after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

February 11, 2003

The primary trend is down.

The Nasdaq Composite closed 1 point down at 1295.

The next major support level is at 1200.

The primary trend is up (the last low was 1108, the last high 1521).

The S&P 500 eased 6 points to close at 829.

The index has formed a base between 768 and 964 but appears headed for a re-test of the support level.

The Chartcraft NYSE Bullish % Indicator dropped to 44% (February 10).

Qatar-based Al-Jazeera network aired an audiotape purporting to be from Osama bin Laden. (more)

Federal Reserve Chairman Alan Greenspan stresses the need for budget discipline and says that tax cuts should only be passed if other revenue is found to replace it. (more)

New York (16.00): Spot gold is up 120 cents at $US 363.50.

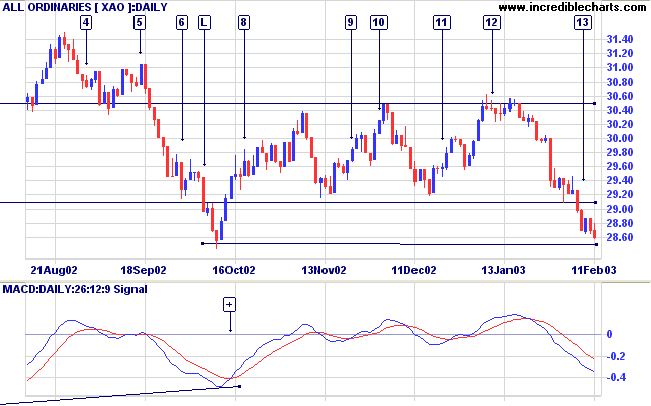

The index is fast approaching a major support level, with a strong band of support between 2850 and 2779.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

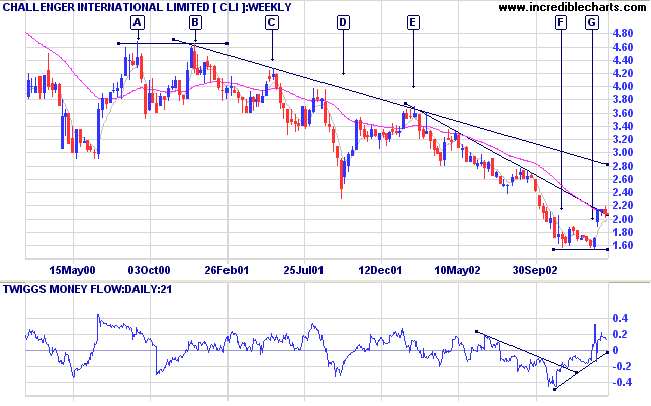

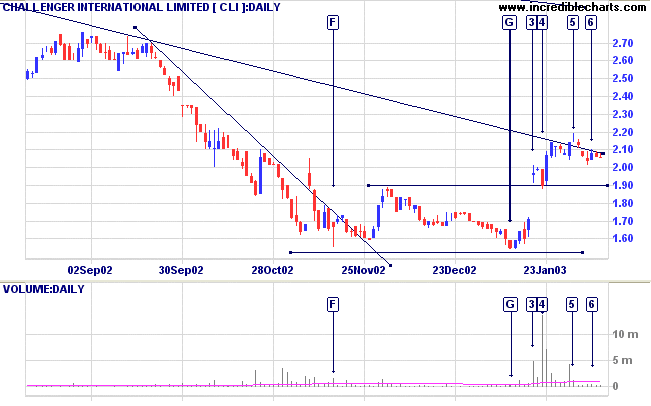

Many stocks in the Diversified Financials industry group have been punished by the market over the last two years and CLI was not spared. The stock completed a double top at [A] and [B] followed by a stage 4 down-trend. At the end of last year CLI made a sharp reversal, forming a double bottom at [F] and [G] completed with a strong gap above the resistance level.

Twiggs Money Flow signals accumulation; MACD and Relative Strength (price ratio: xao) are rising.

However, the base is narrow and we should be alert to possible failure.

CLI appears to be having difficulty breaking above the long-term trendline.

For further guidance see Understanding the Trading Diary.

Do not be desirous of having things

done quickly.

Do not look at small advantages.

Desire to have things done quickly prevents their being

done thoroughly.

Looking at small advantages prevents great

affairs from being accomplished.

- The Analects of

Confucius

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.