Those readers who have had difficulty registering for the Chart Forum,

or uploading chart images to their posts:

Please refer to Forum Troubleshooting for assistance.

Trading Diary

February 19, 2003

If the rally carries above the first resistance level at 8189, this will signal (secondary/intermediate cycle) weakness in the down-trend.

The primary trend is down.

The Nasdaq Composite also formed an inside day, closing down 12 points at 1334.

The primary trend is up.

The S&P 500 closed down 6 points at 845 on another inside day.

The first resistance level is 868.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 18).

New York (18:30): Spot gold rallied 690 cents to $US 349.30.

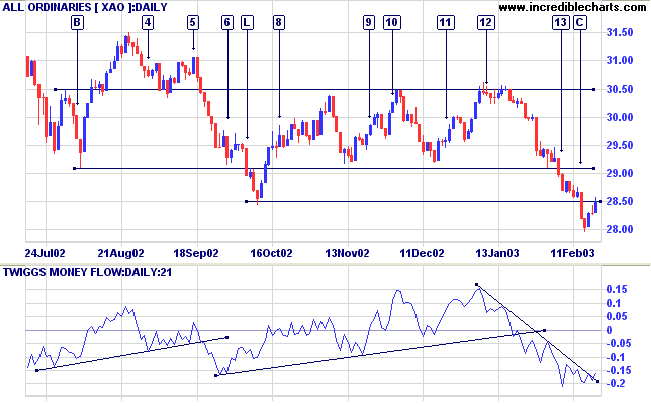

A move above 2850 will signal down-trend weakness.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below. Twiggs Money Flow has completed a small bullish divergence and broken the downward trendline.

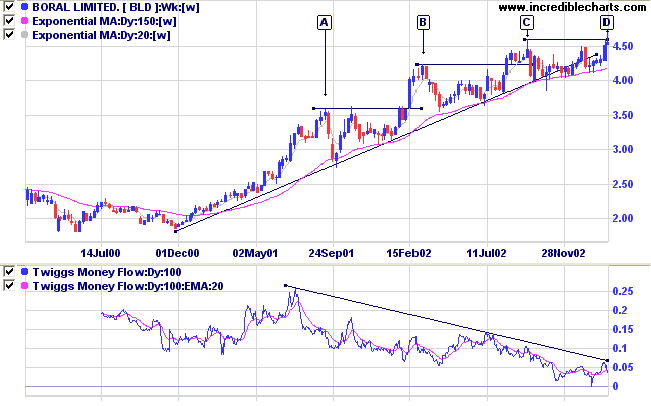

After a broad base in 2000, Boral started with a fast stage 2 up-trend. The trend accelerated into a high at [A] before progressively slowing, with lengthy consolidations following the highs at [A], [B] and [C]. The last consolidation, after [C], did not hold above the support level from [B], confirming that BLD is in a creeping up-trend.

The Materials Index is in a stage 2 up-trend.

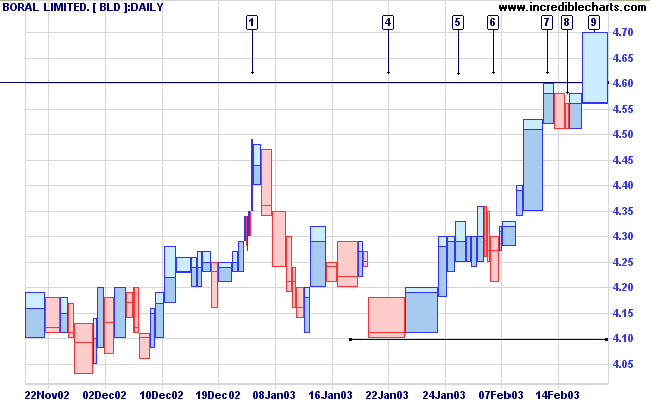

The stock has now made a false break at [D], rising above the 4.60 resistance level but closing back below.

The long-term 100-day Twiggs Money Flow shows a strong bearish divergence.

Relative Strength (price ratio: xao) is still rising; while MACD is bullish; and 21-day Twiggs Money Flow is falling.

The breakout at [9] displayed good volume but closed weakly, at the day's low. A false upward break is normally followed by a test of support levels, probably at the 4.10 level in this case. A break below the low of [8] will complete the bear signal.

For further guidance see Understanding the Trading Diary.

They who lack talent expect things to happen

without effort.

They ascribe failure to a lack of inspiration or ability, or to

misfortune,

rather than to insufficient application.

At the core of every true talent there is an awareness

of the difficulties inherent in any achievement,

and the confidence that by persistence and patience

something worthwhile will be realized.

- Eric Hoffer.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.