This slot will occasionally be used for advertising.

We need to accurately gauge normal response levels and ask users not to make false/spurious responses.

We are not paid for click-throughs.

Trading Diary

February 28, 2003

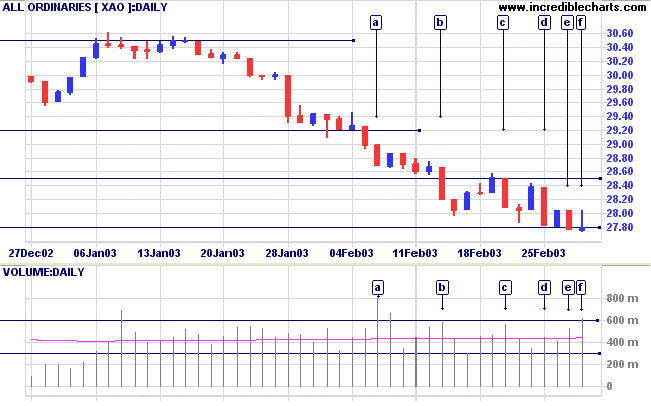

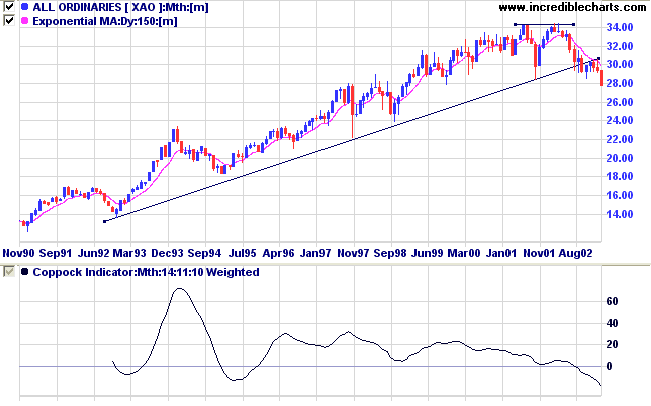

The primary trend is down.

The Nasdaq Composite closed up 1% at 1337. The next support level is at 1200.

The primary trend is up.

The S&P 500 gained 4 points to close at 841. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 40% (February 27).

There is a strong link between consumer confidence and stock market performance. (more)

New York (17.00): Spot gold closed up 410 cents at $US 349.60.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

Changes are highlighted in bold.

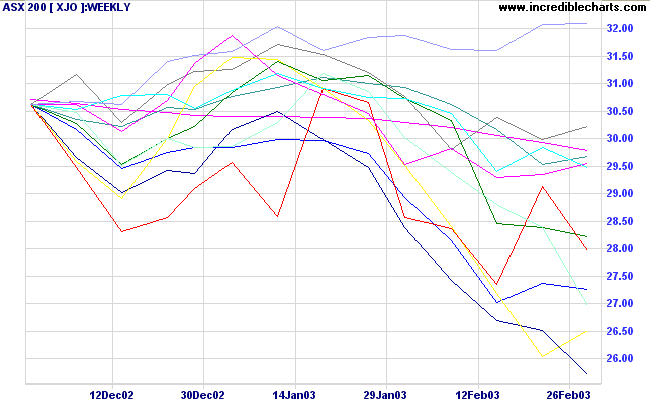

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is level)

- Telecom Services [XTJ] - stage 4 (RS is level)

- Utilities [XUJ] - stage 2 (RS is rising)

As mentioned earlier in the week, the Materials sector should be broken down into component industries, many of which are also positive.

Industrials has joined IT, Health Care, Cons. Discretionary, Financials and Telecom sectors in the "weak" category.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 24 stocks (compared to 16 on February 14, 2003; 99 on August 23, 2002; and 10 on October 4, 2002).

Three of the stocks were from Construction Materials and three from Electronic Equipment.

For further guidance see Understanding the Trading Diary.

When you have completed 95 percent of your journey,

you are only halfway there.

- Japanese proverb.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.