|

|

|

WineOrb, Australia’s premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us

in less than 25 words why you would like to attend. The best

entries will be invited to join us at the Masterclass on the

16th May 2003. Click here to enter. |

Trading Diary

April 11, 2003

The intermediate trend is down. A rise above 8552 will signal a reversal to an up-trend; a fall below 7903 will signal continuation.

Monday 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down.

The Nasdaq Composite took a similar route, closing 0.5% down at 1358.

The intermediate trend is down. A rise above the equal highs at 1430 will signal a reversal; a fall below 1336 will signal continuation.

The primary trend is up.

The S&P 500 lost 3 points to close at 868.

The intermediate trend is down, until the index breaks above 904.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 46% (April 10), after completing a Bull Correction buy signal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

The University of Michigan consumer sentiment index recovered to 83.2, from a 10-year low of 77.6 in March. (more)

Retail sales

March retail sales rose 2.1% after a sharp drop in February. (more)

Wholesale prices

Higher energy costs and car prices drove the Producer Price Index up 1.5% in March, sparking fears of inflation. (more)

New York (15.30): Spot gold closed up at $US 327.20.

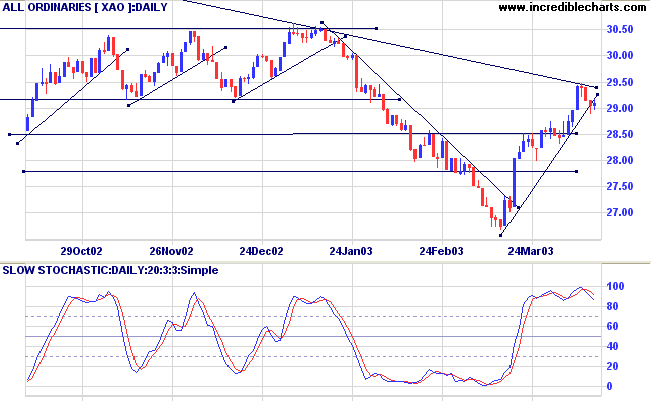

The intermediate up-trend continues. The upward trendline has been broken so we need to be alert for further signs of weakness.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals accumulation.

Long-term: There is already a bull signal: the March 18 follow through day. Wait for confirmation from the primary trend reversal.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

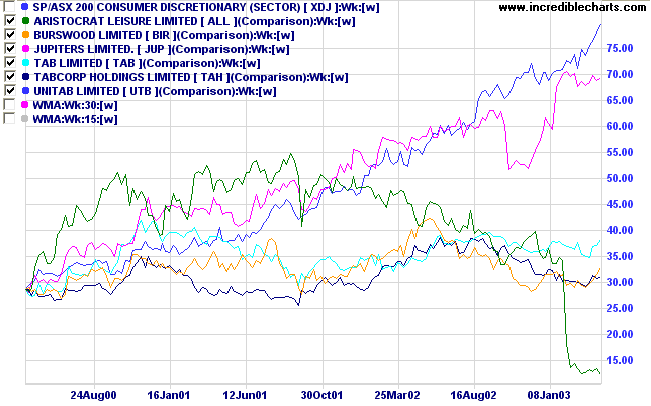

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 1 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

Burswood and TAB may be worth watching.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned a massive 131 stocks (compared to 99 on August 23, 2002; and 8 on March 14, 2003). The Financial sector is most prominent:

- Banks (9)

- REITs (10)

- Diversified Metals & Mining (6)

- Agricultural Products (5)

- Broadcasting & TV (4)

- Oil & Gas Exploration (5)

- Diversified Financial (8)

- Construction Materials (4)

We are here to make a choice between the quick and the dead.

That is our business.

Behind the black portent of the new atomic age lies a hope

which, seized upon with faith, can work out a

salvation.

If we fail, then we have damned every man to be the slave of

fear.

Let us not deceive ourselves: we must elect world peace or

world destruction.

- Bernard Baruch (1870 - 1965).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.