The new Premium data will include an end-of-day snapshot (equities and indices only)

at 4:30 p.m. AEST.

Trading Diary

March 11, 2003

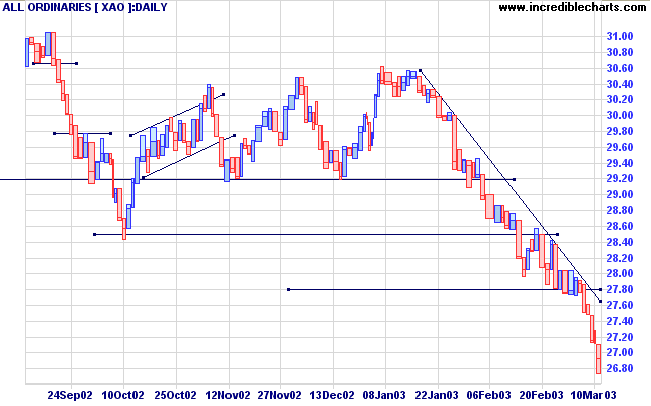

The intermediate cycle is down; the next support level is at 7500.

The primary trend is down.

The Nasdaq Composite lost 0.5% to close at 1271.

The intermediate trend is down, with the next support level at 1200.

The primary trend is up; a fall below 1108 will signal a reversal.

The S&P 500 fell a further 7 points to close at 800.

The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 38% (March 10).

Stocks continue to sink on concerns over Iraq. Warnings from Maytag and Nokia added to the gloom. (more)

New York (16.40): Spot gold fell 340 cents to $US 350.80.

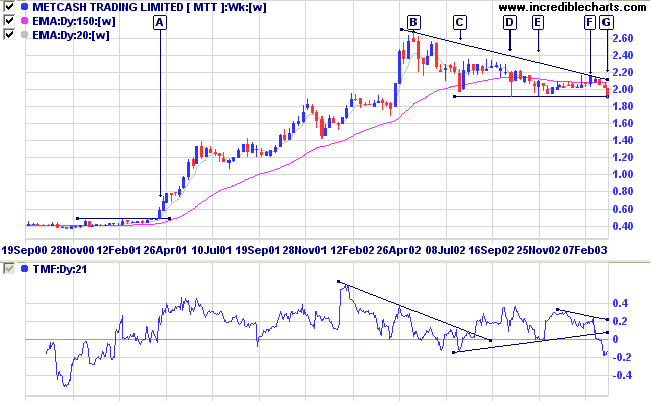

Last covered on September 4, 2002.

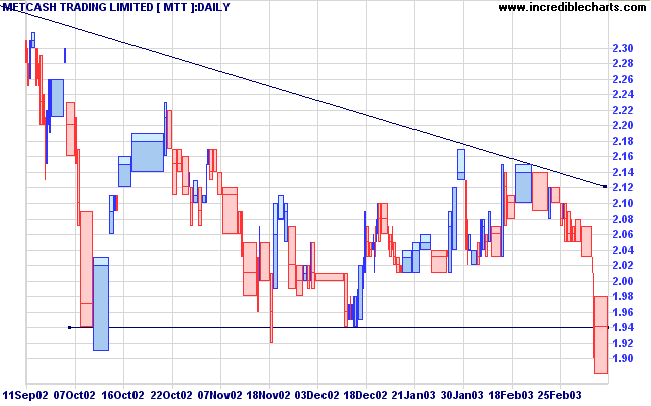

After breaking out from a base at [A] MTT commenced a stage 2 up-trend to [B]. The stock then formed a lower high, followed by a descending triangle with equal lows at [C], [D] and [E]. There is now a break below support at [G].

Relative Strength (price ratio: xao) is level; MACD is negative; and Twiggs Money Flow shows a bearish divergence.

The Consumer Staples sector trends downward.

With the bearish triangle pattern, and the weak state of the market, watch for volume drying up above the support level and another attempt to break below. A break within the next few days would be a fairly strong bear signal. A fall below 1.88 would add weight to the signal.

For further guidance see Understanding the Trading Diary.

In the middle of difficulty lies opportunity.

- Albert Einstein

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.