We are making good progress

and will announce a start date shortly.

Trading Diary

February 26, 2003

The primary trend is down.

The Nasdaq Composite closed down 1.9% at 1303. The next support level is at 1200.

The primary trend is up.

The S&P 500 also broke below congestion, closing 11 points down at 827. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator dropped to 40% (February 25).

The market is still unsettled by prospects of war with Iraq, with Turkey pulling out its oil tank trucks and Hans Blix saying that "Iraq could do more" to cooperate. (more)

New York (17.21): Spot gold is back up 300 cents at $US 354.40.

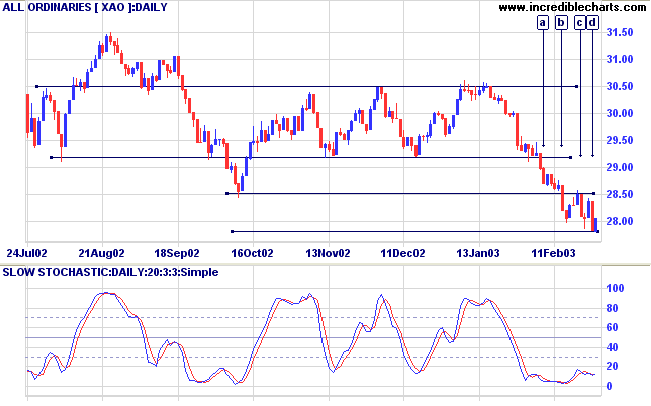

Slow Stochastic (20,3,3) crossed to above its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

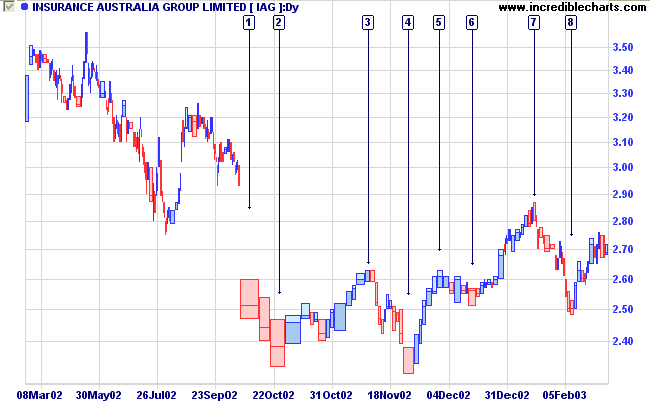

Bear markets generally have three stages:

- Abandonment of the hopes and expectations that sustained inflated prices.

- Prices decline in response to disappointing earnings.

- Distress selling follows as speculators attempt to close out their positions and securities are sold without regard to their true value.

Distress selling is the same as a downward spike: wide daily falls and heavy volume, frequently accompanied by gaps. IAG displays a good example at [1] to [2] below.

Volume must be sufficient for control to pass from sellers, who bought at far higher prices, to buyers who have bought at low prices in expectation of making a gain, relieving selling pressure on the stock.

Remember: The broader the base - the bigger the move.

For further guidance see Understanding the Trading Diary.

Through the release of atomic energy, our generation has

brought into the world

the most revolutionary force since prehistoric man's

discovery of fire.

This basic force of the universe cannot be fitted into

the outmoded concept

of narrow nationalisms.

- Albert Einstein

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.