As of 3.00am AEST, Sunday 30 March 2003, Daylight Saving ends in New South Wales, Victoria, South Australia, Tasmania and the ACT.

Market hours remain unchanged in these states, but will commence one hour later in all other states

Trading Diary

March 28, 2003

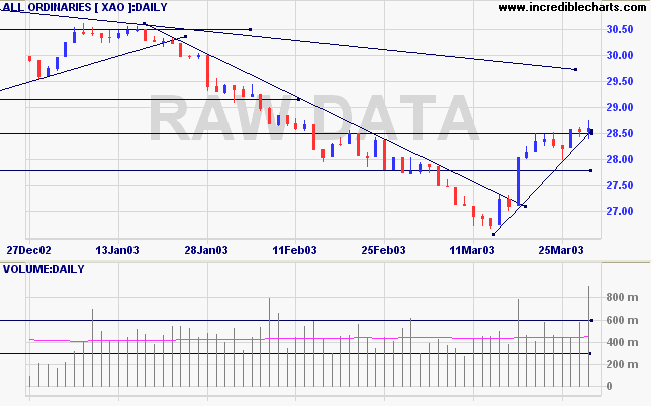

Monday 17th's follow through signal remains valid so long as the index holds above 7763.

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite closed down 1% at 1369.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 formed an inside day, down 5 points at 863.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator remains at 36% (March 27).

Apart from the Energy sector, which has benefited from higher oil prices, corporate earnings show almost zero growth. (more)

New York (17.00): Spot gold closed up 330 cents at $US 331.50.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (21) signals accumulation.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 4 (RS is level)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is rising)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned an even higher 50 stocks (compared to 99 on August 23, 2002; and 8 on March 14, 2003). Two industries were prominent:

- Banks (SGB, ANZ, WBC, NAB and BOQ)

- REITs (ADB, ART, GHG, GPT, WFT, LUO, GAN, DDF and DOT)

For further guidance see Understanding the Trading Diary.

Nothing is so exhausting as indecision,

and nothing is so futile.

- Bertrand Russell.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.