Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 13, 2003

The intermediate trend is up.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 closed 3 points down at 942.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite gapped down at the opening but rallied to close almost unchanged at 1539.

The intermediate trend is up.

The break above 1521 provides clear confirmation that the index is in a primary up-trend.

The Chartcraft NYSE Bullish % Indicator rose to 58.94% on May 12, following a Bull Correction buy signal on April 3.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

The up-tick in Tech company sales may be due more to postponed replacements than to real growth. (more)

New York (17.56): Spot gold retreated to $US 349.50.

On the five-year chart gold has respected the long-term upward trendline.

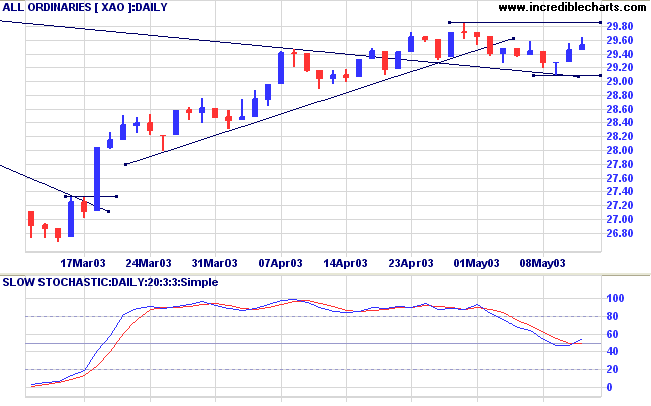

The intermediate up-trend is weak; a close below 2909 will signal a reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) is below its trendline but still signals accumulation.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the XAO falls below 2909.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

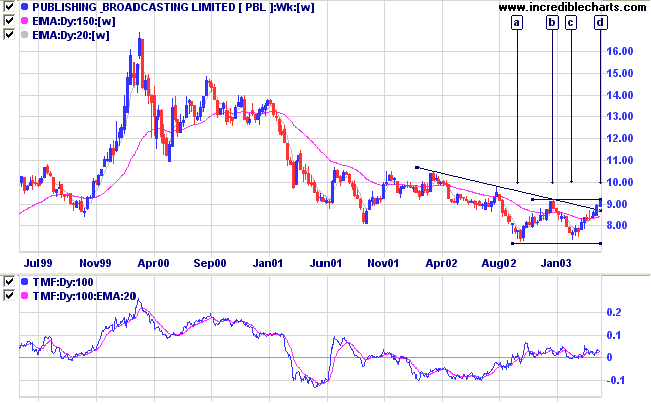

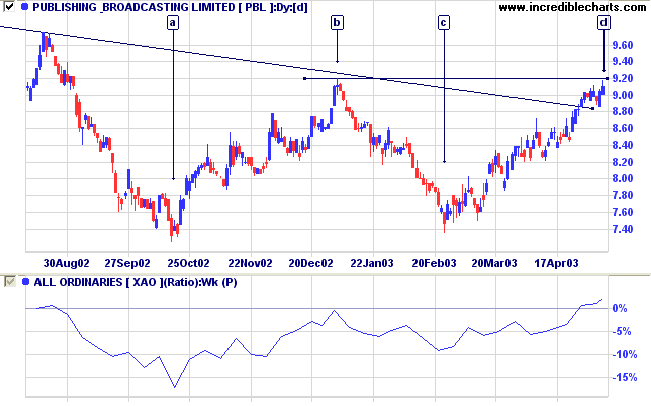

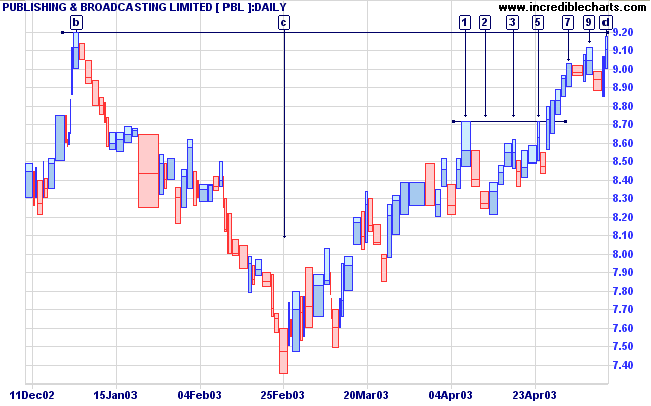

Last covered on July 25, 2002.

PBL threatens to complete a double bottom reversal, [a] to [d], after a lengthy stage 4 down-trend.

Twiggs Money Flow (100-day) signals strong accumulation.

The latest rally to [d] is on thin volume and we can expect further consolidation below 9.20 before the double bottom pattern is completed.

Making no mistakes is what makes victory

certain:

Avoid what is strong and strike at what is weak

......like water, taking the line of least resistance.

- Sun Tzu: The Art of War.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.