The new Premium data will include market statistics:

New Highs/Lows, Advances/Declines and Advance/Decline Volume.

Trading Diary

March 17, 2003

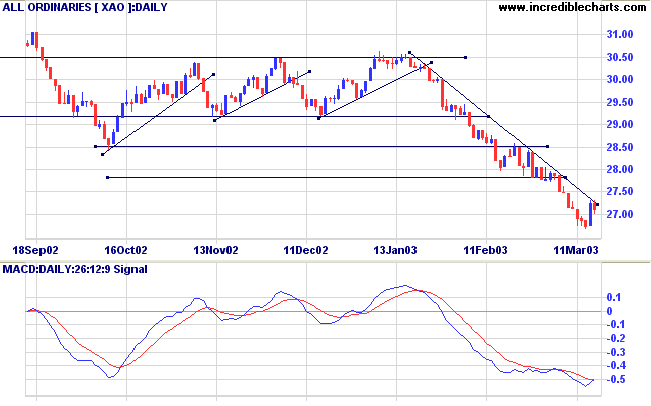

The primary trend is down.

The Nasdaq Composite follow-through day surged 3.9% to close at 1392. The large correction does not alter the intermediate trend, which is still down.

The primary trend is up; a fall below 1108 will signal a reversal.

The S&P 500 staged a similar rally, up 29 points at 862.

The intermediate trend is down - until there is a higher low followed by a further high.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 36% (March 14).

The market rallies as the US and its allies decide not to seek a further resolution from the UN security council, making war with Iraq inevitable. (more)

The US dollar improves to 0.94 Euros, while bond yields rise and oil prices fall. (more)

New York (19.45): After surging to 345.00 spot gold fell back to $US 337.90.

MACD (26,12,9) threatens to cross its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (21) signals distribution.

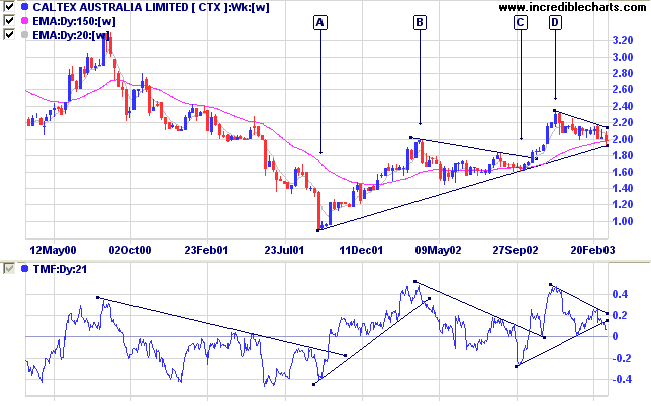

Last covered on November 27, 2002.

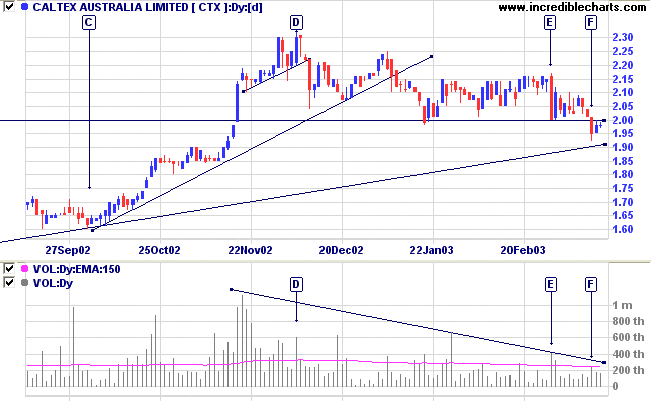

Caltex has been in a slow up-trend since a V-bottom in October 2001. The secondary reaction back to the supporting trendline at [C] was followed by a strong rally to [D], before the present correction back to the trendline.

Relative Strength (price ratio: xao) is rising, while MACD and Twiggs Money Flow are bearish.

If price is to hold above the supporting trendline we should see a dry up of volume and narrow ranges on the down-days and increases on the up-days; the opposite of the present pattern.

A break below the supporting trendline would be a bear signal, strengthened if CTX falls below support at 1.83.

Westpac [WBC] and Bank of Queensland [BOQ] are in lengthy consolidations. UniTab [UTB] has formed a new high in a slow up-trend. SFE has formed an unstable V-bottom while Symex [SYM] is in a broad base.

Bearish crossovers in the ASX 200 included seven Real Estate Trusts: CEP, MGR, IIF, MCW, AIP, MGI and GPT. The steel industry was also represented by BHP Steel [BSL] and Onesteel [OST].

Last covered on March 13,2003.

Bristile is subject to a takeover offer from Brickworks Limited [BKW] at $3.15 per share and shareholders are also due to receive a 9 cent interim dividend; so BRS is unlikely to fall below $3.24 per share until the ex-date of April 1st, 2003.

For further guidance see Understanding the Trading Diary.

War's climate of danger, exertion, uncertainty, and chance also

demands other intellectual qualities:

Presence of mind . . .

is nothing but an increased capacity of dealing with the

unexpected.

- Claus von Clausewitz: "On War"

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.