We should have the free trial available next week.

The free trial period will be extended until 31 May 2003.

Trading Diary

April 3, 2003

For further guidance see Understanding the Trading Diary.

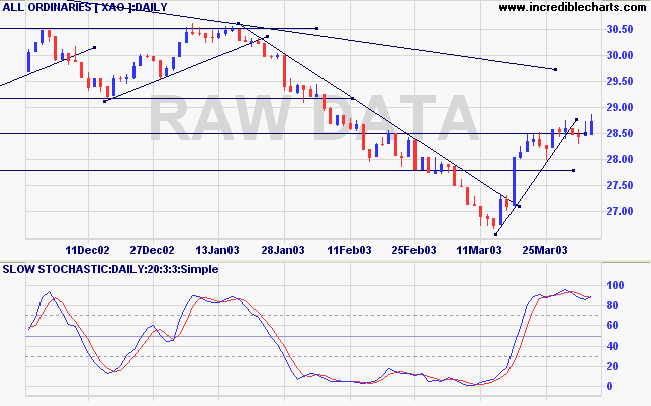

Monday 17th's follow through signal remains valid (as long as the index holds above 7763).

The intermediate cycle is down; a rise above 8552 will signal a reversal.

The primary trend is down.

The Nasdaq Composite gapped up at the opening but later weakened to close unchanged at 1396.

The intermediate trend is down; a rise above 1425 will signal a reversal.

The primary trend is up.

The S&P 500 retreated 4 points to close at 876.

The intermediate trend is down, until the index breaks above 895.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 38% (April 2).

Coalition forces approach the outskirts of Baghdad. (more)

Pack behavior

When traders think in packs. (more)

New York (17.30): Spot gold is down further at $US 325.10.

The intermediate up-trend has lost momentum; the long upper and lower shadows signal uncertainty.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) crossed to above its signal line; Twiggs Money Flow (21) signals distribution.

Long-term: Wait for the March 18 follow through to be confirmed by the intermediate signal above.

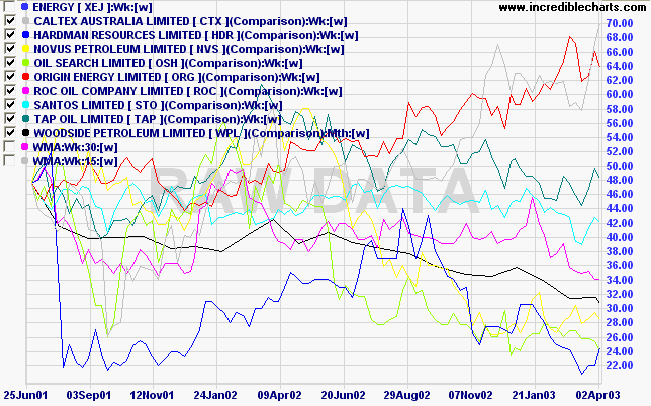

The Energy index is in a stage 4 down-trend but relative strength is rising and 100-day Twiggs Money Flow signals accumulation.

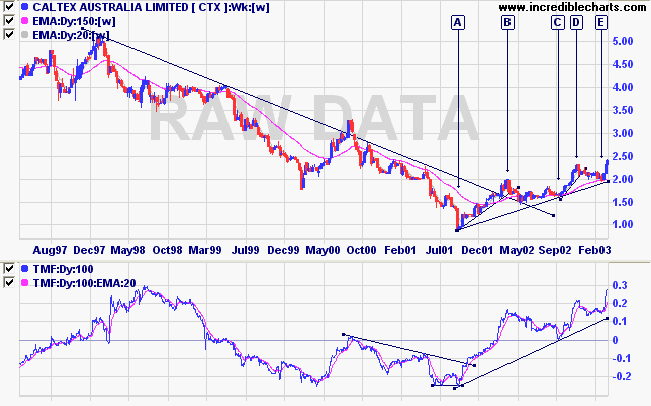

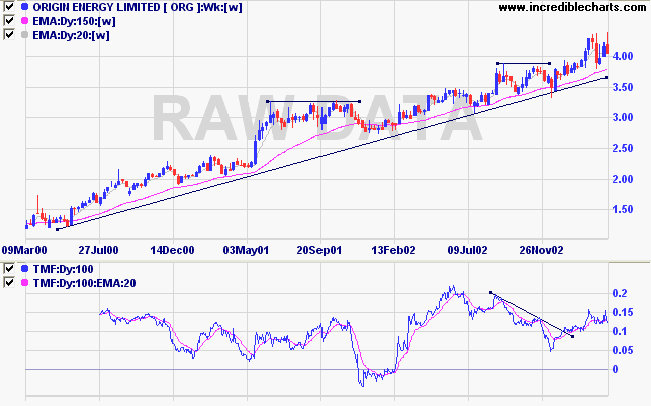

Two stocks have significantly out-performed the rest of the sector over the past 9 months: Caltex Australia and Origin Energy.

The fool doth think he is wise,

but the wise man knows himself to be a fool.

- William Shakespeare: As You Like It.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.