We are making good progress

and will announce a start date shortly.

One area that is likely to be delayed is dividend data

- we have to find another data supplier due to reliability issues.

Trading Diary

February 21, 2003

The next support level is 7500.

The primary trend is down.

The Nasdaq Composite closed 18 points up at 1349. The congestion signals uncertainty.

The primary trend is up.

Several readers have queried the direction of the Nasdaq primary trend and I am sure that many hold the view that the trend is down. This depends on the criteria used to identify secondary corrections in terms of Dow theory:

(1) minimum number of weeks?

(2) minimum retracement of primary trend move?

(3) minimum % price move?

I use (1) 3 weeks, and either (2) 1/3 or (3) 10% as the minimum requirement for a secondary correction. If you use only (1) and (2), you end up with a different result.

Whether the reaction in July/August 2002 qualifies as a secondary correction is a gray area. The only proof is in the outcome: will the index fall below 1108 or rise above 1521? Until then it is counter-productive to keep changing one's analysis in accordance with the short-term emotional swings of the market.

The S&P 500 gained 11 points to close at 848, forming an outside day. The current congestion signals uncertainty.

The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 20).

The market faces an uncertain two weeks, with the release of key economic indicators and continuing tensions over Iraq. (more)

New York (16.00): Spot gold closed 120 cents down at $US 350.70.

The next support level is at 2779 (from October 1999).

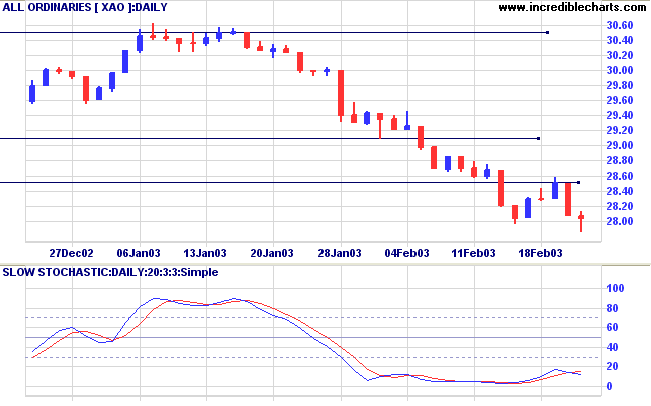

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is below. Twiggs Money Flow again crossed above its trendline.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is level)

- Telecom Services [XTJ] - stage 4 (RS is level)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 20 stocks (compared to 99, August 23rd and 10 on October 4th).

Four of the stocks were from Construction Materials.

For further guidance see Understanding the Trading Diary.

A good general does not keep changing his

mind

but sticks to his chosen course of action,

until faced with clear evidence that it is wrong.

- Claus von Clausewitz: translated from Vom Kriege "On War"

(1831)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.