As of 3.00am AEST, Sunday 30 March 2003, Daylight Saving ends in New South Wales, Victoria, South Australia, Tasmania and the ACT.

Market hours remain unchanged in these states, but will commence (and end) one hour later in all other states.

Trading Diary

March 31, 2003

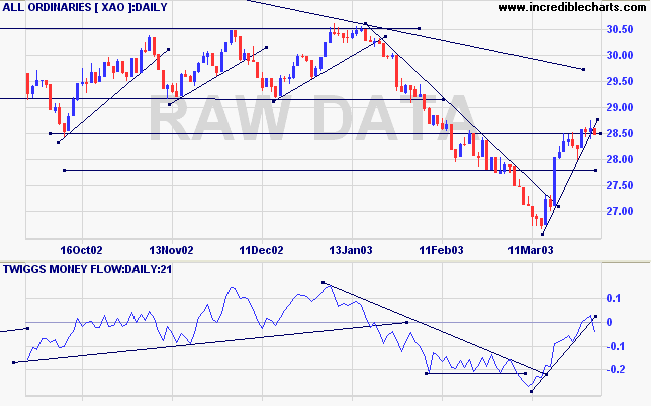

Monday 17th's follow through signal remains valid so long as the index holds above 7763.

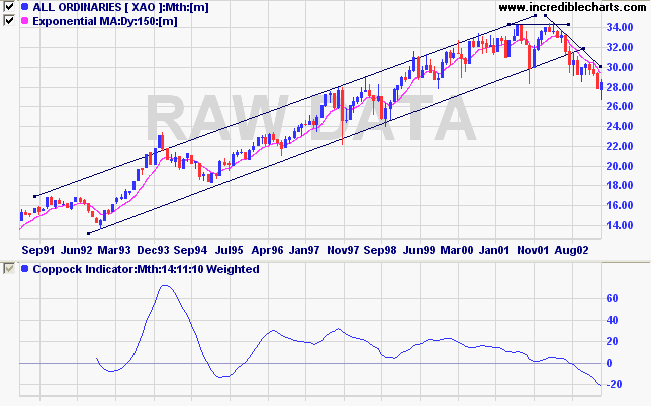

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite gapped down 2.1% to 1341.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 fell 15 points to 848.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 38% (March 28).

The method of calculation appears to have changed slightly.

The Chicago-area Purchasing Managers Index declined to 50.5; below expectations. A reading of less than 50 signals contraction in manufacturing activity. (more)

New York (18.15): Spot gold jumped more than 500 cents to $US 336.90.

The intermediate up-trend has lost momentum.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; Twiggs Money Flow (21) signals distribution.

Last covered on December 10, 2002.

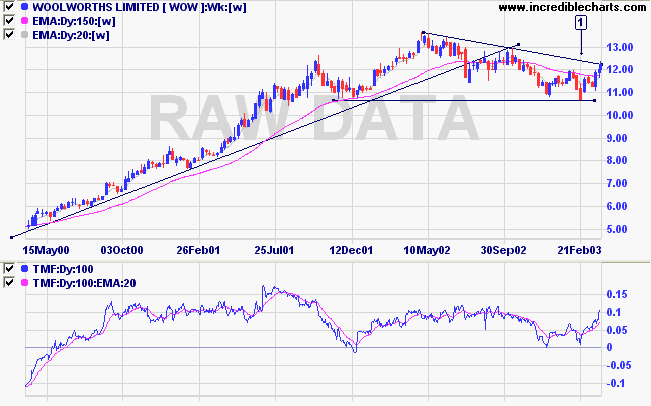

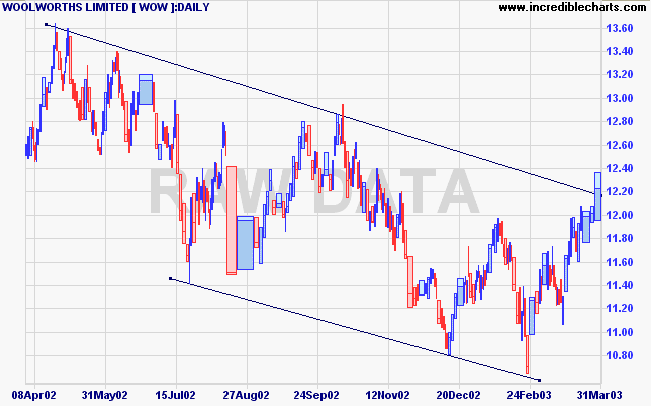

The retailer has been in a creeping down-trend since it broke the long-term supporting trendline in 2002. After testing support around 10.70, at [1], the stock has rallied to test the downward trendline.

100-day Twiggs Money Flow shows a bullish divergence at [1].

Relative Strength (price ratio: xao) is rising while MACD and Twiggs Money Flow (21) both display bullish divergences.

A pull-back that respects support at 12.00 will be bullish; a dry-up of volume and volatility on the pull-back would increase the strength of the signal.

A break below the last low, at 11.76, will signal continuation of the down-trend.

For further guidance see Understanding the Trading Diary.

Everything is vague to a degree you do not realize

till you have tried to make it precise.

- Bertrand Russell.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.