The new Premium data will include market statistics:

New Highs/Lows, Advances/Declines and Advance/Decline Volume.

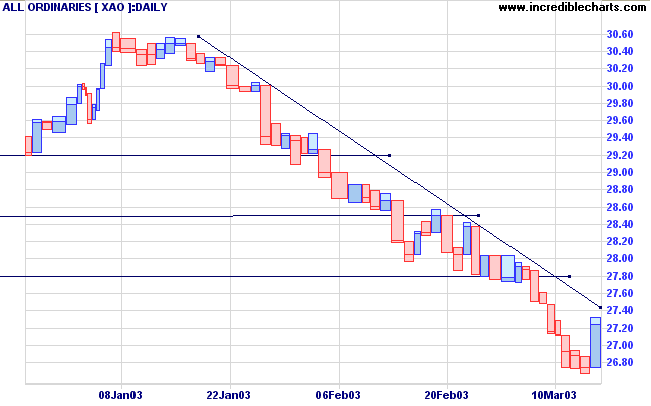

Trading Diary

March 14, 2003

The primary trend is down.

The Nasdaq Composite showed short-term exhaustion after Thursday's gap upwards; closing unchanged at 1340.

The intermediate trend is down, with the next support level at 1200.

The primary trend is up; a fall below 1108 will signal a reversal.

The S&P 500 closed 2 points up at 833. The shooting star reversal requires a close below 818 to complete the pattern.

The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 36% (March 13).

The producer price index increased 1% in February, driven by higher oil prices. (more)

The University of Michigan consumer sentiment index has fallen to 75.0, from 79.9 in February. (more)

New York (16.00): Spot gold closed at $US 336.00.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (21) signals distribution.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 4 (RS is level)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

The weakest sectors are Information Technology, Health Care and Consumer Discretionary.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned the lowest number yet: 8 stocks (compared to 99 on August 23, 2002; and 10 on October 4, 2002).

For further guidance see Understanding the Trading Diary.

Engulfed by fear and suspicion,

we try desperately to invent ways out,

plan how to avoid

the obvious danger that threatens us so terribly.

Yet we're mistaken, that's not the danger ahead:

Another disaster, one we never imagined,

suddenly, violently, descends upon us,

and finding us unprepared - there's no time now -

sweeps us away.

- C. P. Cavafy: Things Ended

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.