We are making good progress

and will announce a start date shortly.

Trading Diary

February 27, 2003

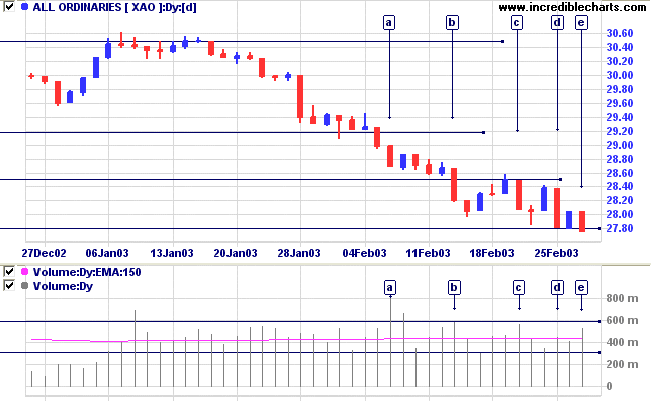

The primary trend is down.

The Nasdaq Composite formed another inside day, up 1.5% at 1323. The next support level is at 1200.

The primary trend is up.

The S&P 500 gained 10 points to close at 837. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 40% (February 26).

The US Commerce Department measured a 3.3% rise in durable goods orders for January. (more)

The UN Security Council remains deadlocked over the resolution proposed by the United States, Britain and Spain, declaring that Iraq "has failed to take the final opportunity" to disarm. (more)

New York (17.00): Spot gold dropped sharply, losing 800 cents to $US 345.20.

Slow Stochastic (20,3,3) crossed back below its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

The Materials Sector under GICS covers a vast array of industries. Traders should recognize that many of these industries have low correlation to each other and can be treated as separate sectors for trading purposes:

- Chemicals

- Containers & Packaging

- Construction Materials

- Metals & Mining

- Gold & Precious Metals

- Forestry & Paper Products

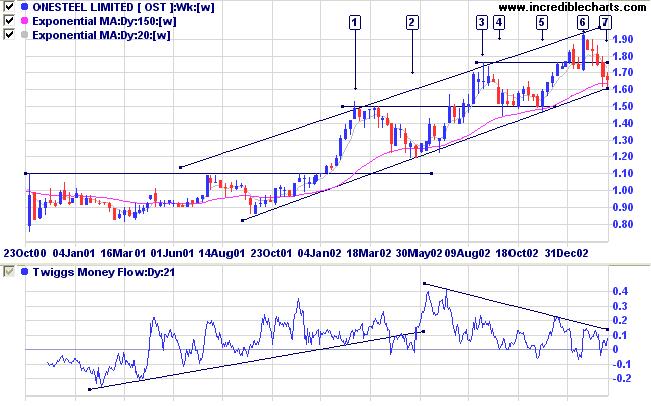

Last covered on August 20, 2002.

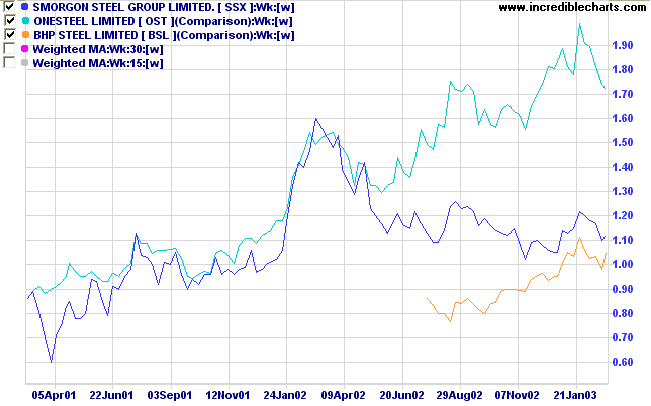

Two of the three steel producers in the Materials sector are still showing strong performance (OST and BSL).

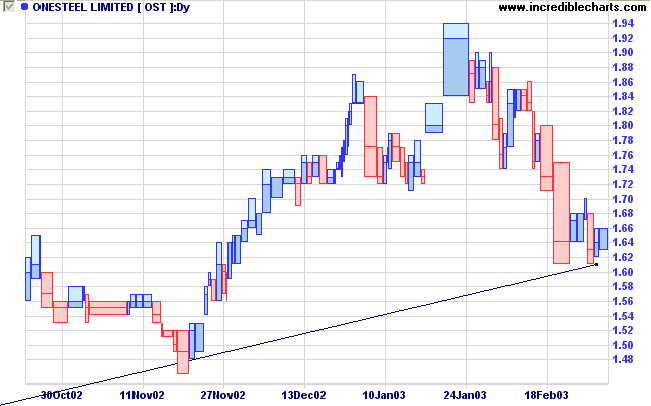

The question is: will OST stay within the trend channel, or will it break downwards to re-test support at 1.50?

If downward volume dries up, this will be an encouraging sign.

For further guidance see Understanding the Trading Diary.

Twenty years from now you will be more disappointed by the

things you didn't do

than by the ones you did.

- Samuel Clemmens

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.