|

|

|

WineOrb, Australia's premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us in less than 25 words why you would like to attend. The best entries will be invited to join us at the Masterclass on the 16th May 2003. Click here to enter. |

Trading Diary

March 4, 2003

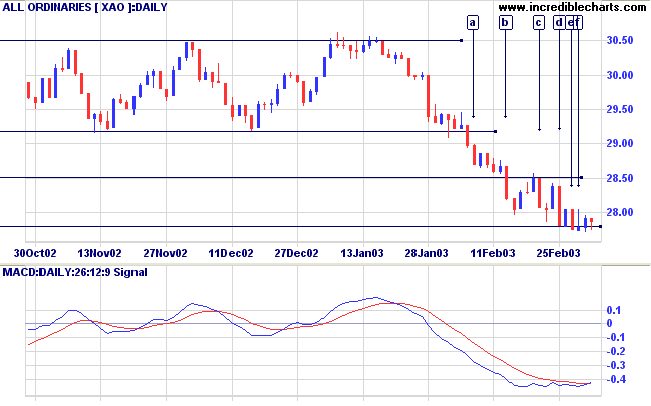

The primary trend is down.

The Nasdaq Composite closed down 1% at 1304. Equal highs (on 21/2 and 3/3) signal that the index is likely to weaken. The next support level is at 1200.

The primary trend is up.

The S&P 500 lost 13 points to close at 821. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 40% (March 3).

General Motors February auto sales are 19% below figures from 2002. (more)

New York (16.55): Spot gold has gained 440 cents to $US 352.90.

Slow Stochastic (20,3,3) and MACD (26,12,9) have both crossed to above their signal lines. Twiggs Money Flow shows a small bullish divergence.

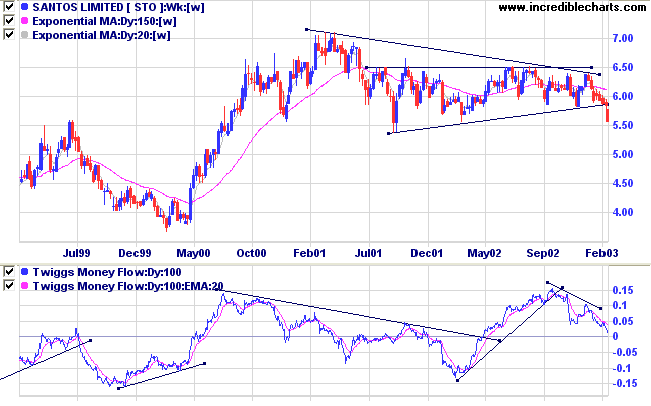

Last covered on February 18, 2003.

STO has formed a stage 3 top, in the form of a triangle, over the past two years. We now see a break below the base of the triangle and the 100-day Twiggs Money Flow signals weakness.

Relative Strength (price ratio: xao) is level, but MACD signals weakness and 21-day Twiggs Money Flow signals distribution.

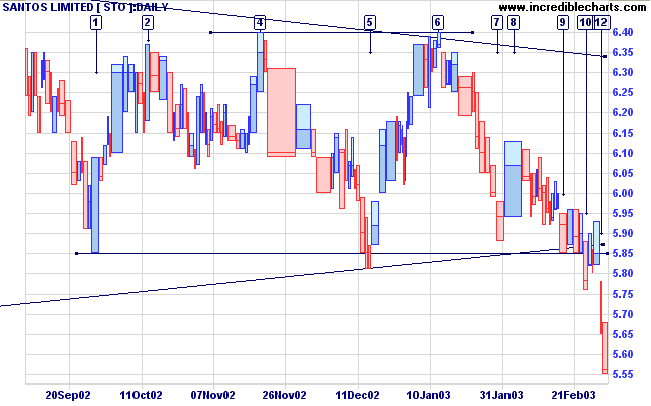

Day [12] gapped down on light volume and was followed by a second strong downward bar.

The projected target is 4.11 (5.85 - 7.11 + 5.37).

For further guidance see Understanding the Trading Diary.

Zigong asked: Is there any single word that could guide one's

entire life?

The Master said: Should it not be reciprocity?

What you do not wish for yourself, do not do to others.

- The Analects of Confucius

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.