The Bigpond cable connection was down for more than 6 hours this morning.

Trading Diary

April 2, 2003

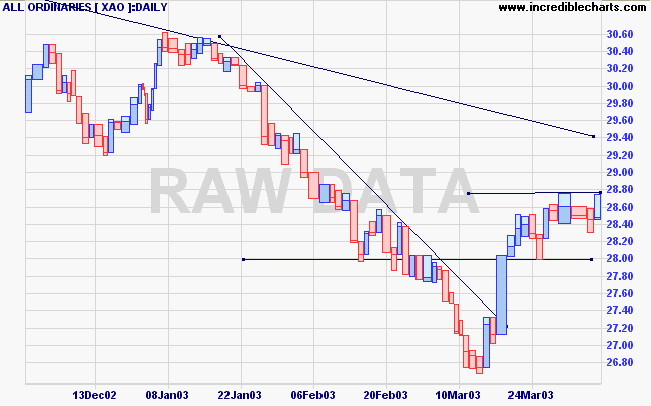

Monday 17th's follow through signal remains valid (so long as the index holds above 7763).

The intermediate cycle is down; a rise above 8552 will signal a reversal.

The primary trend is down.

The Nasdaq Composite gapped strongly upwards, closing 48 points higher at 1396.

The intermediate trend is down; a rise above 1425 will signal a reversal.

The primary trend is up.

The S&P 500 rallied 22 points to close at 880.

The intermediate trend is down, until the index breaks above 895.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 38% (April 2).

The method of calculation has changed slightly.

Hopes for a quick end to the war boosts technology stocks, with Microsoft up more than 5%. (more)

New York (22.06): Spot gold fell sharply to $US 327.60.

The intermediate up-trend has lost momentum; the long upper and lower shadows signal uncertainty.

The primary trend is down.

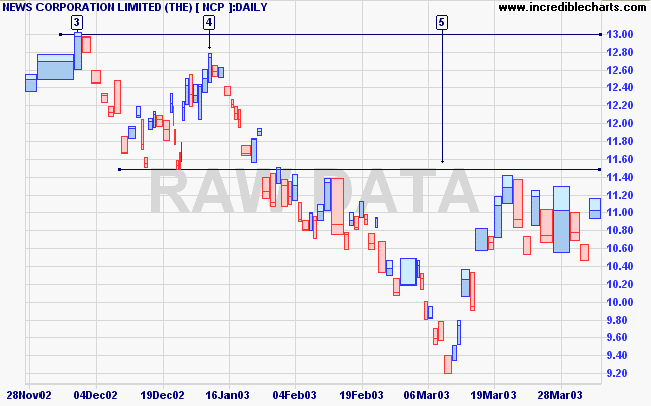

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals distribution.

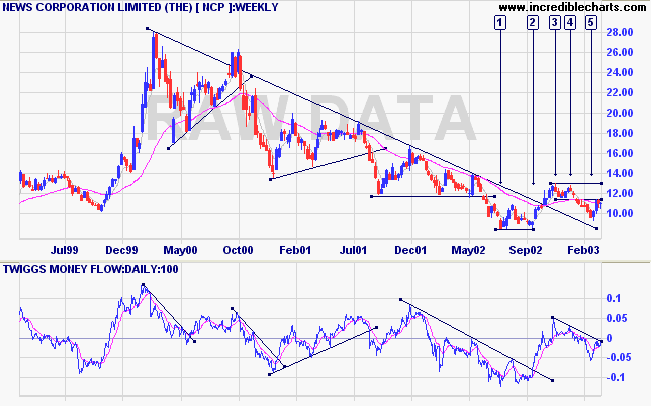

Last covered on March 24, 2003.

NCP broke above the long-term downward trendline before forming a double top at [3] and [4]. The latest trough has respected the broken trendline.

100-day Twiggs Money Flow still shows distribution; a rise above zero would be a bull signal.

Relative Strength (price ratio: xao) is level; while MACD and Twiggs Money Flow (21) are neutral.

A break above 11.50 on strong volume will be bullish for short-term traders. A break above the high of 13.00 would be a strong long-term signal.

A break below 10.45 would be bearish.

For further guidance see Understanding the Trading Diary.

If a man is offered a fact which goes against his instincts, he

will scrutinize it closely,

and unless the evidence is overwhelming, he will refuse

to believe it.

If, on the other hand, he is offered something which

affords a reason for acting in accordance to his

instincts,

he will accept it even on the slightest evidence.

- Bertrand Russell.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.