Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 6, 2003

The intermediate trend is down. I prefer to wait for a clear break above resistance (8643) to signal the start of an up-trend. A fall below 8258 will signal continuation.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 rallied 8 points to close at 934.

The slow intermediate up-trend continues, approaching resistance at 940.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite broke above resistance to set a new 6-month high of 1523; up 1.3% on the day.

The intermediate trend is up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator is at 55.25% (May 5), following a Bull Correction buy signal on April 3.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

The Federal Reserve policy meeting decides to leave the overnight lending rate unchanged at the 40-year low of 1.25%; and warns of downside risks. (more)

New York (18.30): Spot gold has climbed to $US 344.00.

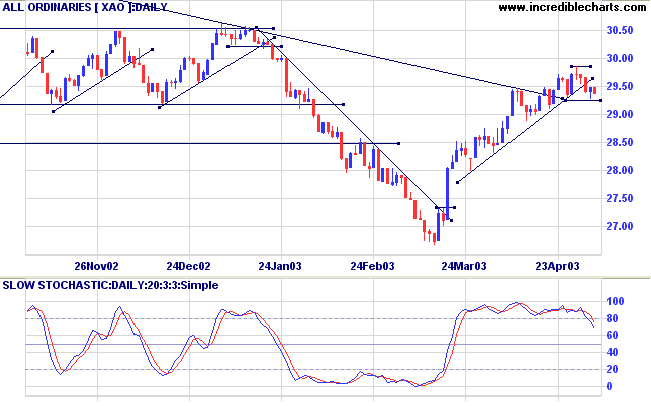

The intermediate up-trend continues but the indicators show that it is weakening; a break below Monday's low of 2926 will signal a reversal.

The primary trend is down. A rise above 3062 will signal reversal to an up-trend.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines and the Stochastic has fallen below 80%, a further bear signal; Twiggs Money Flow (21) is below its upward trendline but continues to signal accumulation.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Correction: Yesterday's diary contained a typo - The 21-day Twiggs Money Flow shows a strong bearish divergence.

Last covered on October 18, 2003.

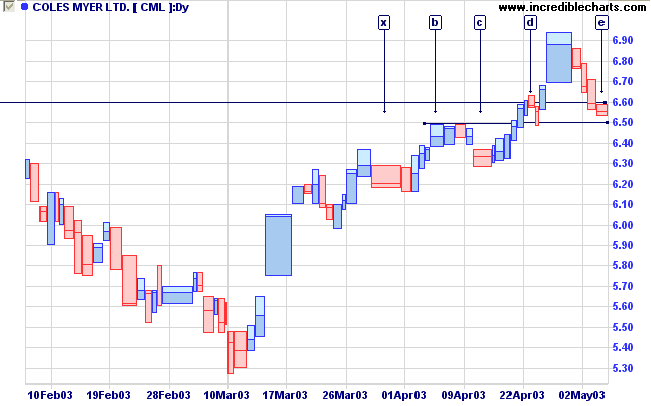

After a sharp downward spike, CML has rallied strongly to a new 6-month high.

Twiggs Money Flow shows a strong bullish divergence at [1], with the trough ending above the zero line.

Later, CML broke above resistance after a short pull-back at [d], but has since corrected to test the new support level at [e].

Relative Strength (price ratio: xao) and MACD are bullish.

A break below 6.50 would be a bear signal.

Everybody is ignorant.

Only on different subjects.

- Will Rogers.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.