after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

February 5, 2003

This is a likely continuation pattern and the index appears headed for a re-test of support at 7500.

The primary trend is down.

The Nasdaq Composite lost 5 points to close at 1301. The next major support level is at 1200.

The primary trend is up (the last low was 1108 and the last high 1521).

The S&P 500 is also in a congestion pattern, closing down 5 points at 843, and appears headed for a re-test of support at 768.

The index is forming a base between 768 and 964.

The Chartcraft NYSE Bullish % Indicator is on a bull correction signal at 46% (February 4).

Colin Powell's address to the U.N. Security Council fails to sway Germany and France who are opposed to military action. (more)

New York (16:55): Spot gold dropped to $US 369.90 after reaching 388.00 earlier in the day.

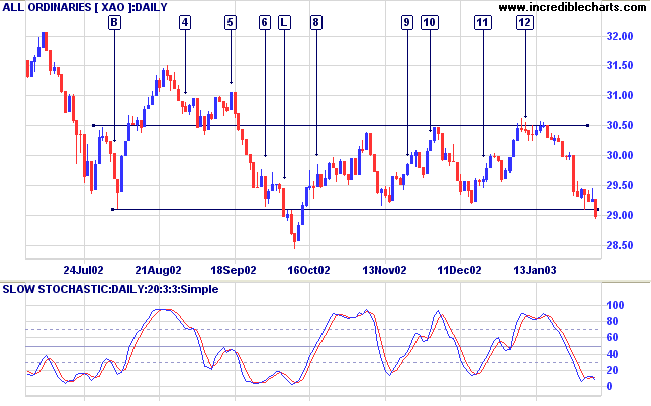

Slow Stochastic (20,3,3) has crossed back below its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

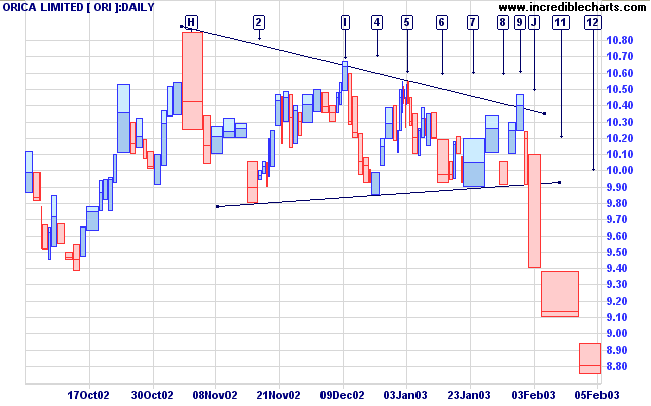

Last covered on October 29, 2002.

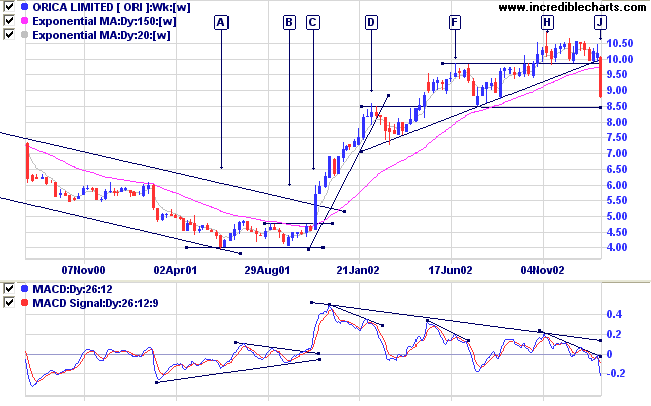

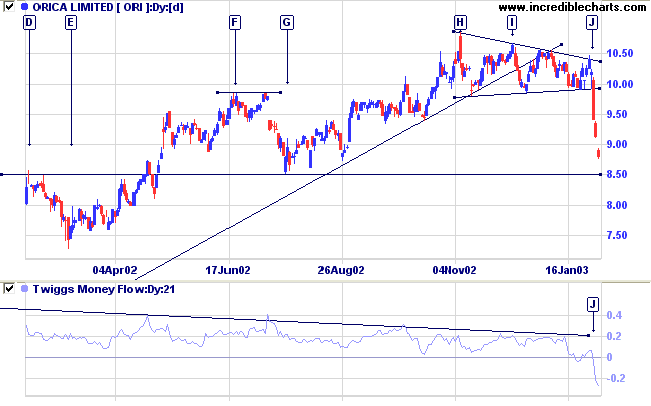

Orica commenced a stage 2 up-trend after completing a double bottom, [A] and [B], with a breakout at [C]. The trend commenced at a very fast pace and, as often happens, this proved unsustainable. After [D] ORI slowed to a creeping up-trend before forming a top at [H]. The chart now shows a strong breakout from the congestion pattern at [J], which has also breached the long-term trendline.

Relative Strength (price ratio: xao) is falling and MACD has completed a strong bear signal with a peak below zero.

A drop like this is unsustainable and a pull-back can be expected in the next few days, possibly at the 8.50 support level (highlighted on the daily and weekly charts). The duration and strength of the pull-back will indicate the likely speed of the down-trend.

For further guidance see Understanding the Trading Diary.

We have identified danger, physical

exertion, intelligence, and friction

as the elements that coalesce to form the atmosphere of

war,

and turn it into a medium that impedes activity.

The novice cannot pass through these

layers of increasing intensity of danger

without sensing that here ideas are governed by other

factors,

that the light of reason is refracted in a manner

quite different

from that which is normal in academic

speculation.

- Prussian military thinker

Claus von Clausewitz:

translated from Vom Kriege ("On War")

(1831)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.