Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 2, 2003

The intermediate trend is down. A rise above 8587 will signal the start of an up-trend; a fall below 8109 will signal continuation.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 gained 14 points to close at 930.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite rallied more than 2% to close at 1502.

The intermediate trend is up; overhead resistance is at 1521.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator continues to climb after a Bull Correction buy signal, reaching 53.32% (May 1).

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Rising unemployment and a drop in average working hours reflect slowing business activity. The market shrugged this off, believing in a post-Iraq rebound in consumer spending. (more)

New York (15.30): Spot gold ended the week up 2.3% at $US 340.70.

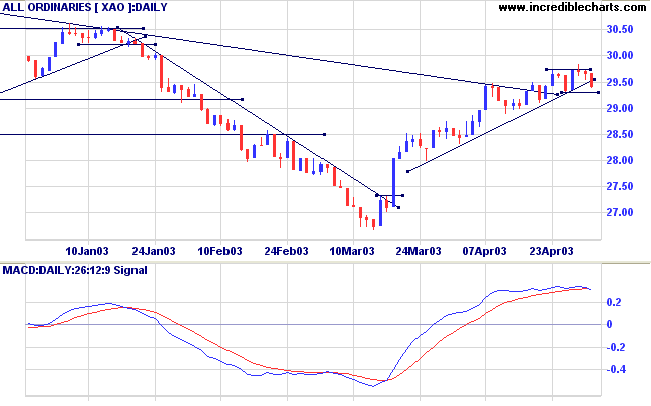

The intermediate up-trend continues; a break below 2931 will be bearish.

The primary trend is down, although the trendline has been broken; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) have crossed to below its signal line; Twiggs Money Flow (21) is below its upward trendline but continues to signal accumulation.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Changes are highlighted in bold.

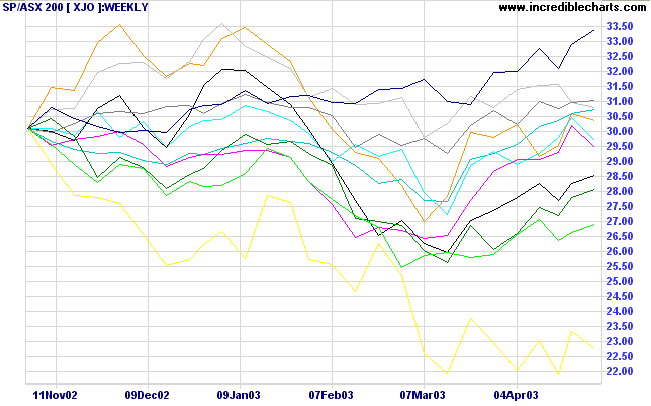

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 3 (RS is falling)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 1 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

Utilities is the only sector trending upwards;

Property Trusts are level;

Materials is weakening;

Energy,

Financials (excl. Property),

Consumer Staples and

Consumer Discretionary show signs of recovery;

Industrials,

Health Care and

Telecom are bottoming;

while

IT remains weak.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned a lower 80 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Gold (4)

- Diversified Financial (4)

- REITs (5)

If you're ridin' ahead of the herd, take a

look back every now and then to make sure it's still

there.

- Will Rogers.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.