The server is updated at 7.30 p.m. AEST (Sydney) time.

As of Sunday 30 March 2003, Daylight Saving ended in New South

Wales, Victoria, South Australia, Tasmania and the ACT.

This means that the updates will occur one hour later in other

states.

Trading Diary

April 1, 2003

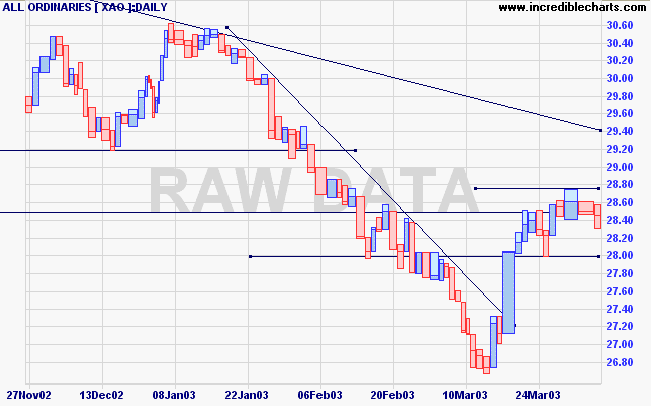

Monday 17th's follow through signal remains valid so long as the index holds above 7763.

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite formed an inside day, signaling uncertainty. The index closed 7 points higher at 1348.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 also showed a hook reversal, closing 10 points up at 858.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 38% (March 31).

The method of calculation has changed slightly.

The Institute for Supply Management index of manufacturing activity fell to 46.2 in March, from 50.5 in February. A reading of less than 50 signals contraction. (more)

New York (17.20): Spot gold eased to $US 334.50.

The intermediate up-trend has lost momentum, but the long shadow on the latest bar signals increased buying pressure.

The primary trend is down.

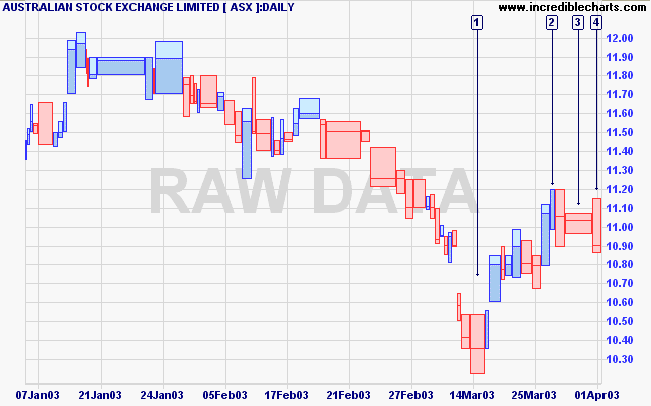

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals distribution.

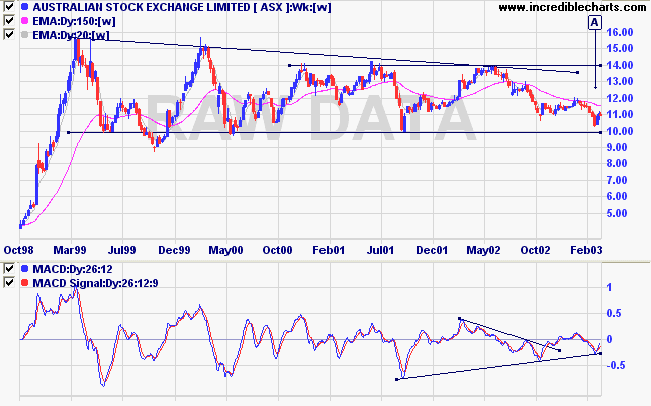

The ASX has been in a stage 3 top for the last 4 years. After twice testing resistance at 16.00 the stock has ranged between support at 10.00 and resistance at 14.00

100-day Twiggs Money Flow shows weakness.

Relative Strength (price ratio: xao) is level; while MACD and Twiggs Money Flow (21) both display bullish divergences at [A].

If price respects the 10.00 support level, the stock may be expected to rally back to resistance at 14.00. A dry-up of volume and volatility near the support level will increase the likelihood of a rally.

A break below 10.00 would be bearish.

For further guidance see Understanding the Trading Diary.

The most savage controversies are those about matters

as to which there is no good evidence either way.

- Bertrand Russell.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.