Explains how to use the [Sectors ASX 200] project file

and how to set up Sector Comparison charts.

Trading Diary

March 25, 2003

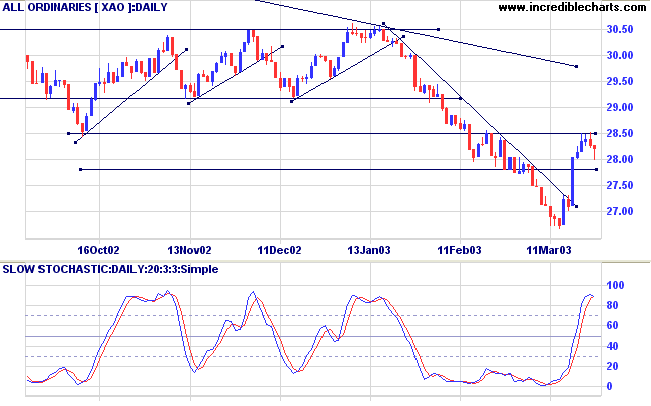

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite gained 1.5% to close at 1391.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 formed an inside day, gaining 10 points to close at 874.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator remains at 36% (March 24).

The Conference Board consumer confidence index fell to 62.5 from 64.8 in February; in line with expectations. (more)

Senate slashes tax cuts

Concerned about the growing budget deficit, the Senate votes to halve President Bush's $US 726 billion tax cut plan. (more)

New York (16.30): Spot gold eased 100 cents to $US 328.10.

The intermediate trend is down, despite the break above the trendline.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; Twiggs Money Flow (21) signals distribution.

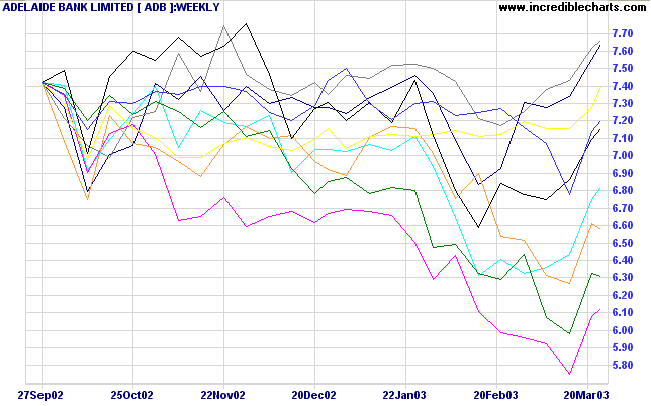

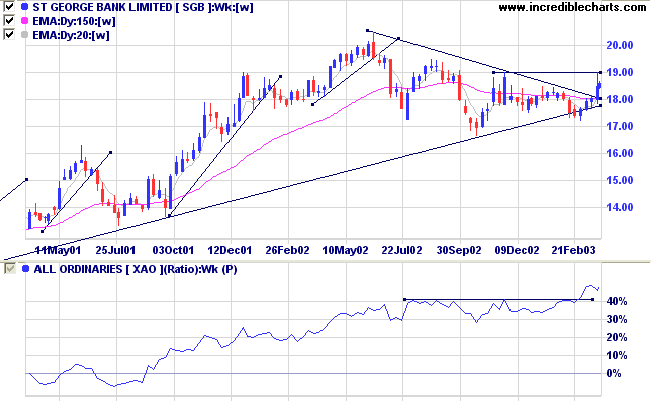

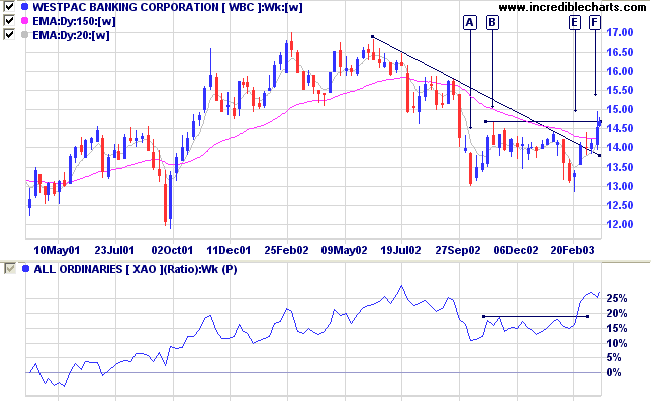

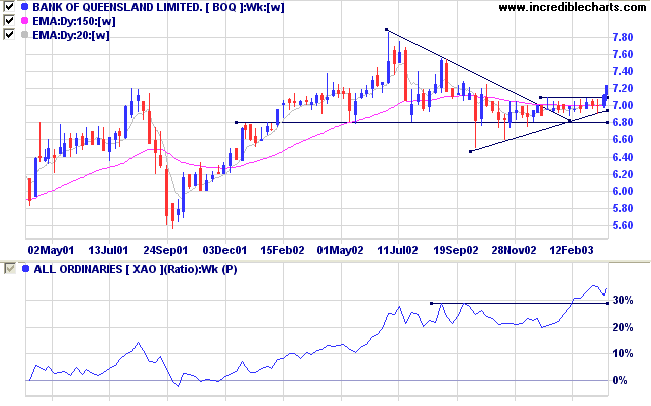

The Financial Sector is recovering faster than the other sector indices.

The 6-month price comparison chart reveals that

SGB,

WBC and

BOQ are the strongest performers in the sector. Also of interest are

ANZ and

NAB, while

CBA,

ADB,

BEN and

BWA still show weakness.

For further guidance see Understanding the Trading Diary.

In any moment of decision, the best thing you can do is the

right thing.

The worst thing you can do is nothing.

- Theodore Roosevelt.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.