We are making good progress

and will announce a start date shortly.

One area that is likely to be delayed is dividend data

- we have to find another data supplier due to reliability issues.

Trading Diary

February 25, 2003

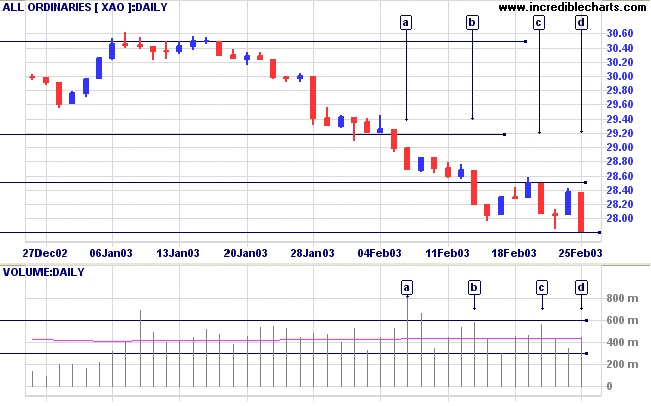

The primary trend is down.

The Nasdaq Composite mirrored the Dow, closing up 0.5% at 1328.

The primary trend is up.

The S&P 500 repeated the story, breaking below congestion and then rallying back up to close at 838. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 24).

The Conference Board index of consumer confidence dropped to 64 from 78.8 in January. (more)

New York (16.45): Spot gold is back down 540 cents at $US 351.70.

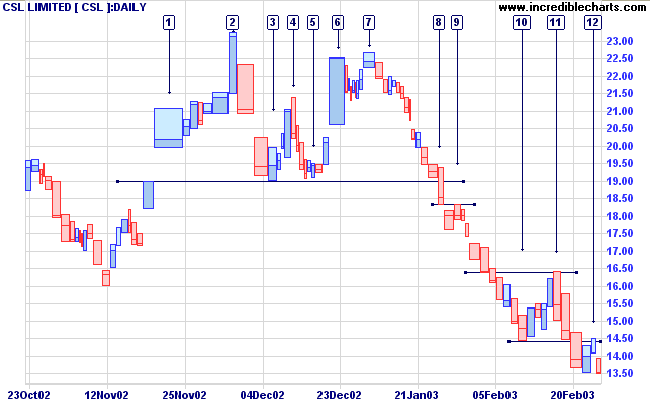

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

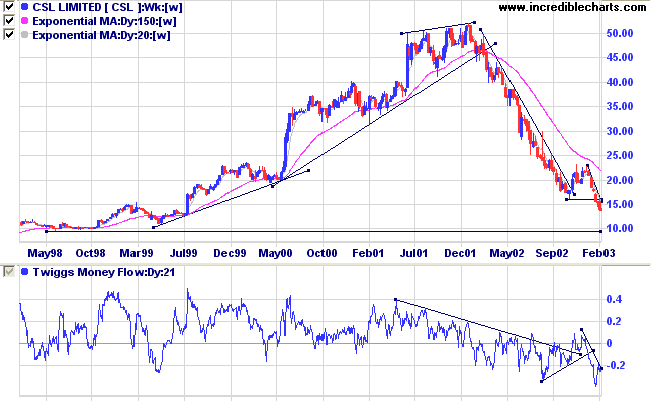

Last covered on December 2, 2002.

Another stock from the weak Health Care sector, CSL formed a stage 3 top in 2001 after a strong up-trend. The ensuing down-trend was even faster, falling to 16.00 at the end of November before a brief rally to 23.00. The stock then formed a double top, a strong continuation signal in a down trend, before resuming the stage 4 decline.

Relative Strength (price ratio: xao) is weakening, Twiggs Money Flow signals strong distribution and MACD is bearish.

The down-trend is strong and the next major support level is at 10.00 (on the weekly chart).

For further guidance see Understanding the Trading Diary.

Whatever failures I have known, whatever errors I have

committed,

whatever follies I have witnessed in private and public

life

have been the consequence of action without

thought.

- Bernard Baruch

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.