Subscribe by 31 May 2003.

The Daily Trading Diary will be mailed exclusively to Premium members from May 1st.

Trading Diary

April 24, 2003

The intermediate trend is down. A rise above 8587 will signal reversal to an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The Nasdaq Composite formed an inside day, signaling uncertainty, down 9 points at 1457.

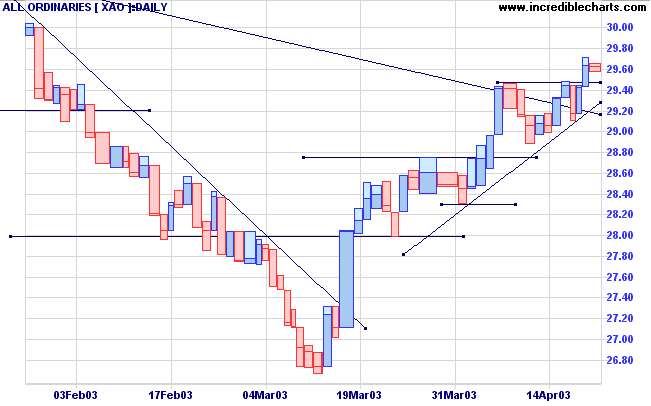

The intermediate trend is up.

The primary trend is up.

The S&P 500 lost 8 points to close at 911.

The intermediate trend is up.

The primary trend is down; a rise above 954 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator is at 50% (April 23), after completing a Bull Correction buy signal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

New unemployment claims jumped to 455,000 for the week ended April 19, signaling contraction. (more)

But durable goods orders increase

A 2% jump in March durable goods orders (1.3% excluding defense items) is welcome news for the manufacturing sector. (more)

New York (19.00): Spot gold is back up to $US 333.60.

The intermediate trend is up.

The primary trend is down; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs Money Flow (21) signals accumulation.

Long-term: There is already a bull signal: the March 18 follow through day. Wait for confirmation from a primary trend reversal.

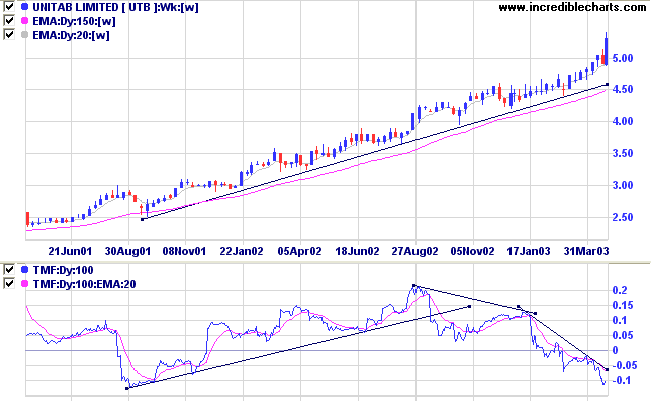

Last covered on September 2, 2002.

Here is an interesting divergence between two key indicators.

UTB has been in a stage 2 up-trend for the past 3 years, not crossing below its' long-term moving average in the last 18 months.

But notice how Twiggs Money Flow (100-day) has dipped below the zero line, showing a strong bearish divergence just when the general market appears to be strengthening.

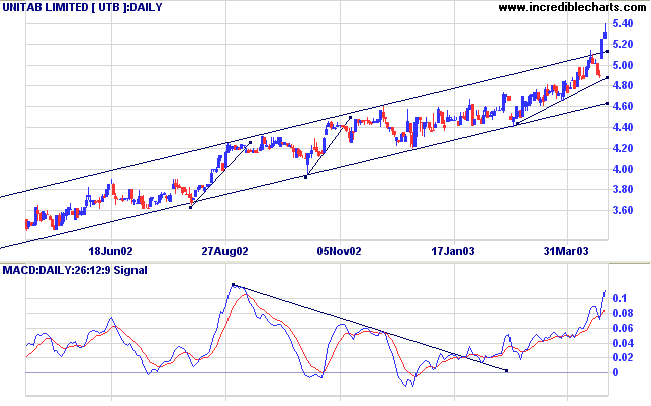

Relative Strength (price ratio: xao) is rising and MACD shows a strong bull signal. Twiggs Money Flow (21) displays the same bearish divergence as the 100-day indicator.

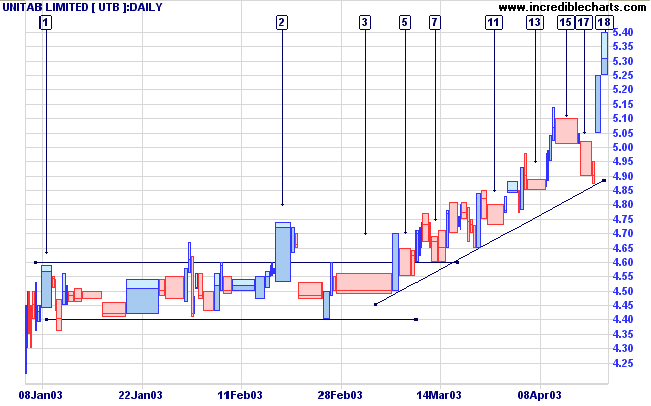

There are a few points worth attention:

- long shadows at [5] and [7] signal accumulation;

- all corrections are of short duration - not more than 4 days;

- down-volume is largest on square bars [11], [13] and [15] - signaling the presence of strong buying support;

- even though down-volume appears dominant, it has not broken the upward trend.

Long-term traders should wait for opportunities at the long-term trendline.

When price is above the upper trend channel traders should lock in profits with tighter stops (or a trailing % stop).

A break below 4.87 (the intermediate trendline) would be bearish.

If you examine their trades,

many failed traders will show a series of small or moderate

gains

and then a few large, devastating losses.

Successful traders may, at times, incur a series of small

losses

but these are then offset by several large gains.

~

Protect the downside and the upside will take care of

itself.

- Donald Trump: The Art of the Deal

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.