You can't afford to invest your ego in any position in the market. If the market moves against your position, you need to react quickly.

I do not believe in predictions, only in probabilities.

Trading Diary

January 30, 2003

The primary trend is down.

The Nasdaq Composite fell 2.6% to close at 1322. The next major support level is at 1200.

The primary trend is up.

The S&P 500 lost 20 points to close at 844. The index appears headed for a re-test of support at 768.

The Chartcraft NYSE Bullish % Indicator is on a bull correction signal at 48% (January 29).

AOL Time-Warner report a record $US 98.7 billion loss for the year, writing down their investment in AOL and cable divisions. (more)

Rising unemployment

Rising claims for unemployment benefits signal a weakening labor market. (more)

New York (16:45): After a short pull-back to 362.00 spot gold has soared to $US 370.80.

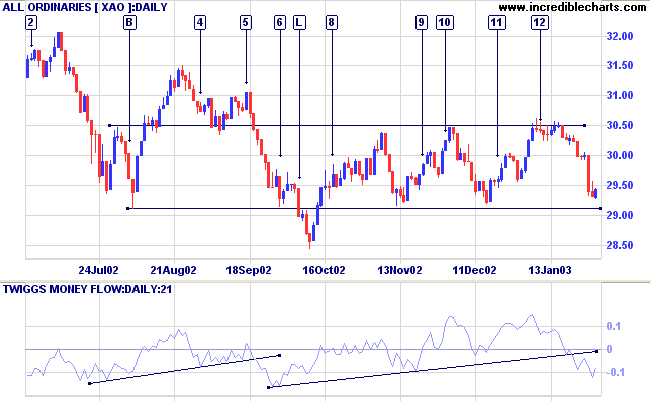

The 2915 support level is likely to be severely tested over the next few days.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines; Twiggs Money Flow signals distribution.

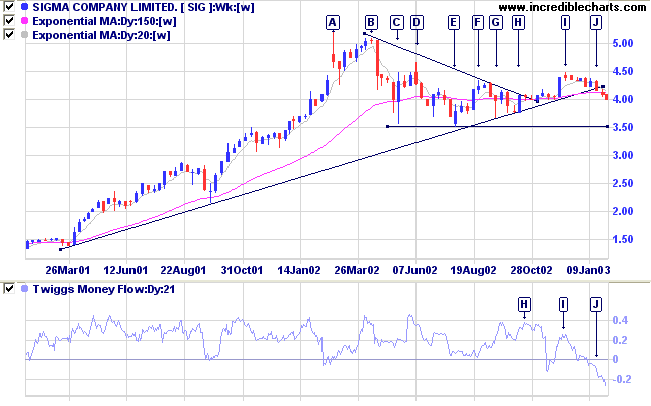

Last covered on October 3, 2002.

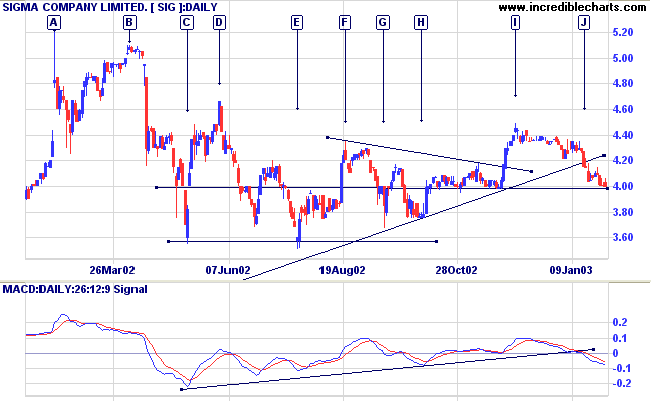

SIG has been in a stage 3 top for the last year after a completed double top pattern at [A] and [B] was followed by a fall back to 3.50 at [C]. After a lower high at [D], the stock has been moving sideways, ranging between 3.50 and 4.30.

Recently, SIG broke its long-term trendline at [J] and Twiggs Money Flow signals strong distribution [J] after signaling strong accumulation for more than two years.

Relative Strength (price ratio: xao) is falling and MACD is bearish.

For further guidance see Understanding the Trading Diary.

I do not allow my possessions - or my prepossessions either - to do any thinking for me.

That is why I repeat that I never argue with the tape.

- Edwin Lefevre: Reminiscences of a Stock Operator (1923)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.