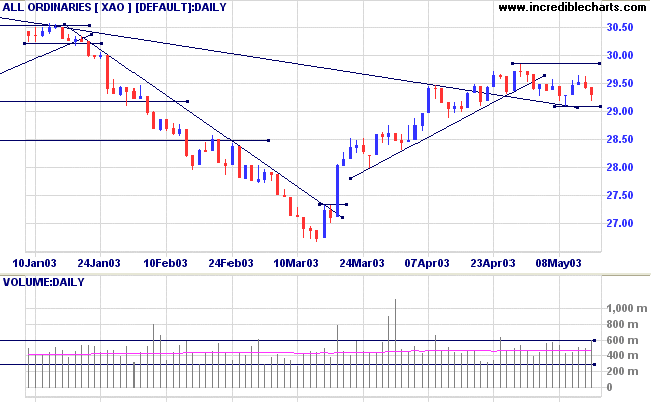

The intermediate trend is up.

The index is in a primary up-trend.

The Chartcraft NYSE Bullish % Indicator increased to 59.95% on May 14, following a Bull Correction buy signal on April 3.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

New York (18.08): Spot gold has retreated to $US 351.40.

On the five-year chart gold has respected the long-term upward trendline.

The intermediate trend is up; a close below 2909 will signal a reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed back below; Twiggs Money Flow (21) is weakening.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the intermediate trend reverses down (falls below 2909).

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

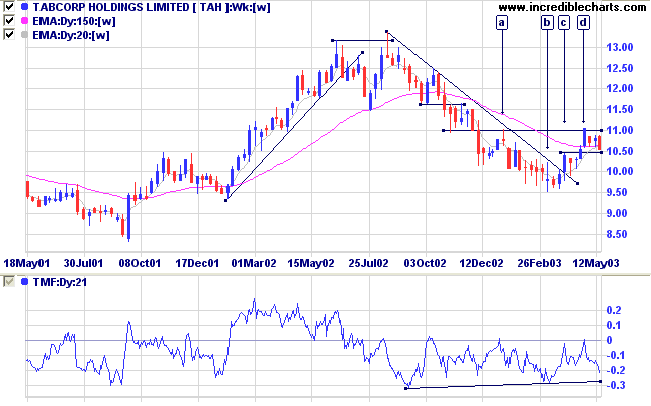

Last covered on April 23, 2003.

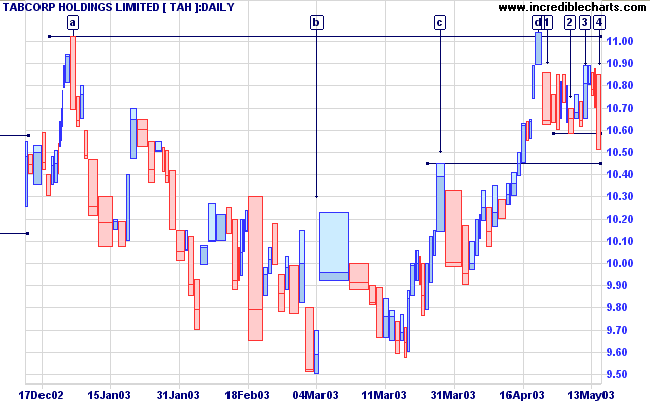

After rallying to test resistance at 11.00 [d], TAH has retreated to below the long-term moving average.

Twiggs Money Flow (21-day) has failed to cross above zero and signals strong distribution.

Relative Strength (price ratio: xao) and MACD have turned downwards.

This was followed by a period of consolidation on lower volume and some short-term traders may have entered on a rise above the high of [2]. The rally to [3] was on thin volume and price then retreated below support at [4]; knocking out stops placed below the low of [2].

Consolidation above 10.45 would be a bullish sign and may signal that another attempt at 11.00 resistance is likely.

One should count each day a separate

life.

- Seneca (4BC to 65AD).

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.