Those readers who have had difficulty registering for the Chart Forum,

or uploading chart images to their posts:

Please refer to Forum Troubleshooting for assistance.

Trading Diary

February 18, 2003

If the rally carries above the first resistance level at 8189, this will signal that the down-trend (secondary/intermediate cycle) is weak.

The primary trend is down.

The Nasdaq Composite gapped up 2.8% to close at 1346.

The primary trend is up.

The S&P 500 gained 16 points to close at 851.

The first resistance level is 868.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 14).

New York (16.45): Spot gold is down 310 cents at $US 343.60.

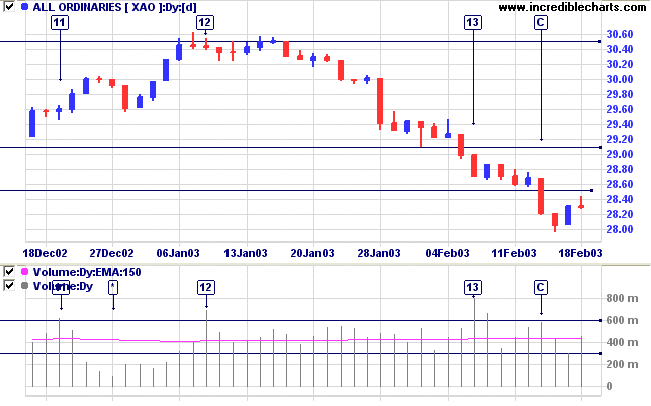

If the index moves lower on Wednesday, this will signal that the down-trend is still strong and threaten the 2779 support level.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

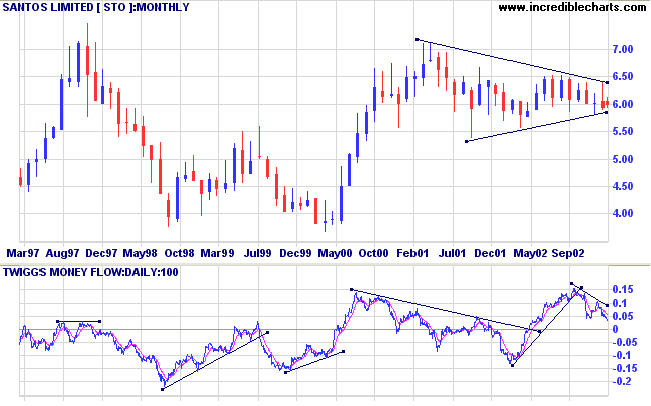

The Energy Index is in a stage 4 down-trend while Santos has been forming a stage 3 top over the past 2 years, in the form of a symmetrical triangle.

I have plotted a longer 100-day Twiggs Money Flow to highlight the long-term cycle of accumulation/distribution. This highlights several useful divergences at reversals in the primary trend. The indicator now signals weakness.

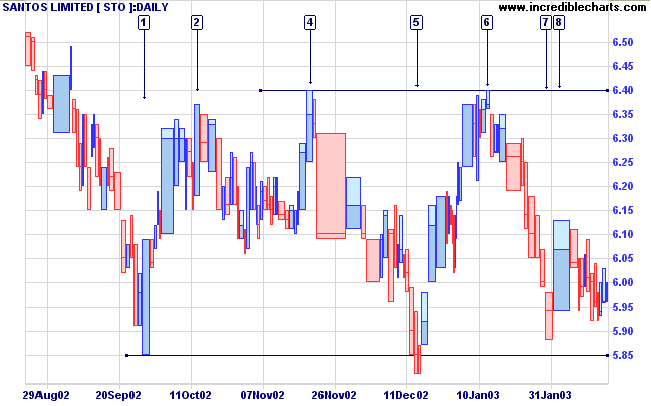

Relative Strength (price ratio:xao) is moving sideways; while MACD is bearish; and 20-day Twiggs Money Flow signals distribution.

For further guidance see Understanding the Trading Diary.

I have found that the greatest traders are the

ones who are most afraid of the markets.

My fear of the markets has forced me to hone my timing with

great precision.

- Mark Weinstein explains his high percentage of winning

trades;

from Market Wizards by Jack Schwager.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.