Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 1, 2003

The intermediate trend is down. A rise above 8587 will signal the start of an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 also fell in early trading but recovered to close unchanged at 916.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite gained 8 points to close at 1472.

The intermediate trend is up; overhead resistance is at 1521.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator is rising after a Bull Correction buy signal; up more than 1% at 52.93% (April 30).

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

High unemployment levels continue to cast a shadow over the market. (more)

New York (19.45): Spot gold continues to climb, reaching $US 341.50.

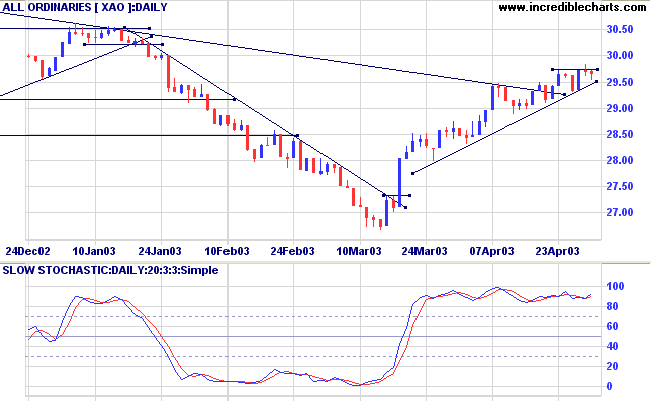

The intermediate up-trend continues.

The primary trend is down, although the trendline has been broken; a rise above 3062 will signal a reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) has crossed below its upward trendline but continues to signal accumulation.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

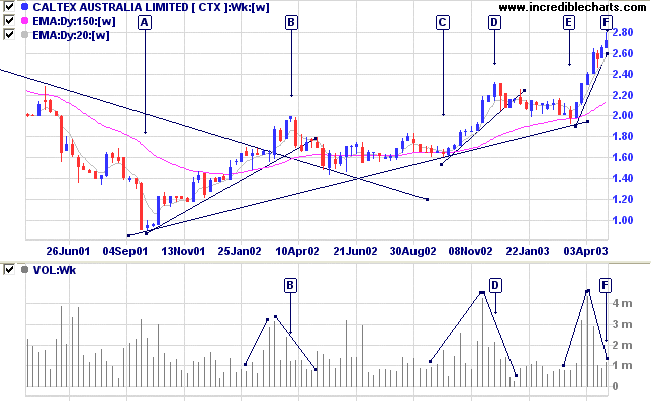

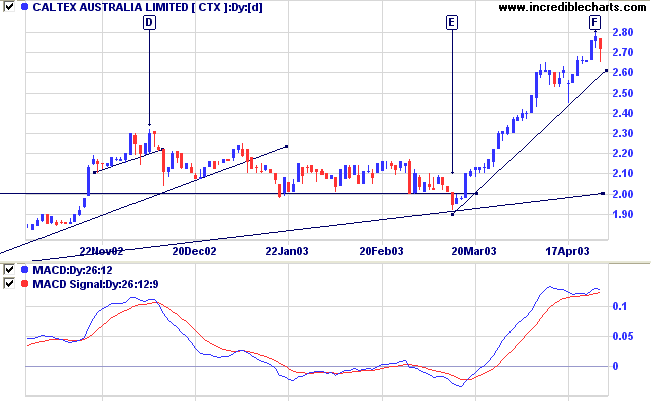

Last covered on April 3, 2003.

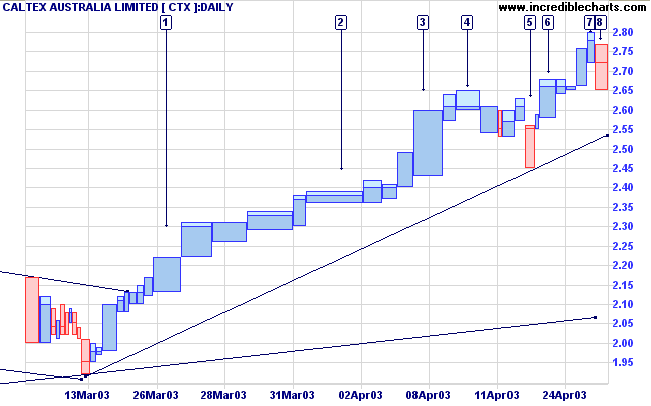

Caltex is in a primary up-trend as shown by the trendline [A] to [E]. The stock makes fast intermediate rallies off the primary trendline:

- [A] to [B];

- [C] to [D]; and

- [E] to [F];

Volume surges in the second half of the rally but fades at the peaks, at [B], [D] and [F].

Twiggs Money Flow (100-day) signals strong accumulation.

MACD and Twiggs Money Flow (21) are bullish.

Relative Strength (price ratio: xao) is rising.

The most solid advice for a writer is this, I

think:

Try to learn to breathe deeply, really to taste food when

you eat,

and when you sleep really to sleep.

Try as much as possible to be wholly alive, with all your

might,

and when you laugh, laugh like hell

and when you get angry, get good and angry.

- William Saroyan.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.