after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 23, 2003

The index ranges between 8161 and 9076, at the top end of the base that has been forming since July 2002.

The primary trend is down and will only reverse up if the Dow breaks above 9076 (the high from December 02).

The Nasdaq Composite rallied 2.1% to 1388.

The primary trend is up.

The S&P 500 recovered 9 points to close at 887, holding above support at 867.

The index ranges between 965 and 768, establishing a base.

The Chartcraft NYSE Bullish % Indicator is at 54% (January 22).

Tech and telecom stocks surged after better-than-expected results from Texas Instruments, Lucent and Qualcomm. (more)

Gold

New York: Spot gold reached $US 365, a 6-year high, before easing to $US 363.00 at 16:00.

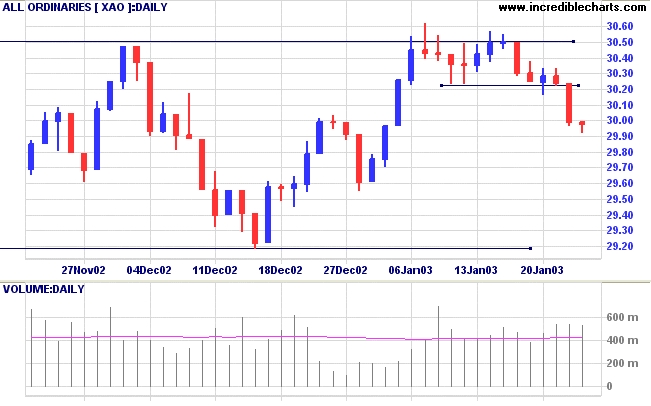

Over the last 3 months the index has been forming a base between 2915 and 3050.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines; Twiggs Money Flow signals distribution.

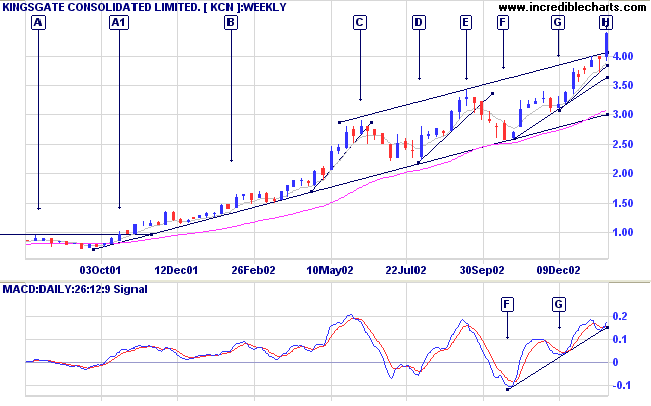

The Thailand gold miner broke out of a stage 1 base at [A1] and has been in a stage 2 up-trend ever since. Not all trends are born equal: there is a creeping trend at [B] followed by fast rallies to [C] and [E] (and sharp reactions to [D] and [F]). Another fast rally has developed from [F] through [G] but we can now observe a third type of trend: the spike at [H]. When a fast trend accelerates into a spike, there is only one likely outcome: a trend at that pace is unsustainable and we can expect a sharp reversal back towards the long-term trend line.

As expected, Relative Strength (price ratio: xao) and Twiggs Money Flow are soaring. MACD shows strong bull signals at [G] and [H], with troughs above the zero line.

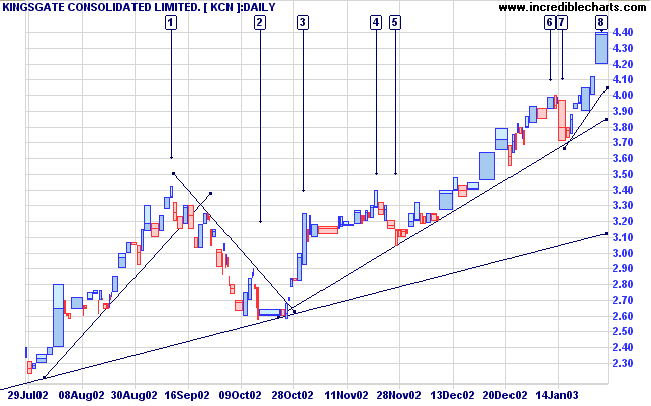

The spike at [8] is only just starting and may carry a lot higher.

For further guidance see Understanding the Trading Diary.

The changing of a vague difficulty into a specific, concrete form

is a very essential element in thinking.

- John Pierpont Morgan.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.