after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

February 7, 2003

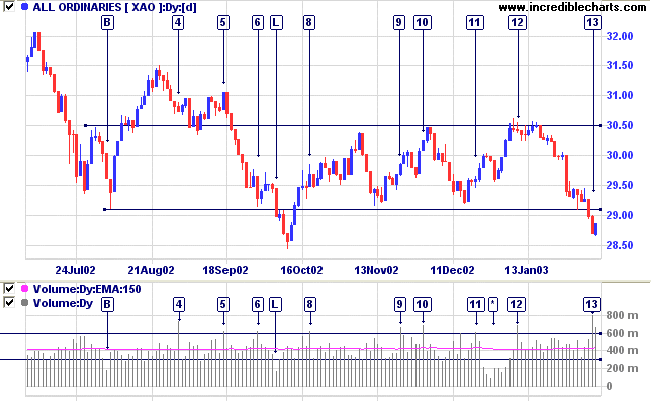

The index appears headed for a re-test of support at 7500.

The primary trend is down.

The Nasdaq Composite closed down 19 points at 1282; the next major support level is at 1200.

The primary trend is up (the last low was 1108, the last high 1521).

The S&P 500 closed down 9 points at 829.

The index formed a base between 768 and 964 but appears headed for a re-test of the support level.

The Chartcraft NYSE Bullish % Indicator remains at 46% (February 6).

The jobless rate fell to 5.7%, from 6.0% in December, but economists ascribe this to seasonal influences. (more)

New York (17.00): Spot gold closed at $US 369.30.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

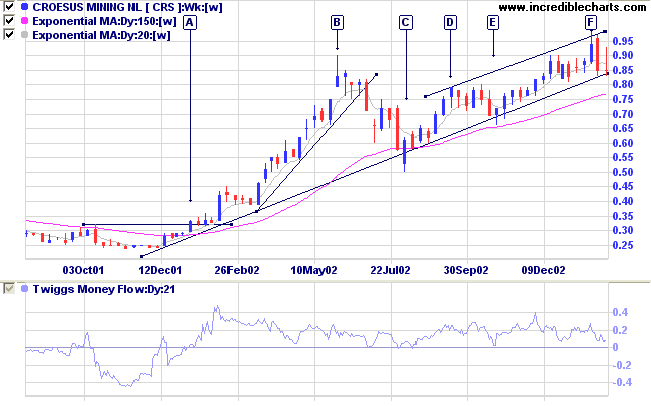

Croesus started a stage 2 up-trend at [A] but then accelerated into a spike at [B]. There was a secondary reaction to [C] before the stock established a fast trend channel.

Relative Strength (price ratio:xao) is rising; Twiggs Money Flow has signaled accumulation for more than a year; and MACD is positive.

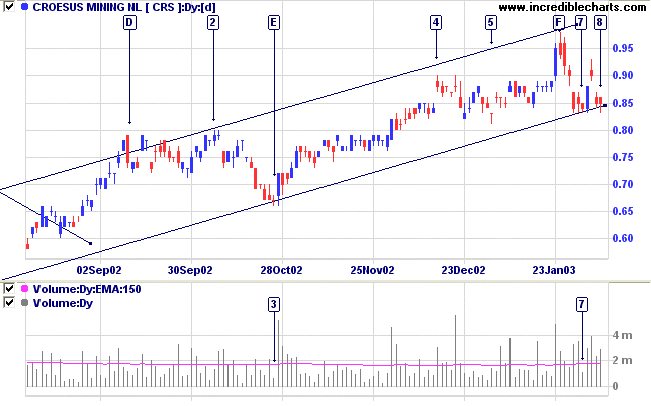

CRS now appears to be forming an equal low at [8]; a strong bull signal in an up-trend. There may be further entry points in the days ahead.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is rising)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is level)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 17 stocks (compared to 99, August 23rd and 10 on October 4th).

There were no prevalent sectors.

For further guidance see Understanding the Trading Diary.

We should be careful to get out of an

experience only the wisdom that is in it - and stop

there;

lest we be like the cat that sits down on a hot

stove-lid.

She will never sit down on a hot stove-lid again,

and that is well;

but also she will never sit down on a cold one

anymore.

- Samuel Clemens (1835 -

1910)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.