|

|

|

WineOrb, Australia’s premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us

in less than 25 words why you would like to attend. The best

entries will be invited to join us at the Masterclass on the

16th May 2003. Click here to enter. |

Trading Diary

April 10, 2003

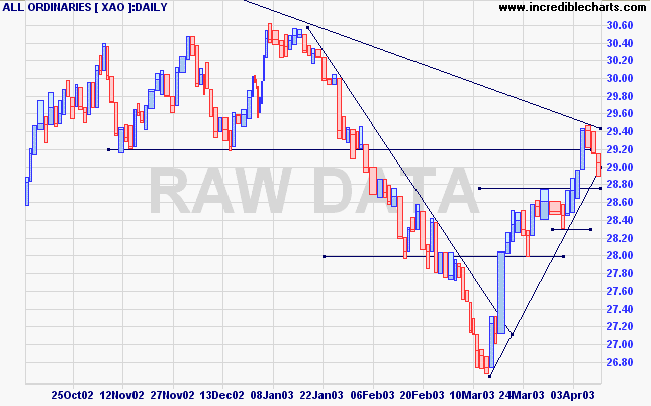

The intermediate trend is down. A rise above 8552 will signal a reversal to an up-trend; a fall below 7903 will signal continuation.

Monday 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down.

The Nasdaq Composite gained 9 points to close at 1365.

The intermediate trend is down. A rise above the equal highs at 1430 will signal a reversal; a fall below 1336 will signal continuation.

The primary trend is up.

The S&P 500 closed up 6 points at 871.

The intermediate trend is down, until the index breaks above 904.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 46% (April 9), after completing a Bull Correction buy signal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

As the influence of the war fades the markets are refocusing on the domestic economy which remains weak. New unemployment claims remain above 400,000 for last week, signaling that the economy is still contracting. (more)

Boeing

The aerospace and defense manufacturer takes a $1.2 billion charge, reflecting the downturn in commercial aviation. (more)

New York (19.16): Spot gold eased to $US 325.30.

The intermediate up-trend continues. Lower volume and a weak close (long shadow) on the correction indicate that the trend is likely to continue.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals accumulation.

Long-term: There is already a bull signal: the March 18 follow through day. Wait for confirmation from the primary trend reversal.

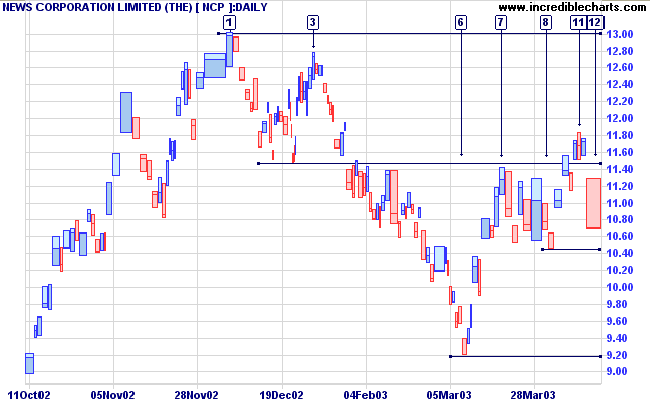

Last covered on March 5, 2003.

My thoughts on reading of the acquisition of DirecTV were: "this should give NCP a boost". The market took a different view, with the stock falling almost 9% on strong volume to close at 10.70. This just serves to confirm: don't follow your hunches, follow the tape.

Relative Strength (price ratio: xao) has leveled; MACD is positive; Twiggs Money Flow (21) has retreated below zero.

The best approach is to stick to your trading plan; do not tinker with your stops. The intermediate trend has not yet reversed and a gap up/down on big volume often exhausts short term momentum. The next few days will provide some clues:

- an inside day on Friday would signal exhaustion;

- a downward day following the inside day may be a false move, especially if on low volume;

- an upward move after the false downward move would be a bull signal;

- a strong downward day on Friday would be bearish.

A fall below 10.45 would be a clear bear signal and may provide an opportunity to go short with a target of 9.20.

Conversely, a rally above the high of [11] would be a bull signal, with a target of 13.00.

For further assistance see Understanding the Trading Diary.

While we stop and think, we often miss our opportunity.

- Publius Syrus (1st century B.C.).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.