after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 29, 2003

The primary trend is down.

The Nasdaq Composite rallied 1.2% to close at 1358. The next major support level is at 1200.

The primary trend is up.

The S&P 500 rallied 6 points to close at 864. The index appears headed for a re-test of support at 768.

The Chartcraft NYSE Bullish % Indicator is on a bull correction signal at 48% (January 27).

The Fed policy meeting left the fed funds rate unchanged at 1.25% and sees "balanced" risks to the economy. (more)

New York (16:15): Spot gold fell sharply to $US 365.80.

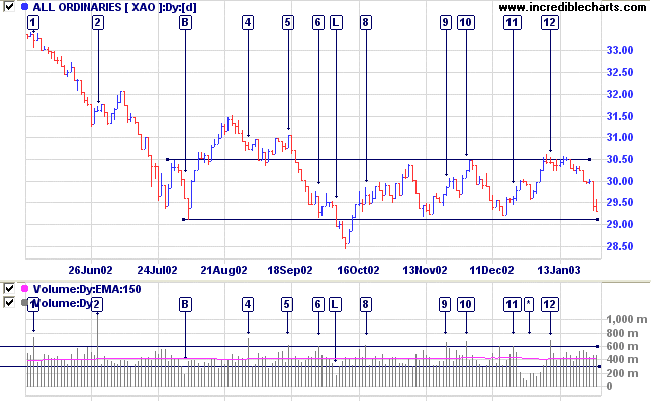

There has been some useful discussion on the Forum as to whether the 2915 to 3050 trading range is a valid base. This is especially relevant as the 2915 support level is likely to be severely tested over the next few days.

Stan Weinstein describes a base as an area where price moves sideways and the stage 4 decline loses momentum ....sellers and buyers move into equilibrium .....volume dries up as the base forms....... but may later expand.

- The low days all occurred over the festive season or on NSW holidays.

- The breakout at [L] occurred on exceptionally low volume, on Labor Day, October 7, and lacked conviction, retreating back above 2915.

- Subsequent volume spikes from [8] to [11] all occurred on up-days.

- However, [12] is on a down-day; threatening support at 2915.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines; Twiggs Money Flow signals distribution.

Last covered on January 21, 2003.

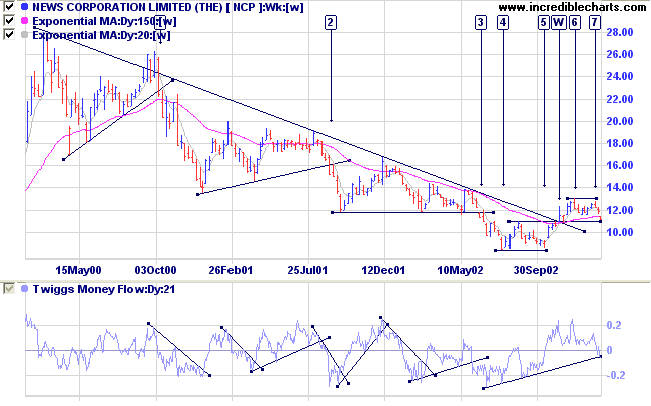

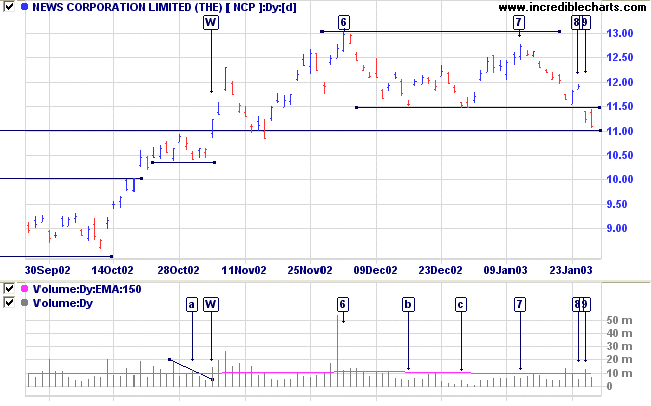

NCP completed a double bottom at [4] and [5] with a breakout at [W].

Since then the stock has formed a double top at [6] and [7].

Relative Strength (price ratio: xao) is neutral; MACD is bearish; and Twiggs Money Flow signals distribution after breaking below its trendline.

Price then gapped down below the support level, at [9], with increasing volume. This completes the double top pattern from [6] and [7], with a target of 10.00.

For further guidance see Understanding the Trading Diary.

It pays, no matter what comes after it,

to try and do things, to accomplish things in this life

and not merely to have a soft and pleasant time.

- Theodore Roosevelt

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.