after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 28, 2003

The primary trend is down.

The Nasdaq Composite also formed an inside day, closing at 1342. The next major support level is at 1200.

The primary trend is up.

The S&P 500 closed up 11 points at 858; another inside day. The index appears headed for a re-test of support at 768.

The Chartcraft NYSE Bullish % Indicator has switched to a bull correction signal at 48% (January 27).

The Conference Board consumer confidence index falls to 79, the lowest level in 9 years. (more)

New York (15:30): Spot gold is holding at $US 369.30.

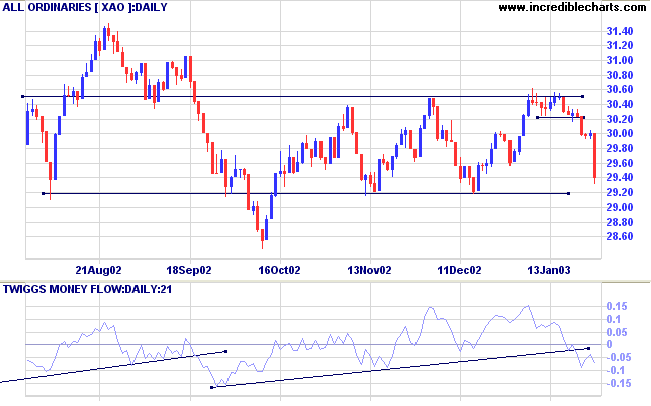

Over the last 3 months the index has been forming a base between 2915 and 3050. The support level is likely to be severely tested over the next few days.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines; Twiggs Money Flow signals distribution.

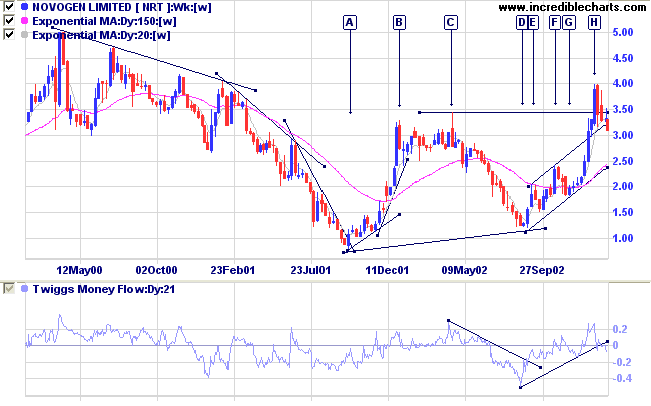

Last covered on October 22, 2002.

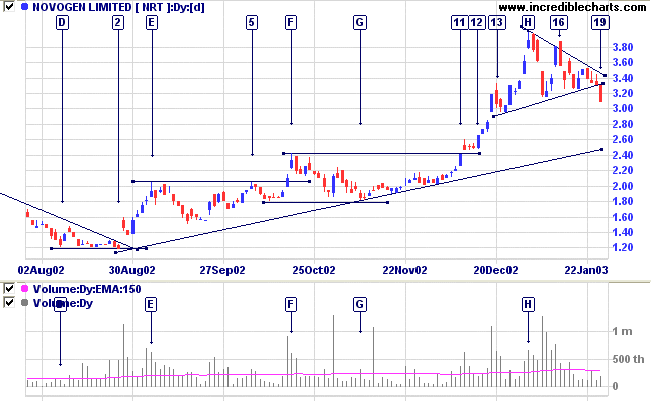

After a stage 4 down-trend to [A] NRT formed a higher low at [D] before completing a double bottom at [H] with a break above the high of [C]. The double bottom is normally a strong bullish signal but price has reversed back below the support level after spiking up to 4.00 at [H].

Note that spikes at [B] and [H] were both unsustainable and pulled back about 25% from their highs.

Relative Strength (price ratio: xao) and MACD are both bearish, while Twiggs Money Flow signals distribution after breaking below its trendline.

For further guidance see Understanding the Trading Diary.

- Lao Tse (c. 600 B.C. - 530 B.C.)

A state is better governed which has but few laws, and those laws strictly observed.

- Rene Descartes (1596-1650)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.